Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin Money worth tumbled a fraction of a p.c previously 24 hours to commerce at $581.49 as of 4:00 a.m. EST whilst large fund supervisor Grayscale seeks regulatory approval for a BCH ETF (exchange-traded fund).

Grayscale submitted a collection of US Securities and Change Fee (SEC) filings on Tuesday looking for approval for ETFs monitoring Bitcoin Money, Hedera, and Litecoin.

The fund supervisor goals to transform its current closed-end trusts for these belongings into ETFs that will probably be listed totally on the NYSE Arca or Nasdaq.

Grayscale used this actual technique to transform its BTC and ETH trusts into exchange-traded merchandise in 2024.

Grayscale filed an S-3 for a Bitcoin Money ETF and Litecoin ETF and an S-1 for a Hedera ETF

— unfolded. (@cryptounfolded) September 9, 2025

The submitting for the ETFs comes because the US SEC pushed again its determination on Nasdaq’s bid to listing the Grayscale Hedera Belief to November 12.

In the meantime, a number of issuers are on the transfer to hunt approval for ETFs monitoring any variety of altcoins, together with Dogecoin and XRP.

For now, the SEC beneath Chair Paul Atkins has delayed selections on a spread of crypto ETF functions. A inexperienced mild from regulators would give traders a strategy to commerce crypto publicity alongside conventional securities in brokerage accounts.

As of June 30, Grayscale’s BCH belief held a internet asset worth of over $202 million at $0.31 per share, in response to the submitting.

Regardless of the information, BCH’s buying and selling quantity has dropped 37% previously 24 hours to $279 million. With the SEC edging nearer to regulatory readability, can Bitcoin Money discover momentum for a rebound?

Bitcoin Money Value Driving The Bullish Channel

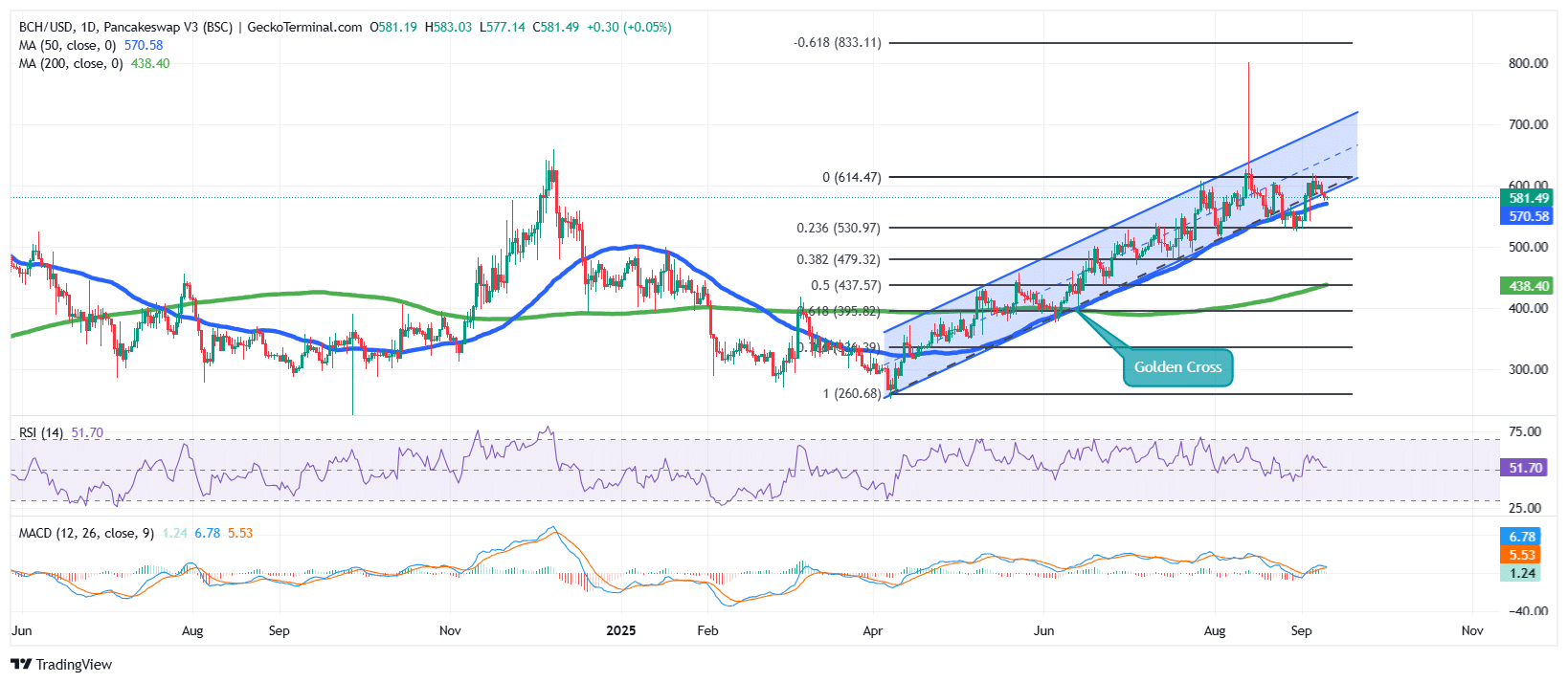

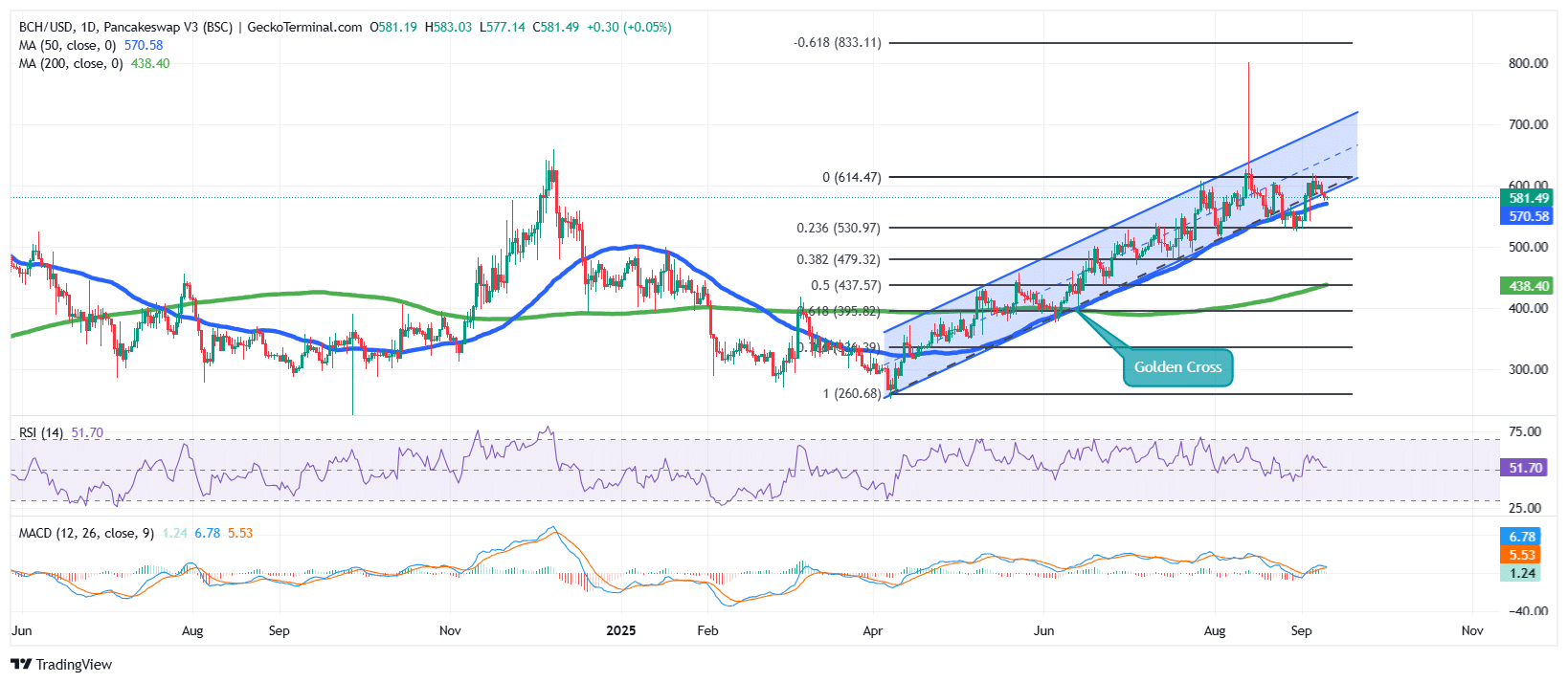

After bottoming close to $260 earlier within the 12 months, the BCH worth has steadily climbed, breaking by means of key Fibonacci retracement ranges, as proven by the BCH/USD every day chart.

BCH is at the moment consolidating slightly below the $614 resistance stage, which coincides with the 0 Fibonacci retracement stage, however stays throughout the confines of the rising channel sample.

The Bitcoin Money worth stays above each the 50-day and 200-day Easy Shifting Averages (SMAs), which act as vital assist ranges, pointing to the bullish place of the asset. The 50-day SMA stays above the 200-day SMA, forming a golden cross at $396, cementing the bullish construction.

BCH Indicators Level To Consolidation

The Relative Power Index (RSI) is at the moment at 51.70, sitting within the impartial zone. This means neither overbought nor oversold circumstances and means that the market is in equilibrium, as traders await contemporary momentum.

In the meantime, the Shifting Common Convergence Divergence (MACD) exhibits the blue MACD line at 6.78, barely above the orange sign line at 5.53, with a histogram studying of 1.24. This setup displays gentle bullish momentum however not a powerful breakout.

BCH is prone to proceed buying and selling throughout the rising channel sample so long as it maintains assist above the 50-day SMA at $570. A decisive breakout above $614 would open the door for a retest of the channel highs round $700, and doubtlessly towards the Fibonacci extension close to $833.

On the draw back, a break beneath the 50-day SMA may sign weak spot, with the following sturdy assist on the 200-day shifting common round $438.

Total, BCH is at the moment in a consolidation section inside a bigger bullish development.

Technical indicators counsel that traders should purchase, whereas shifting averages counsel that they need to promote, which makes the market impartial, in response to Investing.com.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection