- Whales bought over $200M in ETH, exhibiting rising institutional demand.

- Alternate balances are shrinking, signaling diminished promote strain.

- A Fed charge reduce might act as a catalyst for ETH to interrupt above $4,800.

Ethereum is transferring by means of a kind of difficult phases the place the charts don’t give away a lot however the undercurrent tells one other story. Worth is hovering close to necessary ranges, holding round $4,515, whereas volatility and uncertainty dominate the broader crypto market. On the floor, it appears like consolidation. However beneath, one thing larger is brewing — establishments and whales are stacking ETH, and that indicators confidence in its long-term function.

One key issue shaping Ethereum proper now could be provide on exchanges. It’s shrinking, steadily, as cash transfer into chilly storage and long-term wallets. That drop in obtainable provide often interprets to much less promote strain, reinforcing the thought of quiet accumulation whereas retail eyes the day by day swings.

Recent numbers from Arkham add extra weight. Simply yesterday, three new whale wallets scooped up over $200 million price of ETH. Massive cash isn’t hesitating, even in uneven circumstances. They’re positioning for what many consider may very well be Ethereum’s subsequent large breakout — at any time when the market decides to maneuver.

Institutional Shopping for Strengthens Ethereum Outlook

Arkham’s newest report confirmed that whales transferred roughly $205 million price of ETH from FalconX into recent wallets, marking one other signal of rising institutional involvement. These aren’t small retail buys. They’re giant, deliberate strikes that underline Ethereum’s rising significance within the broader digital financial system.

The latest sideways motion isn’t about weak fundamentals — it’s extra tied to uncertainty within the macro panorama. Merchants could give attention to the noise of fast pullbacks or rallies, however establishments see long-term adoption, decrease change balances, and the rising case for ETH as core infrastructure. Alternate knowledge retains exhibiting cash flowing out, and that’s a bullish signal when mixed with large whale accumulation.

The highlight now turns to subsequent week’s U.S. Federal Reserve assembly. Markets count on a charge reduce, and if that occurs, danger property like ETH may benefit from recent liquidity inflows. A dovish Fed would possibly find yourself being the set off that aligns with the buildup development already in play.

Ethereum Worth Evaluation: Key Ranges to Watch

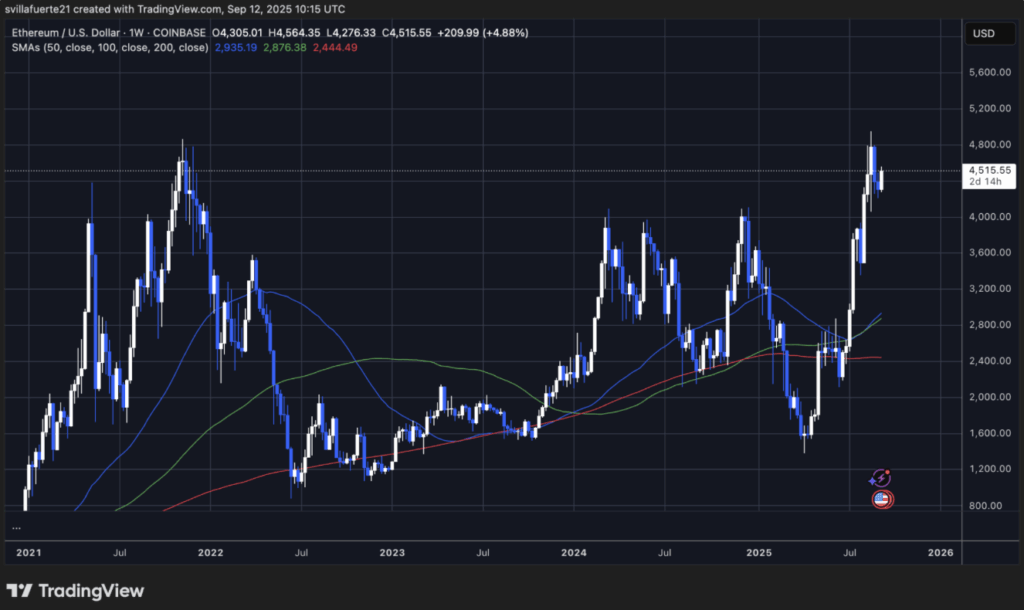

At $4,515, Ethereum has bounced strongly this 12 months, climbing from lows close to $1,600 and practically touching $4,800. That run has made ETH one of many top-performing altcoins of 2025, thanks largely to institutional demand and the shrinking provide story.

On the technical aspect, ETH is sitting comfortably above its main transferring averages. The 50-week SMA is rising at $2,935, the 100-week SMA at $2,876, and the 200-week SMA stays a powerful base down at $2,444. This alignment factors to a strong long-term uptrend.

For bulls, the problem now could be breaking and holding above $4,800. If that resistance offers means, ETH might shortly intention for the $5,200–$5,500 zone. On the flip aspect, if volatility picks up, rapid help lies close to $4,300, with stronger backing nearer to $3,800.

Closing Ideas: Ethereum’s Subsequent Breakout?

Ethereum’s value could look calm on the charts, however the fundamentals present quiet power. With whales scooping up lots of of hundreds of thousands in ETH and change provide drying up, the stage is ready for a possible breakout. Add in a attainable Fed charge reduce, and the timing might align for ETH to push previous resistance and goal new highs.

The subsequent few weeks could resolve whether or not Ethereum reclaims $4,800 and powers towards $5,500, or if it dips again into help zones. Both means, establishments appear unfazed by the noise, betting on ETH’s endurance lengthy after the day by day volatility fades.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.