Ethereum (ETH), the second-largest cryptocurrency, has seen its worth dropping as we speak amid a basic market collapse. Whereas it registers virtually 70% greater liquidations in comparison with Bitcoin (BTC), it nonetheless appears robust in comparison with Solana (SOL).

$507,000,000,000 in ETH positions erased, 95% longs

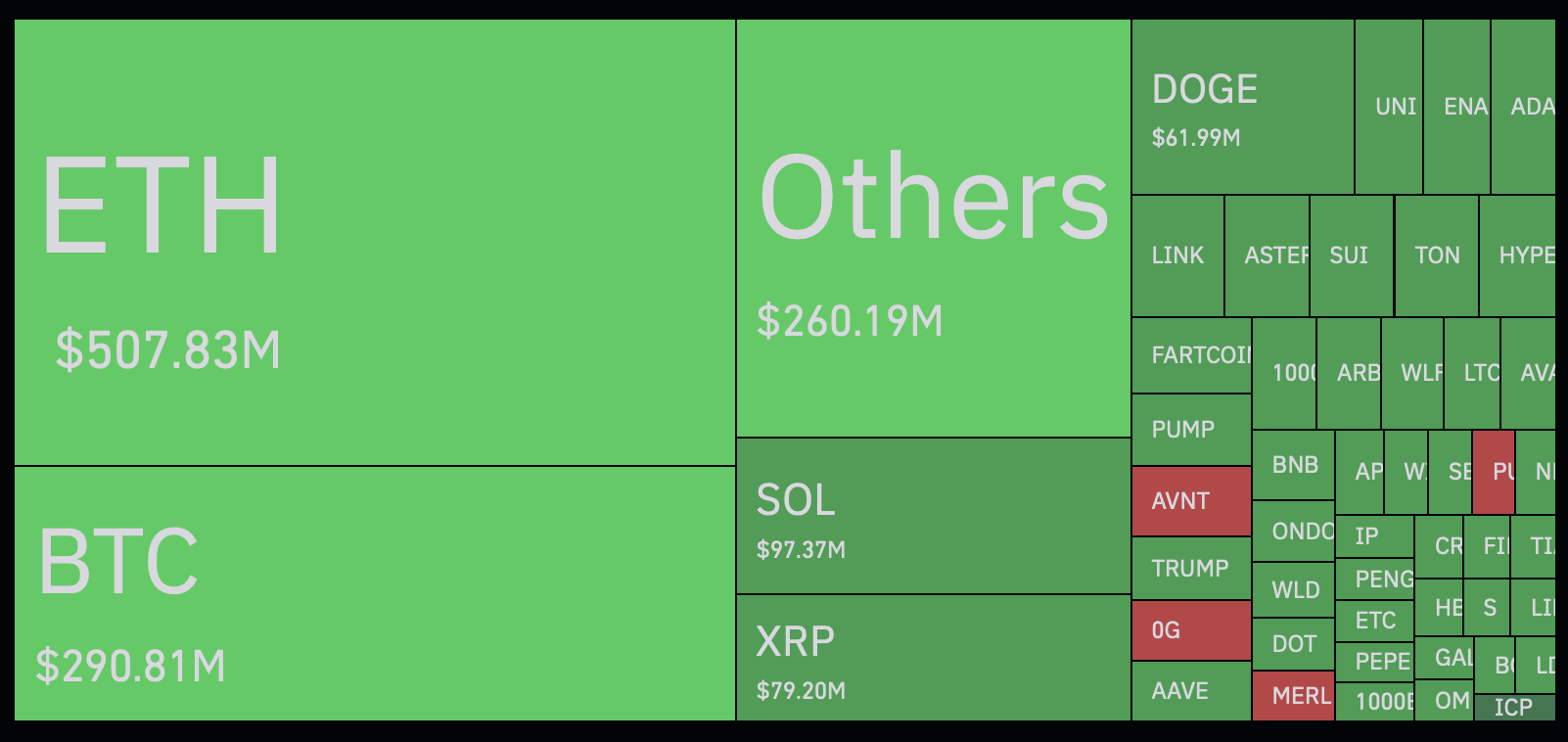

Within the final 24 hours, over half a billion in Ethereum (ETH) futures positions had been liquidated. Based on the information by CoinGlass, the web quantity of Ether contracts erased by the liquidation storm exceeded $507 million.

Out of this monstrous quantity, the largest in 2025, 95% had been lengthy positions. As such, Ethereum (ETH) bulls had been those who misplaced $482.6 million in equal.

Bybit, the second-biggest cryptocurrency change by dealer rely, is liable for over 52% of as we speak’s Ethereum (ETH) liquidations.

Throughout the ongoing massacre, 402,369 merchants had been liquidated, the whole liquidations exceeding $1.71 billion, CoinGlass knowledge reveals. To supply context, for some currencies, as we speak’s drop was extra painful than Crypto’s Black Thursday, March 12, 2020.

It’s attention-grabbing that the liquidations of such quantity had been triggered by mediocre worth swings. Ethereum (ETH) misplaced 6.5% in 24 hours, whereas Solana (SOL) is down by 7.2%.

The Ethereum (ETH) worth dropped to $4,150 whereas Solana (SOL) dropped to $220. Each cryptocurrencies are already recovering from these painful collapses.

Ethereum futures Open Curiosity drops by $3 billion

Ethereum Open Curiosity, i.e., the USD-denominated quantity of Ethereum (ETH) contracts, which aren’t closed but, misplaced $3 billion in hours, dropping by over 10% in a single day.

Previous to as we speak’s worth plunge, it was estimated at $30.3 billion in equal, based on Coinalyze knowledge. In just a few hours, Ethereum (ETH) contracts open curiosity dropped to $27 billion in equal.

Out of this drop, half a billion was brought on by liquidations. In different instances, merchants determined to shut their positions to keep away from extending losses.

Out of an precise $27 billion in Open Curiosity, Ethereum (ETH) perpetuals represent $26.4 billion, whereas Ethereum (ETH) futures with fastened expiration dates solely account for $906.1 million.

For Bitcoin (BTC), web Open Curiosity sits round $80 billion; Binance Futures are liable for $15 billion right here.

Ethereum cofounder Vitalik Buterin endorses “low-risk DeFi”: What to know

The Ethereum (ETH) group continues to be discussing potential methods to speed up the adoption of the second-largest cryptocurrency globally. As lined by U.Right now beforehand, Ethereum (ETH) cofounder Vitalik Buterin indicated “low-risk DeFi” as a doubtlessly engaging alternative for a brand new cohort of customers.

сard

Based on him, low-risk and low-interest decentralized finance protocols would possibly develop into for Ethereum (ETH) the identical catalyst that digital search turned for Google.

Ethereum (ETH), due to this fact, ought to distance itself from speculative “degen” narratives, evolving right into a platform for predictable, steady revenue instruments.