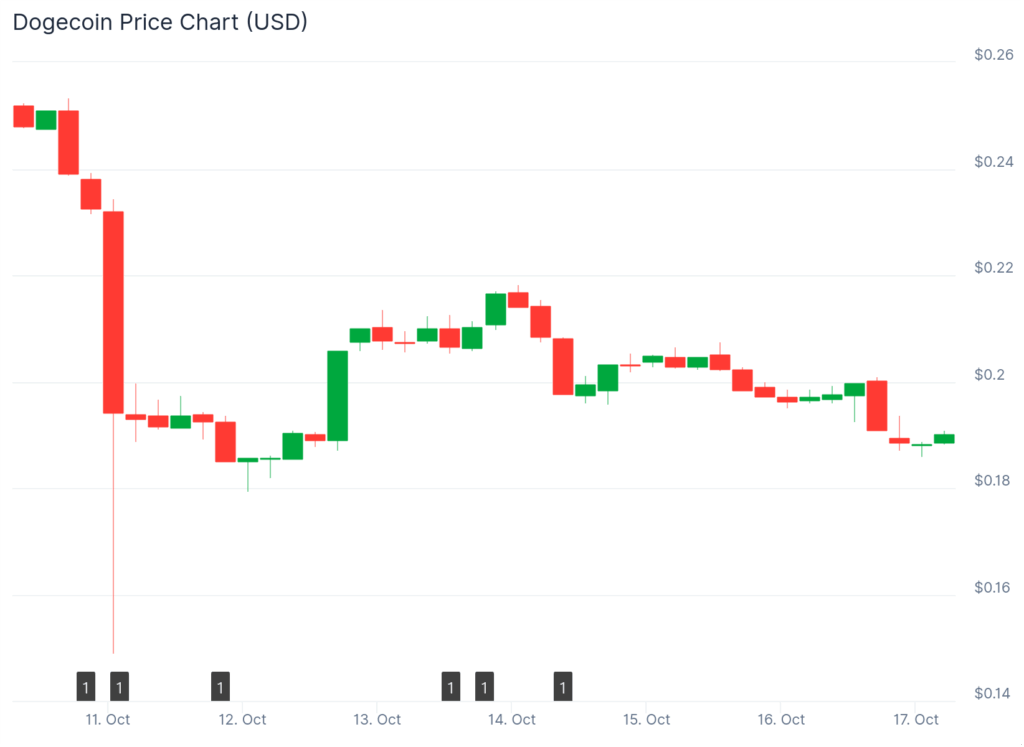

- Dogecoin dropped 21% this week as whales dumped $74 million regardless of information of a Nasdaq merger and potential fee integration.

- Thumzup’s DOGE fee plan was solely exploratory, main merchants to take earnings and set off additional promoting stress.

- Analysts say holding the $0.19 assist stage is essential, with a doable rebound towards $0.25–$0.33 if momentum returns.

Dogecoin simply had one in all its roughest weeks shortly. The meme coin slid about 21%, buying and selling close to $0.20, even after some large headlines that ought to’ve boosted morale. The “Home of Doge,” a company group backed by the Dogecoin Basis, introduced plans to merge with a Nasdaq-listed agency, whereas Thumzup Media revealed it was exploring DOGE funds for creators. However the hype didn’t final — merchants took earnings quick, and whales dumped a staggering $74 million price of DOGE proper after.

Large Bulletins, Small Affect

Initially, the information of a Nasdaq merger created a spark of pleasure throughout the Dogecoin group. It gave the impression of a step towards legitimacy, possibly even a touch of mainstream adoption. Then got here Thumzup’s replace — the social media rewards app mentioned it needed to combine Dogecoin payouts to assist creators earn sooner and skip transaction charges. The issue? It wasn’t an precise launch, only a risk. That single phrase — exploring — despatched merchants working for the exit. DOGE slipped one other 3% that day, displaying how fragile sentiment nonetheless is.

At this level, Dogecoin is down roughly 73% from its all-time excessive of $0.74. Market fatigue and an absence of clear follow-through from company companions have left retail buyers skeptical. Even thrilling bulletins can’t appear to raise the coin when whales are offloading.

Whales Offload $74 Million in DOGE

On-chain knowledge confirmed that giant holders bought about 360 million DOGE, price practically $74 million, in the midst of all this information. The timing suggests many whales used the hype to exit whereas retail buyers have been nonetheless reacting. The sell-off got here as broader crypto markets slipped, with Bitcoin and Ethereum additionally seeing purple.

Nonetheless, the Dogecoin liquidation stood out. The token had proven hints of life earlier within the month, bouncing towards $0.25, however as soon as momentum pale, promoting accelerated. Merchants say it’s a traditional case of “purchase the rumor, promote the information” — particularly with DOGE, the place hypothesis usually drives the complete narrative.

Key Ranges: $0.19 Help and $0.33 Goal

Technically, all eyes are actually on $0.19 — a essential assist line that would determine DOGE’s subsequent transfer. Analyst Ali Martinez famous that Dogecoin continues to be buying and selling inside an ascending channel, suggesting a possible restoration if it holds that base. A bounce might push costs again towards $0.25 and possibly $0.33 within the brief time period.

If that stage breaks although, issues might get uglier quick, with the following assist close to $0.17. The RSI sits round 45, displaying weak momentum and fading enthusiasm. For now, DOGE’s destiny depends upon whether or not patrons step in — or if whales maintain urgent promote.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.