Be a part of Our Telegram channel to remain updated on breaking information protection

Solana co-founder Anatoly Yakovenko has unveiled Percolator, a brand new “implementation-ready” decentralized perpetual change protocol constructed to tackle Aster and Hyperliquid within the fast-growing perp DEX market.

In response to its GitHub repository, Percolator is a technical blueprint for a sharded perpetual futures DEX designed to spice up buying and selling pace and effectivity. The system is nearing stress testing, although some core processes, together with account validation and funding charges, haven’t been finalized.

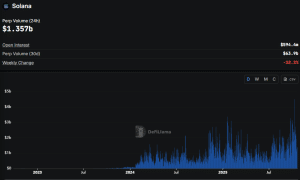

The transfer comes as Solana’s perpetual DEX volumes have slumped greater than 28% up to now week, trailing rivals which have captured a lot of the sector’s liquidity.

Solana perp quantity (Supply: DefiLlama)

“Hyperliquid has poached high-value customers from Solana and has retained them,” stated Matthew Sigel, head of digital property analysis at VanEck, referencing a report that discovered merchants shifting towards the rival change.

Some analysts say Yakovenko’s newest venture marks a bid to reclaim misplaced floor.

DEX Perp Volumes Surge

Over the previous month, volumes throughout the DEX perp sector soared to $1.186 trillion, with Off Chain, zkLighter, and Hyperliquid facilitating essentially the most exercise.

From a protocol perspective, the three-best performers are Lighter, Aster, and Hyperliquid. Lighter leads with $244.605 billion in buying and selling volumes up to now month and round $10.149 billion exercise up to now 24 hours.

Aster, which was launched on the BNB Chain and is backed by Binance founder Changpeng Zhao, aka CZ, has seen roughly $155.244 billion in buying and selling volumes over the previous month and about $9.953 billion within the final 24 hours.

Hyperliquid is the third hottest perp DEX platform with its volumes over the previous 24 hours standing at $8.064 billion. It did, nevertheless, outperform Lighter and Aster in latest month-to-month exercise, with its volumes reaching $313.244 billion over the previous thirty days, greater than double the volumes seen by Aster.

Solana buying and selling volumes stand at $63.9 billion up to now month.

I like this metric.

You possibly can see the distinction in quantity from the primary Hyperliquid season, season 1.5, pts season 2, secret season 2.5, after which no factors season.And but, the no factors interval has nonetheless generated a ton of quantity simply because the product, the entire of… pic.twitter.com/qmNoULpcWk

— Artommy (@Artommy_) October 21, 2025

Hyperliquid Could Be Attracting Solana Customers, VanEck Says

Yakovenko’s plans for a brand new protocol have been unveiled two months after a VanEck report claimed that Hyperliquid was attracting customers from the Solana ecosystem.

In July, Hyperliquid earned 35% of all blockchain income. Its development got here primarily on the expense of Solana, Ethereum, and BNB Chain, researchers led by Sigel at VanEck wrote in a month-to-month crypto recap report.

That’s after Hyperliquid’s buying and selling quantity reached a brand new month-to-month excessive of $319 billion in July, signaling that merchants are selecting to make use of decentralized exchanges as an alternative of their centralized counterparts.

Percolator Protocol Will Consist Of Two Elements

In response to the venture’s Github repository, the Percolator protocol will include two essential components. These are the “Router” program and the “Slab” program.

The router program will perform as the primary mind or coordinator within the system. It would deal with performance corresponding to the place collateral is saved, monitoring the full dangers throughout all trades, guaranteeing trades go to the right market shard, and managing small, non permanent permissions that can enable sure actions for a short interval.

In the meantime, the slab program will function an engine for every buying and selling market. Every of the slabs will run independently and can deal with their particular market’s order guide, matching engines, monitoring positions, and danger guidelines for margin and liquidations.

One of many essential options of the Percolator protocol is that it’ll cut up markets into a number of smaller items referred to as shards. This strategy makes the general system quicker and avoids congestion.

The protocol can even embody reminiscence effectivity. Every market will use as much as 10 MB, and there can even be limits on what number of accounts, orders, and trades it may possibly maintain.

The Github repository reveals that pool sizes have been fantastic tuned to suit inside 10 MB, with the variety of accounts capped at 5,000, orders at 30,000, positions at 30,000, reservations at 4,000, slices at 16,000, trades at 10,000, devices at 32, DLP accounts at 100, and aggressor entries at 4,000.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection