Mike Novogratz’s Galaxy Digital has moved extra Bitcoin out of its wallets, stirring recent debate about whether or not large gamers are promoting or simply dealing with shopper enterprise.

Associated Studying

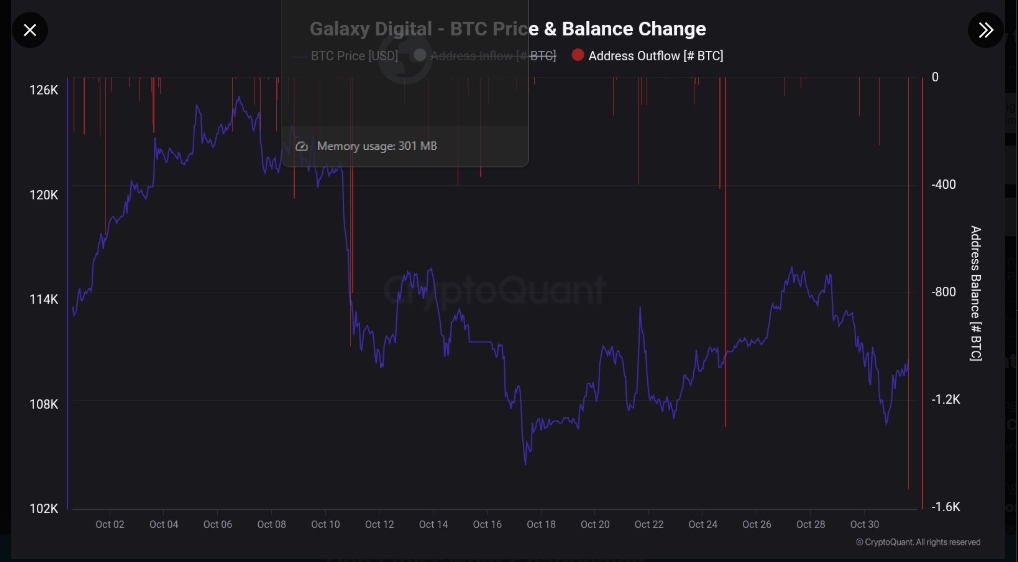

Based on on-chain trackers and posts shared by analytics agency CryptoQuant, a complete of 1,531 BTC was lately transferred out of wallets linked to Galaxy.

Galaxy’s Shopper Trades

Galaxy acts as each a service provider financial institution and a buying and selling desk for establishments, so massive transfers don’t at all times imply the agency is slicing its personal publicity.

Experiences have identified that Galaxy has executed main shopper orders earlier than — together with a notional sale of over 80,000 BTC up to now quarter — and lots of of these trades are dealt with off-exchange through OTC channels.

These details make it onerous to learn short-term outflows as pure profit-taking by Novogratz’s agency.

Galaxy Digital Outflow Spikes 🚨

Over 1,531 BTC moved out of Galaxy Digital wallets — a transparent signal of rising short-term promoting strain available in the market. 📉 pic.twitter.com/6BdsOZFatM

— Maartunn (@JA_Maartun) October 31, 2025

On-Chain Sample Provides Element

The 1,531 BTC motion follows a string of recorded outflows. For instance, trackers logged an outflow of 411 BTC on Oct. 24, suggesting this isn’t an remoted blip however a part of a number of current transfers tied to the agency’s wallets.

Some analysts say the sample appears like rising promoting strain. Different market watchers say the sums are in line with shopper execution and rebalancing.

Market Sentiment Cut up

Sentiment indicators present a cut up temper. Social measures and the so-called Concern and Greed gauge have dipped into concern territory these days. But heads of some asset managers argue the other.

Bitwise CEO Hunter Horsley has mentioned establishments are “speeding in,” and he factors to rising institutional curiosity as a sign that demand is constructing at increased ranges.

These two views sit at odds: seen outflows and rocky short-term flows on one aspect, and rising institutional allocation on the opposite.

Value Context And What It Means

Bitcoin has been buying and selling just a bit over $110,000 as these strikes occur. That value stage issues as a result of merchants watch it as a barrier for bulls.

When large transfers land close to key value factors, they get additional consideration; some see them as profit-taking, others as routine shopper service. Both manner, the online impact on value will depend on whether or not patrons step in to soak up the availability.

Associated Studying

Indicators Merchants Are Watching

Keep watch over three objects: ETF flows, OTC exercise, and on-chain outflows from recognized custodians. Spot crypto ETFs have proven internet withdrawals in current weeks, which might sap demand even when large establishments are slowly shopping for elsewhere.

If ETF outflows persist whereas wallets tied to main brokers maintain shifting cash out, value strain might rise. But when inflows return to identify ETFs or massive patrons match the OTC gross sales, that strain can ease shortly.

Featured picture from Unsplash, chart from TradingView