Bitcoin continues to slip deeper into the correction part, with the value now coming into the decrease boundary of the broader demand area. The market is approaching an space the place long-term patrons traditionally start accumulating, but momentum stays decisively bearish within the brief time period.

Technical Evaluation

By Shayan

The Day by day Chart

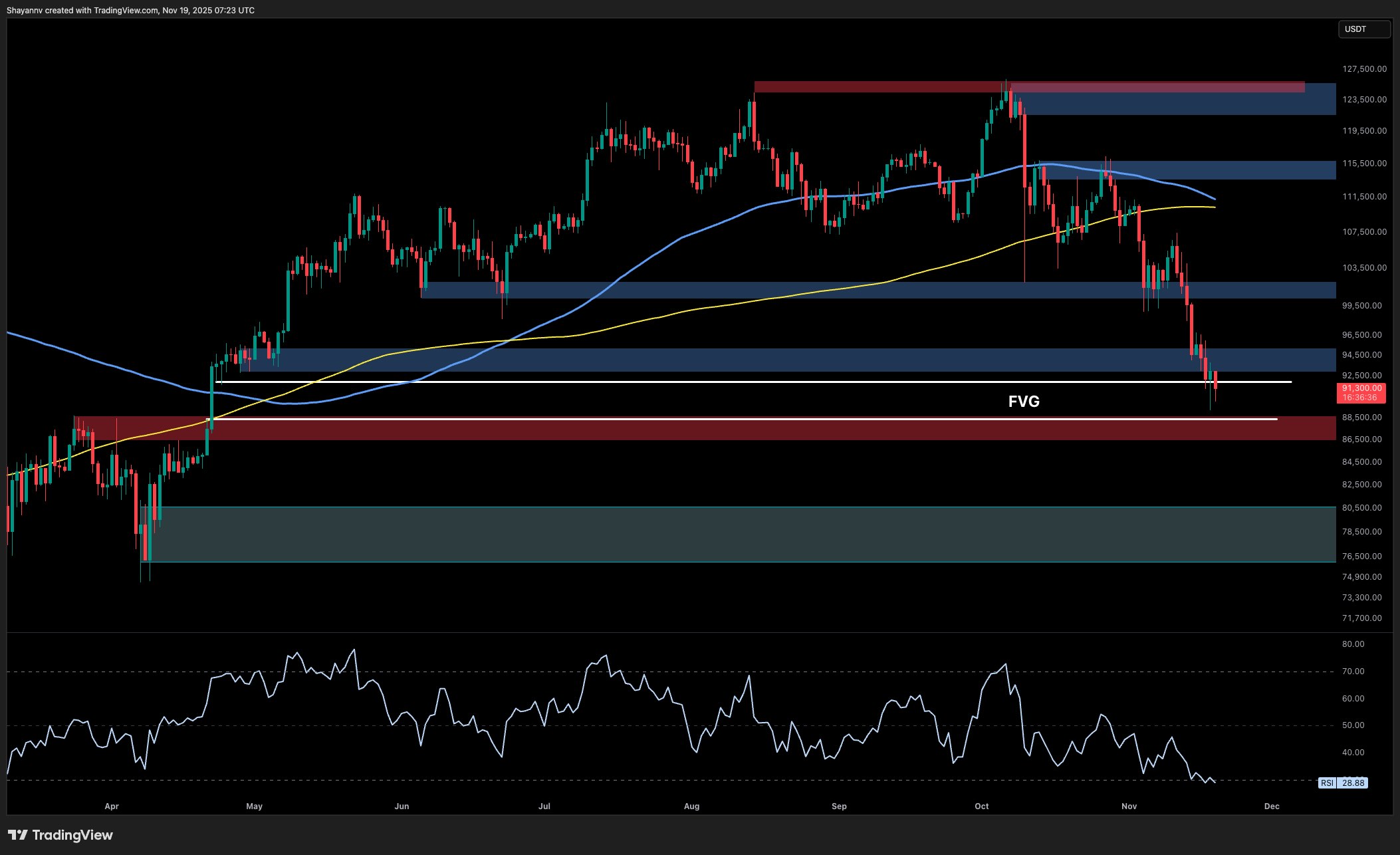

BTC has prolonged its decline into the $90K–$92K demand block, finishing a full sweep of the October liquidity pocket. The asset is at present interacting with the decrease half of a multi-week Truthful Worth Hole, the place earlier macro re-accumulation phases have shaped.

Each the 100-day and 200-day transferring averages proceed to slope downward above the value, confirming that patrons stay below strain. The newest breakdown under $96K produced no significant response, suggesting that momentum remains to be with the sellers for now.

What’s changing into extra notable, nevertheless, is the rising separation between the value and its imply pattern. The RSI has reached deeply oversold historic ranges, matching the situations seen in the course of the mid-cycle retracements of April and August. If patrons handle to defend the $89K–$92K band, this zone might type the bottom of a multi-week consolidation, doubtlessly marking a higher-timeframe accumulation zone earlier than the subsequent structural reversal.

Affirmation of power would solely come if the market reclaims the $98K–$100K area. Failure to take action retains the door open towards the decrease demand zone close to $85K.

The 4-Hour Chart

On the decrease timeframe, the asset continues to maneuver inside a bearish formation, with every decrease excessive forming nearer to the assist boundary. This compression typically seems within the later levels of a downtrend.

Bitcoin is testing the $90K–$92K assist field for the second time, and the reactions stay weak. A clear bullish reversal above $96K would point out a shift in short-term momentum, permitting a corrective rally towards the unfilled inefficiency at $102K.

If sellers preserve management, a deeper sweep of the $88K liquidity layer turns into seemingly. The construction stays weak, however the clustering of lows inside this area means that purchase orders could also be absorbing provide quietly, a typical characteristic of early accumulation phases, even when the value volatility persists.

On-chain Evaluation

By Shayan

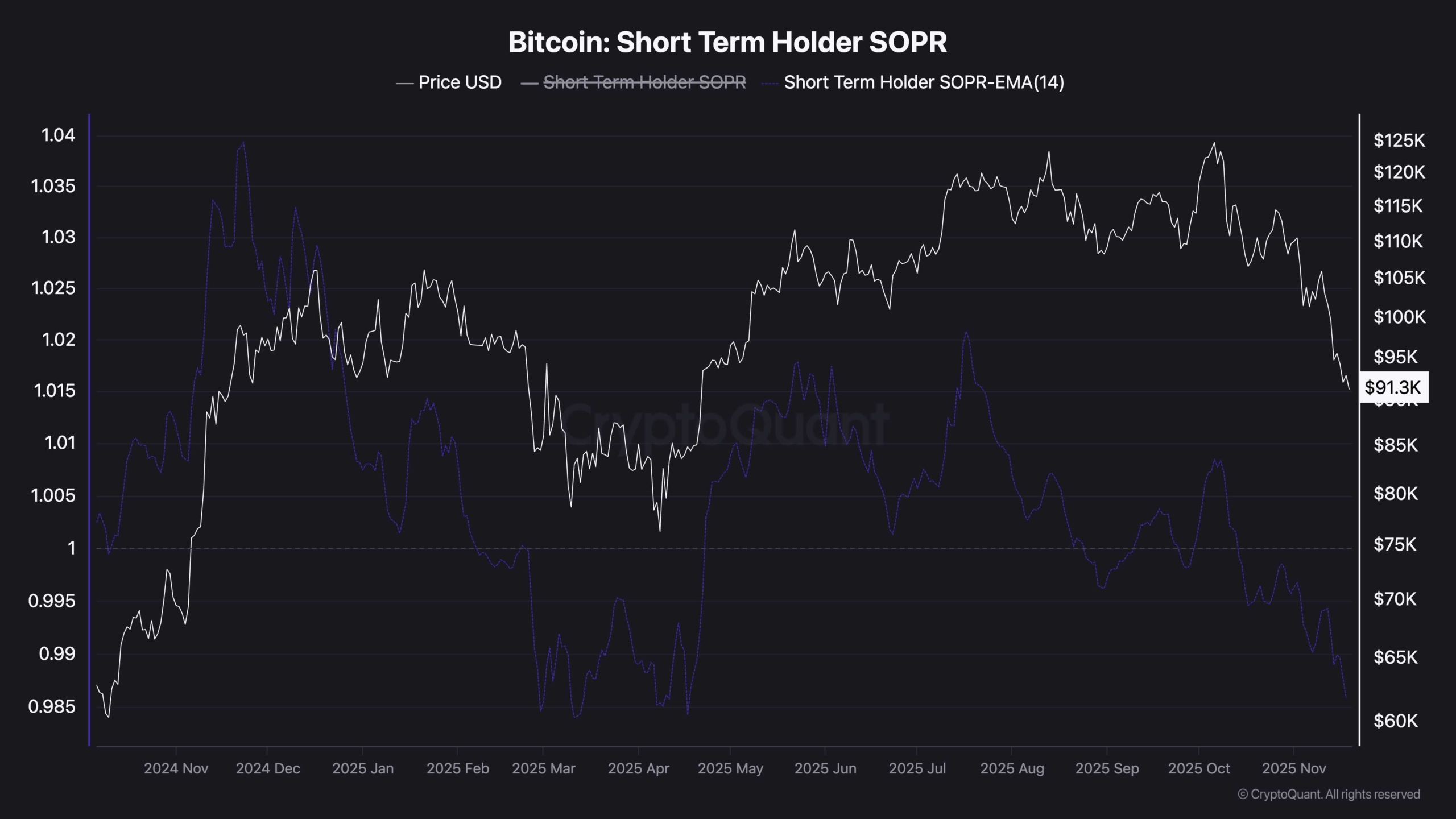

Bitcoin is coming into one of the vital intense short-term capitulation phases of this cycle. The Quick-Time period Holder SOPR has dropped sharply towards 0.97, confirming that short-term holders at the moment are realizing losses on a persistent foundation. SOPR has remained under the important 1.0 threshold for a number of weeks, forming a transparent capitulation band.

Traditionally, such intervals characterize fear-driven liquidations slightly than knowledgeable long-term distribution. This conduct tends to emerge not at the start of corrections however close to their later levels, when weak palms are flushed out and stronger holders start absorbing provide.

Whereas this doesn’t assure a direct reversal, it displays an essential structural shift. The continued loss-taking by short-term traders resets value bases and clears out speculative positioning, permitting the market to transition towards a more healthy basis for the subsequent macro transfer.

If worth stabilizes above the $89K–$92K zone whereas SOPR stays suppressed however begins curling upward, it could point out that capitulation has reached exhaustion and that accumulation is underway. A sustained breakdown of this zone, nevertheless, would open the trail towards a deeper sentiment reset earlier than restoration can develop.

The publish Bitcoin Value Evaluation: Is BTC Heading Beneath $90K Once more as Sellers Stay in Management? appeared first on CryptoPotato.