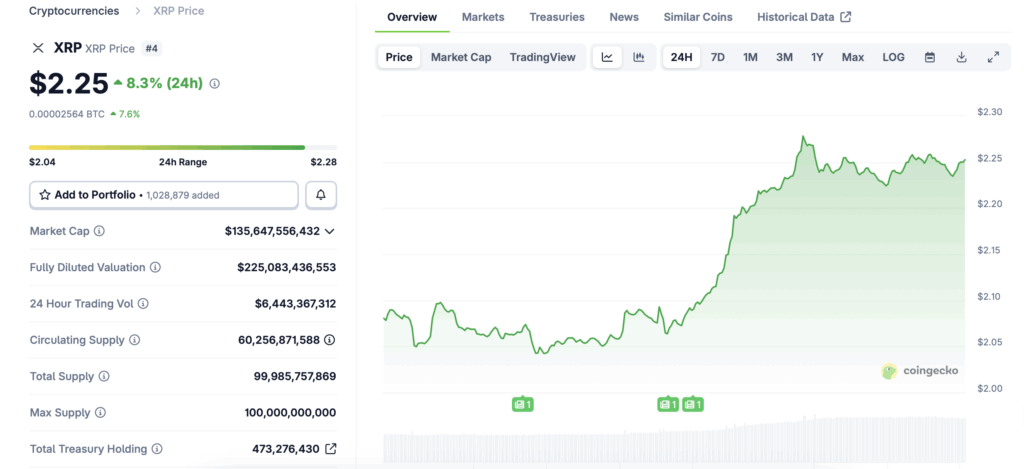

- XRP spiked over 9% to round $2.27 after Franklin Templeton and Grayscale launched spot XRP ETFs, becoming a member of Bitwise and Canary in providing regulated publicity.

- Ripple’s 2025 SEC settlement cleared long-standing authorized uncertainty, opening the door for main establishments to deal with XRP as a severe settlement and bridge asset.

- With rising futures open curiosity, a number of ETFs, and rising deal with cross-border funds and tokenized settlement, XRP is more and more positioned as core infrastructure moderately than simply one other altcoin.

XRP exploded practically 10% to hit $2.27 after Franklin Templeton and Grayscale kicked off buying and selling for his or her new spot XRP ETFs on Monday. The $1.69 trillion asset supervisor now joins Bitwise and Canary Capital in rolling out regulated XRP funding merchandise — and so they didn’t maintain again, calling XRP “foundational” for world settlement rails.

For a crypto neighborhood that spent years ready for readability, this wave of ETFs seems like a line within the sand. With Ripple’s SEC battle lastly wrapped up earlier this yr, the door for institutional cash is swinging broad open.

Wave of Wall Avenue ETFs Alerts a New Part for XRP

Franklin Templeton launched the Franklin XRP ETF (XRPZ) on NYSE Arca, structured as a grantor belief that tracks the CME CF XRP-Greenback Reference Charge. Coinbase Custody handles the crypto storage, and BNY Mellon oversees administration. Mainly: a clear, regulated wrapper for buyers who don’t wish to contact the asset straight.

“XRPZ provides buyers a regulated option to faucet right into a digital asset that’s taking part in a vital position in world settlement infrastructure,” mentioned David Mann from Franklin Templeton.

Grayscale stepped in with its personal product, GXRP, providing a zero-fee launch interval — a daring transfer that’s already catching consideration.

Bitwise bought there first, dropping its spot XRP ETF per week earlier and pulling in $100 million proper out the gate. A number of ETF launches back-to-back suggests these corporations have been ready for one factor: regulatory inexperienced lights.

Ripple’s Settlement Lastly Clears the Path

Ripple’s $125 million settlement with the SEC in Could 2025 eliminated the ultimate cloud hanging over XRP. The deal resolved all claims with out Ripple admitting wrongdoing. The SEC confirmed that $50 million was paid straight, and the remaining launched from escrow — sufficient readability for Wall Avenue to maneuver with out hesitation.

Franklin Templeton’s entry is the largest credibility stamp to this point. With their dimension, oversight, and custodians, the institutional world now has a totally compliant option to get publicity to XRP — one thing that was unimaginable only a yr in the past.

Nonetheless, ETF filings warn about volatility, regulatory unknowns outdoors the U.S., and the truth that these merchandise should not diversified. You’re shopping for XRP, interval, nothing else within the basket.

Technical Strengths Make XRP Enticing to Establishments

XRP runs on the XRP Ledger — a quick, low-fee, energy-efficient blockchain constructed for settlement, not hypothesis. XRPL handles transactions in round 3 to five seconds and has already processed greater than 3.3 billion transfers.

In comparison with Bitcoin, which largely features as a retailer of worth, XRP’s infrastructure is designed for banks, fintechs, and cross-border fee corridors. That’s one of many huge causes Grayscale and Franklin Templeton preserve emphasizing XRP’s position as a foreign money bridge.

Open curiosity in XRP futures has additionally climbed, hinting at a surge of institutional and retail participation. It’s not simply ETF hype — merchants are positioning for an even bigger transfer.

World Fee Narratives Add Gasoline

Some analysts have identified that XRP may play a job in rising fee corridors — particularly throughout Asia, Africa, and the Center East.

Black Swan Capitalist even instructed China has oblique publicity to XRP through the BRICS New Improvement Financial institution and main Japanese fintech SBI Holdings. Whereas China isn’t adopting XRP straight, geopolitical curiosity in cross-border digital settlement retains creeping into the dialog.

BRICS suggestions from April 2025 included calls to assist new digital fee methods. They didn’t point out XRP explicitly, however the overlap with XRP’s use case is tough to disregard.

In the meantime, the European Central Financial institution continues exploring cross-border digital funds, discussing “Challenge Nexus” earlier this yr, which goals to hyperlink fragmented regional methods.

All these threads — from Wall Avenue ETFs to world settlement initiatives — level in the identical route: XRP is changing into more and more related on the earth’s shift towards sooner, interoperable cash.

The put up Wall Avenue Wraps XRP in ETFs — Right here Is Why This May Be a Turning Level for the Ledger first appeared on BlockNews.