- Aave’s SEC investigation formally ended, eradicating a significant long-term threat, however worth motion barely reacted

- Falling open curiosity and weak momentum recommend merchants are nonetheless stepping again within the quick time period

- AAVE stays technically fragile under key resistance, with draw back ranges nonetheless in play

Aave (AAVE) remains to be sliding, and the chart isn’t hiding it. On the time of writing on Wednesday, the token was buying and selling under $186 after one other clear rejection from a well-defined resistance zone. Regardless of a significant regulatory cloud lastly lifting, short-term worth motion tells a unique story, one the place bearish stress remains to be very a lot in management.

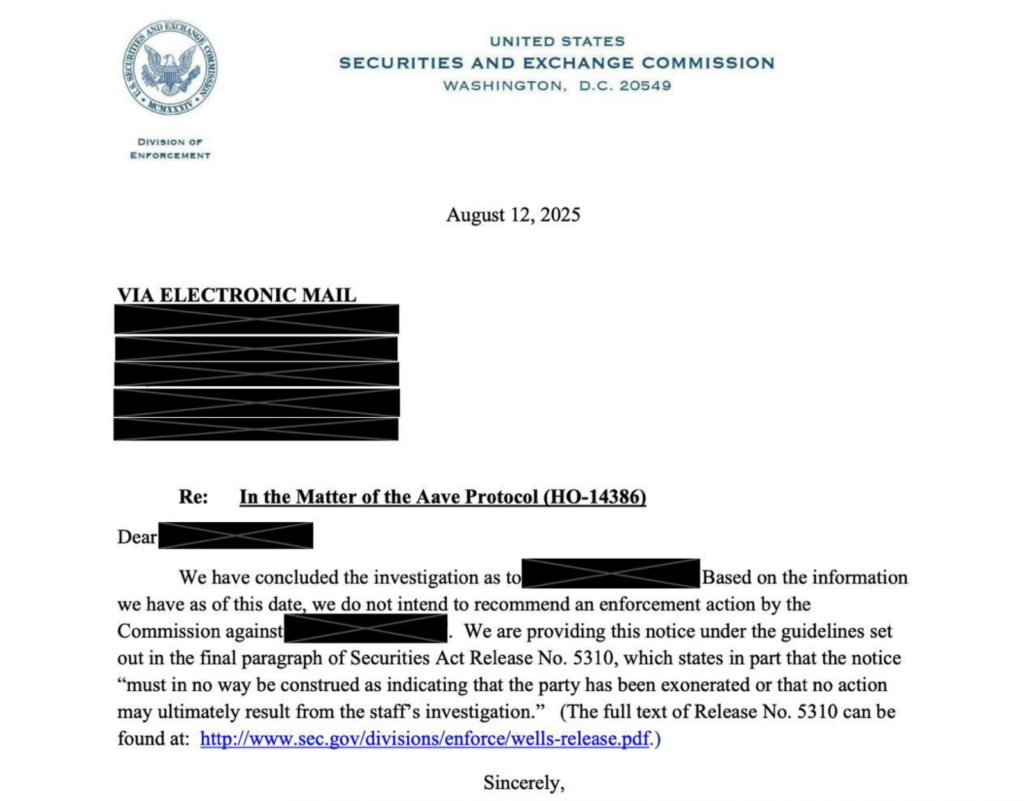

SEC investigation ends, however worth barely reacts

Earlier this week, Aave founder and CEO Stani Kulechov confirmed that the U.S. Securities and Alternate Fee has formally closed its four-year investigation into the Aave protocol. He described the result as a turning level, noting that DeFi has operated beneath heavy regulatory scrutiny for years and that this chapter can now lastly shut.

From a long-term perspective, it is a clear win. The elimination of regulatory uncertainty improves investor confidence and offers the protocol extra freedom to give attention to product growth and adoption. Nonetheless, the market shrugged. On the day of the announcement, AAVE fell one other 3.48%, a reminder that reduction narratives don’t at all times translate into speedy worth power, particularly in risk-off circumstances.

Derivatives information retains flashing warning

Zooming into derivatives, the tone stays defensive. Open curiosity for AAVE on Binance has dropped to roughly $56.6 million, hovering close to yearly lows. That decline suggests merchants are exiting positions reasonably than opening new ones, a traditional signal that speculative urge for food is cooling.

When open curiosity falls alongside worth, it normally means conviction is fading. There’s no aggressive dip-buying exhibiting up but, and that lack of leverage help retains downward stress intact.

Technical construction favors sellers, for now

Technically, AAVE bumped into bother earlier this month after failing to reclaim its 50-day exponential transferring common close to $198.64. That degree additionally aligns with the higher boundary of a falling channel, making it a tricky ceiling. Since that rejection on December 10, worth has slipped roughly 8%, settling close to $185.

Momentum indicators are beginning to lean bearish. The RSI sits round 47, under impartial, hinting that sellers are progressively gaining management. In the meantime, the MACD traces are tightening and edging nearer to a bearish crossover. If that flip confirms, it will add extra weight to the draw back case.

If weak spot persists, the subsequent degree to observe sits close to $179. A each day shut under that opens the door to a deeper transfer towards the weekly help round $160. On the upside, bulls would want a decisive push again above the 50-day EMA close to $198 to shift the short-term construction.

For now, the regulatory victory is actual, however the chart remains to be asking for endurance.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.