- Cardano’s Ouroboros Linear Leios improve improves scalability with out sacrificing safety

- Grayscale elevated ADA publicity, signaling rising institutional confidence

- A protracted-term breakout hinges on reclaiming the $1.00–$1.20 resistance zone

For a protracted stretch, Cardano seemed caught. ADA traded sideways, generally drifting decrease, even because the ecosystem rolled out upgrades and expanded quietly behind the scenes. That disconnect made the token really feel undervalued to many long-term holders, particularly whereas improvement saved shifting ahead. Now, with Midnight’s privateness layer already built-in into a number of chains and core protocol upgrades touchdown, the image is beginning to look extra intentional than unintended.

Ouroboros, Cardano’s newest evolution, has additionally performed a task right here. The improve helped reposition ADA as one thing establishments may really take critically, with Grayscale stepping in as one of many extra seen accumulators. Taken collectively, these strikes trace that Cardano’s sluggish interval could have been extra about constructing than stalling.

How Ouroboros Linear Leios Adjustments Cardano’s Throughput

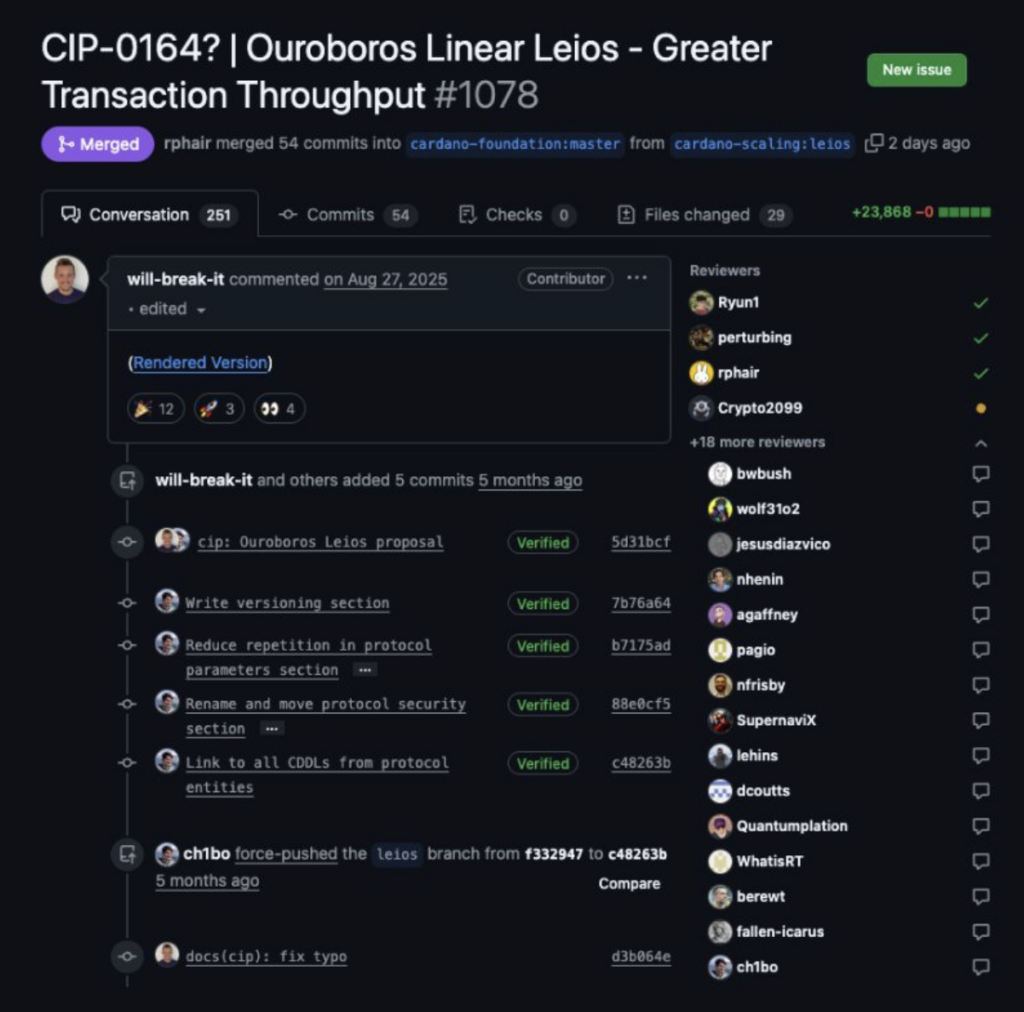

On the protocol degree, Cardano merged CIP-0164 with Ouroboros Linear Leios to considerably improve transaction pace and capability. This improve, finalized and merged on January 6, 2025, launched a two-tier block construction that separates how transactions are dealt with on the community. It’s a refined change, however an vital one.

Endorser Blocks are designed to course of massive volumes of non-sensitive transactions in parallel, whereas Reference Blocks deal with operations the place order nonetheless issues. DeFi trades that want front-running resistance, for instance, keep protected in a approach that resembles the present Ouroboros Praos mannequin. The concept is to scale with out sacrificing safety or equity.

Simulations recommend the improve may increase capability by 30 to 60 instances utilizing bigger blocks and financial incentives. By routing higher-value transactions by way of safer channels, the system additionally reduces MEV danger. Whereas some group members flagged potential points round certification and restoration, the profitable mainnet deployment confirmed the mannequin works, and provides builders a clearer integration path going ahead.

Establishments Begin Leaning Into ADA Publicity

On the institutional facet, ADA has began exhibiting up extra prominently. Grayscale’s Good Contract Platform Fund went by way of a quarterly rebalance, and Cardano emerged as a significant piece of the allocation. ADA now accounts for 18.55% of the fund, putting it third behind Solana at 29.55% and Ethereum at 29.00%.

That shift alerts greater than routine rebalancing. It displays a broader try by establishments to extend publicity to scalable proof-of-stake platforms past the apparent leaders. Different property within the fund embrace Sui, Avalanche, and Hedera, however the rising ADA weight suggests confidence in Cardano’s long-term positioning.

What’s notable is the timing. This accumulation coincides with Cardano enhancing the effectivity and suppleness of its proof-of-stake design. On the similar time, spot market whales seem like shifting in the identical course as establishments, quietly constructing positions whereas value stays compressed.

Can ADA Lastly Break By way of $1

From a technical standpoint, analysts are watching a long-term setup that’s been years within the making. Crypto analyst Crypto Patel factors to the two-week ADA/USDT chart, the place value has been compressing inside a big symmetrical triangle because the 2021 peak. A descending resistance line fashioned across the $3 degree intersects with a macro ascending help, creating strain that gained’t final without end.

The important thing accumulation zone sits between $0.28 and $0.38, an space Patel describes as good cash demand. So long as ADA holds above roughly $0.30, the construction stays intact. A breakout above the $1.00–$1.20 resistance zone can be the set off that adjustments the dialog, opening the door to increased targets at $2.60, $5.00, and doubtlessly $10 over time.

There’s a clear invalidation level, although. A weekly shut beneath $0.28 would weaken the complete bullish thesis and recommend the bottom has failed. Till then, the setup favors endurance. Exterior forces like adoption and regulation will nonetheless matter, however structurally, ADA is positioned higher than it has been in years.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.