Worth motion is formed by a dominant downtrend on the upper timeframe, whereas Monero makes an attempt a tactical short-term restoration inside a nonetheless fragile construction.

Monero (XMR) – The place We Stand Now

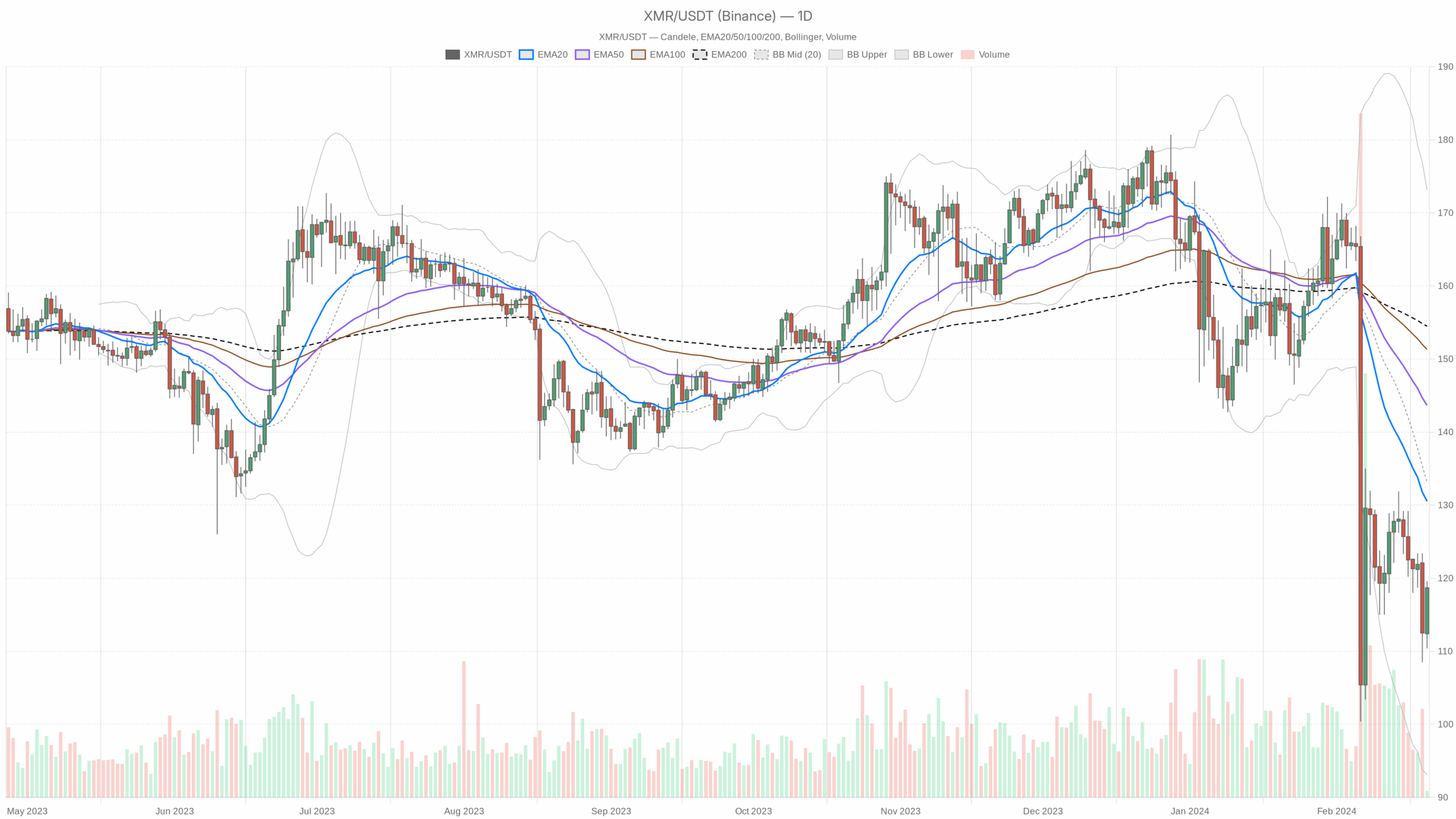

Monero is buying and selling round $118.7 towards USDT, deep inside a medium-term downtrend however with a noticeable short-term rebound attempting to construct from beneath. Every day construction remains to be clearly bearish, but decrease timeframes present rising danger urge for food and an try to squeeze shorts.

This can be a traditional second the place development and imply reversion are preventing one another: the dominant path remains to be down on the day by day chart, however 1H and 15m momentum are pushing up from oversold territory. In different phrases, the trail of least resistance remains to be decrease, however the market is now not keen to promote at any value.

Given the present readings, the essential state of affairs on D1 is bearish, with a tactical bullish countertrend part underway intraday.

Every day Chart (D1) – Bears Management the Pattern

On the day by day timeframe, Monero is in a mature downtrend. Worth is buying and selling beneath all key shifting averages and below the Bollinger mid-band, with volatility nonetheless significant and the sentiment backdrop in Worry.

Pattern Construction – EMA Cluster

- Worth: $118.7

- EMA 20: $130.53

- EMA 50: $143.65

- EMA 200: $154.49

All three EMAs are stacked above value and above one another (20 < 50 < 200) with a transparent downward slope. Worth sitting virtually $12 beneath the 20-day EMA confirms a bearish regime the place rallies are, by default, suspect.

What it implies: Structurally, XMR remains to be in a downtrend. Any bounce towards $130–145 is, for now, a possible promoting zone till the day by day closes begin reclaiming the 20-day EMA and flattening the 50-day.

Momentum – RSI & MACD

RSI beneath 40 reveals bearish momentum, however not outright capitulation. Sellers are in management, but the market is just not extraordinarily oversold anymore. That often matches with a market that has already taken a success and is now in a pause or bounce part.

What it implies: Draw back strain dominates, however the straightforward a part of the selloff might be behind us. This can be a zone the place countertrend longs can seem, however they’re preventing the first development.

- MACD (D1): line -9.66, sign -8.97, histogram -0.69

MACD is detrimental, with the road barely beneath the sign and a small detrimental histogram. That’s in step with a bearish development, however notice the histogram magnitude is modest. Draw back momentum is actual, however not accelerating exhausting.

What it implies: The downtrend is energetic however not in waterfall mode. Bears nonetheless personal the upper timeframe, but they aren’t urgent the gasoline additional at this precise second, which leaves room for short-covering rallies.

Volatility & Vary – Bollinger Bands and ATR

- Bollinger Bands (D1): mid $133.1, higher $173.11, decrease $93.1

- ATR 14 (D1): $10.34

Worth at $118.7 sits beneath the mid-band and within the decrease half of the band vary, however not hugging the decrease band. The band width is vast ($93–173), signalling an already risky surroundings. ATR round $10 factors to sizeable day by day swings, so strikes of seven–10% in a single session are completely regular right here.

What it implies: The market has already expanded decrease and remains to be risky. That usually results in two-phase conduct: first development, then uneven imply reversion whereas volatility bleeds out. We’re doubtless someplace between these two levels.

Key Every day Ranges – Pivots

- Pivot Level (PP): $116.23

- Resistance 1 (R1): $122.07

- Assist 1 (S1): $112.87

Worth at $118.7 is buying and selling above the day by day pivot however beneath R1.

What it implies: In the present day’s steadiness is barely constructive versus the reference stage, however XMR remains to be capped beneath the primary resistance band. Bulls have intraday management, but they haven’t damaged the day by day downtrend context.

1-Hour Chart (H1) – Countertrend Bounce with Work to Do

On the 1H chart, Monero is transitioning from defensive to extra impartial positioning, with some early indicators of short-term accumulation.

Pattern & Construction – EMAs

- Worth: $118.7

- EMA 20 (H1): $115.86

- EMA 50 (H1): $118.31

- EMA 200 (H1): $122.02

Worth is buying and selling above the 20- and 50-hour EMAs, however nonetheless beneath the 200-hour EMA. The shorter EMAs are beginning to curl up, whereas the 200-hour stays a heavy cap overhead.

What it implies: Intraday, consumers have taken the wheel from the latest lows, however they’re nonetheless driving towards a broader downtrend. The 200-hour EMA close to $122 and the day by day R1 round $122 create a confluence barrier. That’s the first main line the place this bounce will probably be examined.

Momentum – RSI & MACD

RSI is comfortably above 50 however not overbought, matching a wholesome intraday upswing.

What it implies: Bulls have momentum on this timeframe, however there’s nonetheless room to push increased earlier than exhaustion units in. This favors continuation of the bounce so long as the market stays above the intraday EMAs.

- MACD (H1): line -1.71, sign -2.00, histogram 0.29

The MACD line remains to be beneath zero, nevertheless it has crossed above the sign with a constructive histogram. This setup is typical of a rebound inside a wider downtrend.

What it implies: Quick-term momentum is shifting to the upside, however the transfer is corrective in nature till MACD pushes into constructive territory and holds there.

Volatility & Quick-Time period Ranges – Bollinger, ATR, Pivots

- Bollinger Bands (H1): mid $116.28, higher $124.46, decrease $108.1

- ATR 14 (H1): $3.77

- Pivot Level (H1): $117.4

- R1 (H1): $120.9

- S1 (H1): $115.2

Worth is sitting simply above the mid-band and above the hourly pivot, heading towards the higher band zone round $124. Volatility is reasonable on this timeframe, with about $3–4 anticipated hourly vary.

What it implies: Close to-term management leans towards consumers, with the primary critical intraday resistance between $120.9 (H1 R1) and $122 (day by day R1 / H1 200 EMA). A clear break there would improve this from a easy bounce to a extra significant short-term development change.

15-Minute Chart (M15) – Overheated Execution Zone

The 15-minute chart is the place we see the quick warmth of this bounce, and it’s already operating sizzling.

Quick-Time period Pattern – EMAs

- Worth: $118.7

- EMA 20 (M15): $114.02

- EMA 50 (M15): $114.5

- EMA 200 (M15): $118.12

Worth is buying and selling sharply above the 20- and 50-EMA and simply above the 200-EMA on the 15m chart.

What it implies: Very brief time period, consumers have clearly taken over. Nevertheless, the unfold between value and the quick EMAs is vast, which often doesn’t final. Both value cools off or it goes right into a risky chop whereas the averages catch up.

Native Momentum – RSI & MACD

RSI above 70 on the 15-minute reveals overbought intraday circumstances.

What it implies: The transfer up is robust however stretched. From an execution standpoint, this can be a poor spot to provoke contemporary longs. It’s extra a zone the place short-term merchants both trim or anticipate a pullback.

- MACD (M15): line 0.71, sign 0.11, histogram 0.60

MACD is constructive with the road above the sign and a powerful constructive histogram.

What it implies: Instant momentum is decisively bullish on this micro timeframe. Mixed with overbought RSI, it factors to a robust thrust that’s more and more weak to a shakeout or consolidation.

Very Quick-Time period Vary – Bollinger, ATR, Pivots

- Bollinger Bands (M15): mid $113.61, higher $116.71, decrease $110.52

- ATR 14 (M15): $2.06

- Pivot Level (M15): $117.77

- R1 (M15): $120.53

- S1 (M15): $115.93

Worth at $118.7 is buying and selling above the mid-band and above the 15m pivot, and already via the higher band from earlier within the session.

What it implies: The short-term battle is gained by the bulls, however the mixture of band extension and excessive RSI often precedes a pause. Hourly ATR round $3–4 and 15m ATR close to $2 warn that intraday swings could be sharp each methods.

Market Context – Danger Urge for food in a Bearish Shell

The broader crypto market cap sits round $3.22T, up roughly 1.5% within the final 24h, with BTC dominance above 57%. The Worry & Greed Index is at 26 (Worry) as of 2026, reflecting a nonetheless cautious surroundings.

What it implies for Monero:

We have now a market that’s leaning risk-on over the past 24 hours, however sentiment remains to be defensive general. In that surroundings, privateness cash like Monero usually lag on robust BTC-led legs after which catch a part of the transfer through short-covering bounces. That matches effectively with what we’re seeing within the multi-timeframe image: increased timeframe bearish, short-term restoration, cautious risk-taking.

Bullish State of affairs for XMR

For bulls, the present play is a countertrend restoration which may graduate into a bigger reversal if key ranges flip.

Close to-term (intraday) path:

- Maintain above the day by day pivot at $116.23 and the H1 pivot at $117.4.

- 15m RSI cools from overbought (70+) again towards 50–60 through sideways value or a shallow pullback, whereas value stays above the M15 200 EMA (~$118.1) or at worst the H1 50 EMA (~$118.3).

Upside checkpoints:

- $120.9–$122: confluence of H1 R1, day by day R1, and H1 200 EMA. A clear 1H shut above this band would sign that consumers have finished extra than simply squeeze shorts.

- From there, the subsequent technical magnet on the day by day chart is the 20-day EMA round $130.5.

What confirms a extra significant bullish swing:

- A day by day shut above $130–133 (20-day EMA and Bollinger mid-band) would point out that the market is beginning to assault the medium-term downtrend fairly than simply bounce inside it.

- RSI on D1 pushing again above 45–50 and MACD histogram flattening towards zero would assist the thought of a development transition.

Invalidation of the bullish state of affairs:

- A sustained transfer again beneath $116 (below day by day and H1 pivots) would present that the bounce has failed.

- A day by day shut beneath $112.87 (S1) would put the bears firmly again in management and opens the door to a re-test of the decrease Bollinger space towards $100–95.

Bearish State of affairs for XMR

Bears nonetheless personal the upper timeframe, and the first thesis is that rallies get offered till confirmed in any other case.

Core bearish view:

- Every day EMAs stay stacked bearish and much above value, with RSI beneath 40 and MACD detrimental. That’s the spine of the downtrend.

- The present intraday power is handled as a short-covering rally into resistance, not a brand new bull development, except key ranges are reclaimed.

Bearish roadmap:

- Worth fails to carry the $120.9–$122 resistance pocket (H1 R1 / day by day R1 / H1 200 EMA) and begins rejecting from that zone.

- 15m RSI rolls down from overbought and breaks beneath 50, whereas the M15 200 EMA at $118.1 and H1 50 EMA at $118.3 give method.

- A decisive break again beneath $116.23 (day by day PP) turns at this time’s construction from constructive to weak.

Draw back targets from there:

- First, $112.87 (day by day S1) as an instantaneous assist zone.

- If that breaks on a day by day shut, value opens a window towards the decrease half of the Bollinger vary, with the decrease band down close to $93 performing as the intense bearish extension.

What invalidates the bearish dominance:

- A number of day by day closes again above the 20-day EMA (~$130.5), ideally adopted by a flattening or turn-up of the 50-day round $143–145.

- D1 RSI sustainably above 50 and MACD crossing its sign with the histogram turning constructive.

Till these circumstances seem, the broader bias stays bearish, and rallies into the EMA cluster on the day by day chart are technically countertrend. On the similar time, this part can nonetheless host sharp rallies, particularly if the broader market maintains a modest risk-on tone.

Suppose About Positioning Proper Now

Monero is caught between a dominant day by day downtrend and a stay intraday bounce. Increased timeframe merchants will nonetheless name this a bear market rally; decrease timeframe merchants will deal with it as an opportunity-rich surroundings with huge intraday ranges.

Key tensions to bear in mind:

- Pattern vs. Imply Reversion: the day by day development is down. Fading each spike has labored lately, however as value extends away from the EMAs, bounces like this turn out to be sharper. That’s the place imply reversion merchants step in.

- Momentum vs. Construction: M15 and H1 momentum is bullish, however it’s working inside a bearish day by day construction. Sturdy short-term indicators towards the upper timeframe development are typically shorter-lived except backed by actual structural breaks.

- Danger Urge for food vs. Protection: the broader market is recovering with BTC dominance excessive and sentiment in Worry. That often means capital is selective. Privateness cash like Monero is not going to be the primary in line for aggressive risk-on flows, however they will nonetheless transfer exhausting when liquidity is skinny.

In sensible phrases, this can be a part the place chasing on the 15-minute after an overbought spike is dangerous. Markets can whipsaw intraday because the bounce runs into increased timeframe resistance. Place measurement and cease placement matter greater than ordinary given the elevated ATR on each day by day and intraday charts.

Any plan, bullish or bearish, ought to respect the truth that volatility is excessive and the principle development remains to be down. Intraday merchants might lean into the present bounce with tight danger, whereas swing merchants will probably be extra thinking about how value behaves round $122 and particularly $130–133 earlier than altering their broader bias on Monero.

Open your Investing.com account

This part comprises a sponsored affiliate hyperlink. We might earn a fee at no extra price to you.

This evaluation is for informational and academic functions solely and doesn’t represent funding, buying and selling, or monetary recommendation. Markets for Monero (XMR) and different cryptocurrencies are extremely risky and dangerous. All the time conduct your individual analysis and contemplate your danger tolerance earlier than making any buying and selling selections.

In abstract, Monero stays locked in a better timeframe downtrend whereas pursuing an energetic intraday rebound, making a panorama the place tactical alternatives exist however development danger remains to be clearly skewed to the draw back.