Ethereum is exhibiting renewed power because it breaks out from key technical patterns, aligning with broader crypto market optimism. This transfer comes amid continued ETF hypothesis, elevated institutional exercise, and a wave of geopolitical instability driving capital into decentralized belongings. Regardless of macro uncertainty, ETH’s construction throughout a number of timeframes and on-chain information mirror bettering sentiment and positioning.

Ethereum Worth Evaluation: The Each day Chart

On the every day chart, ETH has efficiently damaged out from the symmetrical triangle fashioned over the previous two months. This breakout was supported by the RSI regaining bullish momentum above the 60 stage. The asset can also be making an attempt to reclaim the 100-day MA and the $3,400-$3,600 space, a key resistance stage that aligns with a earlier order block and provide zone.

If consumers break above this stage, the following key resistance would be the 200-day shifting common, which lies across the $3,800. On the draw back, the $3,000 and $2,700 ranges are important help ranges that ought to be protected by the consumers for the market to not flip bearish.

ETH/USDT 4-Hour Chart

On the 4-hour chart, ETH has clearly damaged out of its symmetrical triangle, with a robust bullish push by the $3,300–$3,500 resistance zone. This zone had acted as a ceiling for weeks. The worth is now consolidating round it, and this would possibly counsel a cooldown earlier than the following leg greater.

The RSI, nevertheless, is pulling again from the overbought area, which signifies {that a} consolidation or pullback is probably going earlier than a continued rally. So long as the value holds above the damaged sample, a continuation in direction of the $3,600–$3,700 vary stays seemingly. Then again, a break beneath $3,200 would invalidate the fast bullish construction and will set off a drop again towards the $3,000 stage and even decrease.

Sentiment Evaluation

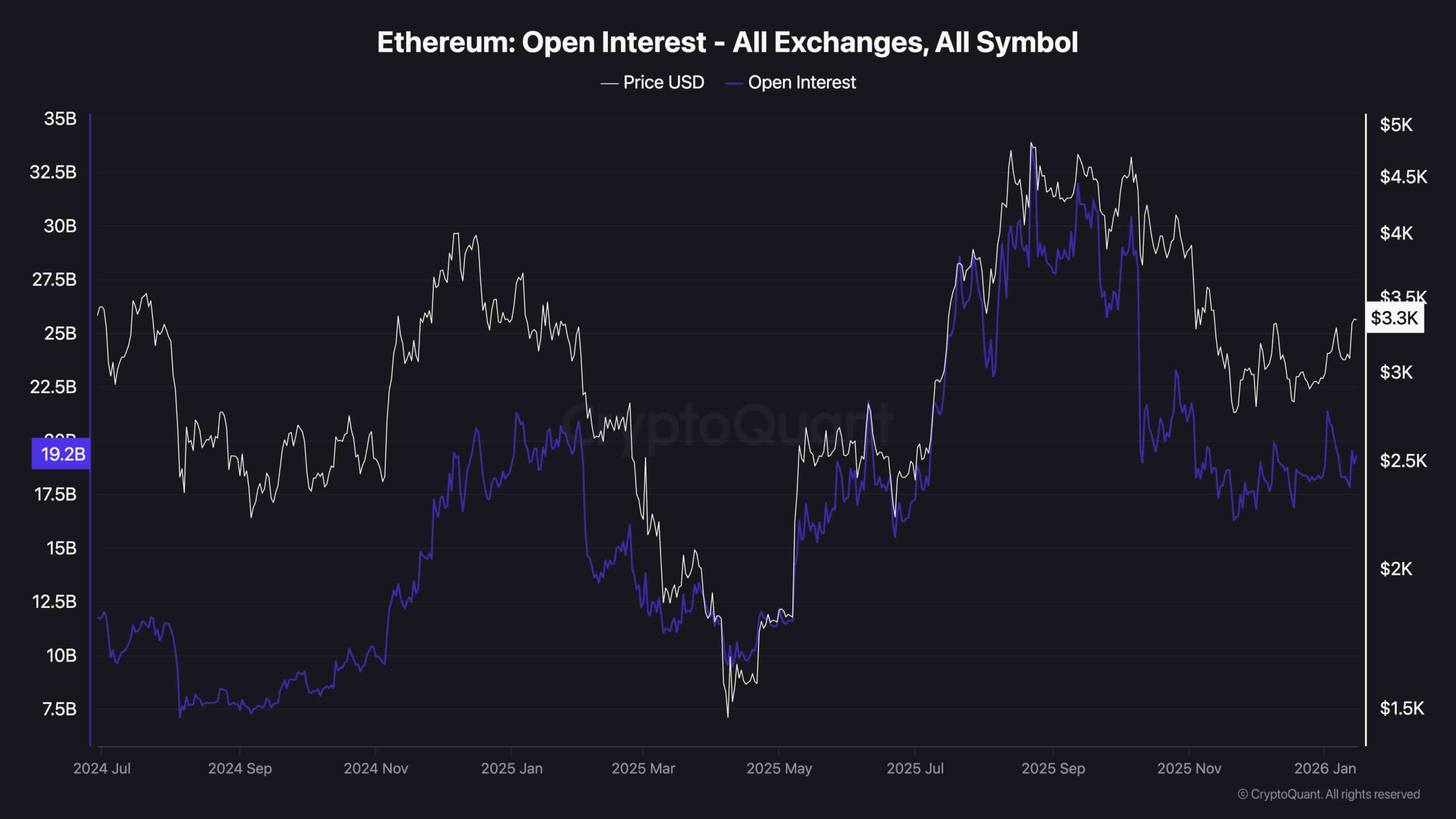

From a futures market sentiment perspective, Ethereum’s open curiosity has been oscillating horizontally, now round $19.2B throughout all exchanges.

This implies that each leveraged quick and lengthy positions have been getting liquidated through the current consolidation, making a liquidation cascade much less seemingly within the quick time period. Because of this, if enough spot demand is current, the value might recuperate sustainably and certain transfer towards the $4K mark within the coming weeks.

The put up Ethereum Worth Evaluation: Is $4K Realistically Inside Attain for ETH? appeared first on CryptoPotato.