- Bitcoin dominates the crypto market and stays the safer, institution-backed selection

- Solana gives larger development potential by sensible contracts and stablecoin adoption

- The choice between BTC and SOL is determined by danger urge for food and long-term objectives

Solana clearly has room to develop, however in relation to security and stability, Bitcoin nonetheless sits in a class of its personal. That hole between upside potential and perceived safety is what makes evaluating the 2 so attention-grabbing as crypto strikes into its subsequent section of adoption.

Bitcoin accounts for practically 60% of the full crypto market worth and has develop into, for higher or worse, essentially the most extensively accepted face of digital belongings. Institutional capital tends to stream there first, and regulatory adjustments over the previous yr have even opened the door for Bitcoin to slowly enter retirement merchandise like 401(ok)s. Solana, by comparability, remains to be seen as a higher-risk wager.

Why Bitcoin Stays the “Safer” Selection

Bitcoin’s fame as digital gold continues to draw conservative buyers, although the comparability isn’t good. Its value stays unstable and infrequently strikes in tandem with tech shares throughout broader market stress. Power consumption is one other ongoing concern, at the same time as miners more and more redirect computing energy towards AI knowledge facilities.

Nonetheless, Bitcoin’s benefits are exhausting to disregard. With greater than $120 billion parked in spot Bitcoin ETFs, robust company adoption, and even government-level curiosity, its institutional backing is unmatched. Bitcoin reached a number of all-time highs in 2025 and, regardless of being down round 13% yr over yr, stays far much less unstable than most altcoins.

Some forecasts stay aggressive. Ark Make investments, for instance, has projected Bitcoin might exceed $760,000 by 2030, reinforcing the concept that “safer” doesn’t essentially imply low-return in crypto.

The place Solana’s Development Story Stands Out

Solana isn’t a newcomer anymore. Almost six years into its life, it blends high-speed transactions and low charges with an ecosystem constructed round sensible contracts. That programmability is its largest benefit over Bitcoin, permitting builders to construct DeFi apps, NFTs, and stablecoin infrastructure immediately on the community.

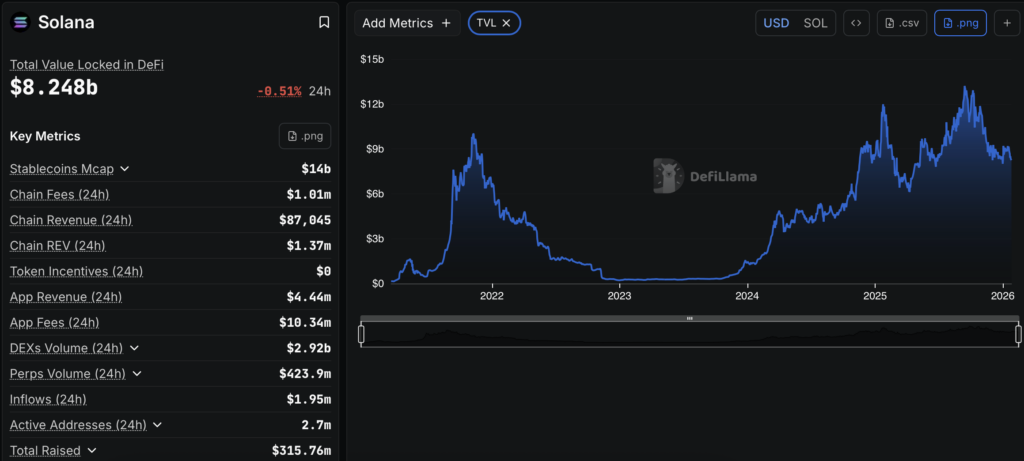

Stablecoins are a key piece of the puzzle. Round 4.5% of circulating stablecoins at the moment dwell on Solana, and its complete worth locked sits close to $8.4 billion. Citigroup has steered the stablecoin market might develop to $4 trillion by 2030. If Solana merely maintains its present share, its TVL might develop greater than 2,000%, a determine that highlights why some buyers view SOL as a high-upside asset.

At roughly $130, Solana trades properly beneath its all-time excessive of $294.33 set throughout final yr’s meme-driven surge. Whereas that drop is notable, it additionally reveals Solana was in a position to reclaim momentum, one thing many altcoins did not do after peaking in 2021.

Dangers Nonetheless Matter for Solana Traders

Solana’s upside comes with added danger. Its market cap is smaller, its observe document shorter, and early in its historical past the community suffered from outages. Whereas builders have made main enhancements and the final main outage occurred in February 2024, the notion hasn’t totally disappeared.

That mentioned, Solana gives one thing Bitcoin doesn’t, staking. SOL holders can earn yield by locking up tokens, producing passive returns whereas supporting community safety. If stablecoin utilization accelerates, Solana may benefit excess of Bitcoin, which can see its transactional function diluted by stablecoins in some areas.

Selecting Between Bitcoin and Solana

In actuality, this isn’t an either-or resolution. Bitcoin and Solana supply publicity to very totally different sides of the crypto ecosystem. Bitcoin appeals to buyers searching for relative stability and institutional validation. Solana attracts these prepared to just accept extra danger in alternate for doubtlessly larger development.

The bottom line is understanding your individual danger tolerance and funding objectives. Crypto stays a younger and evolving asset class, with regulation nonetheless taking form. Whichever path you select, it’s sensible to deal with crypto as a smaller slice of a diversified portfolio quite than the entire thing.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.