Briefly

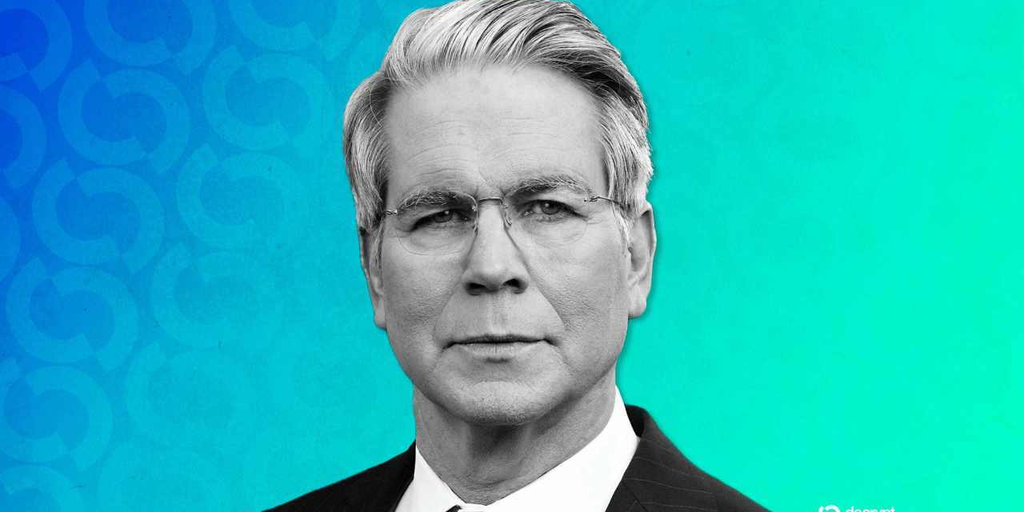

- U.S. Treasury Secretary Scott Bessent mentioned the passing of the Readability Act would convey a peaceful to the markets amid Bitcoin’s current volatility.

- Bessent known as the present market response “self-induced” as some crypto companies (like Coinbase) stand in opposition to the present textual content of the invoice.

- The invoice has round a 62% likelihood of getting signed into regulation in 2026, in response to prediction markets.

The crypto market has been awash in volatility as Bitcoin and Ethereum have tumbled removed from their all-time highs set final 12 months.

But when america authorities passes the Readability Act, also referred to as the crypto market construction invoice, U.S. Treasury Secretary Scott Bessent believes that it could present calm to markets.

“Some readability on the Readability invoice would give nice consolation to the market,” Bessent mentioned in an interview with CNBC on Friday. “I feel it’s essential to get this Readability invoice completed as quickly as potential and on the president’s desk this spring.”

The Treasury Secretary known as a few of crypto’s current ache, which has seen Bitcoin fall greater than 29% within the final month, “self-induced.”

“There’s a group of Democrats who need to work with Republicans on getting a market construction invoice,” he added. “However there are a gaggle of crypto companies who’ve been blocking it… that doesn’t appear to have been good for the general crypto group.”

Bessent’s Friday remarks are delicate in comparison with his current criticisms of the crypto corporations—most notably Coinbase—which have signaled that they’re not serious about supporting the invoice in its present type.

Final week, he known as such events “nihilists,” and mentioned that “any market members that don’t need it [the Clarity Act] ought to transfer to El Salvador.” Final weekend, he outlined them as “recalcitrant actors” throughout a TV look.

American crypto change Coinbase pulled its help over a piece of the invoice that might restrict corporations from offering yield on stablecoins to shoppers. On the time, Coinbase CEO Brian Armstrong mentioned, “We’d quite don’t have any invoice than a nasty invoice.”

It’s not simply Coinbase that would derail the invoice’s completion, although. Bessent additionally famous that if Democrats have been to earn the bulk within the Home of Representatives in the course of the midterm elections later this 12 months, the “prospects of getting a deal completed will simply crumble.”

“Take a look at what the Democrats did to crypto below the Biden administration. It was nearly an extinction occasion,” he mentioned.

Predictors on Polymarket give the invoice round a 62% likelihood of being signed into regulation by the tip of 2026.

Each day Debrief Publication

Begin day-after-day with the highest information tales proper now, plus authentic options, a podcast, movies and extra.