The MicroStrategy inventory value closed round $133 on February 13, rising 8.85% in someday. The weekly acquire reached almost 5%, exhibiting power regardless of broader uncertainty. However this rally comes at a wierd time. Bitcoin fell about 2.2% over the identical interval, creating a niche between the 2 belongings that not often lasts lengthy.

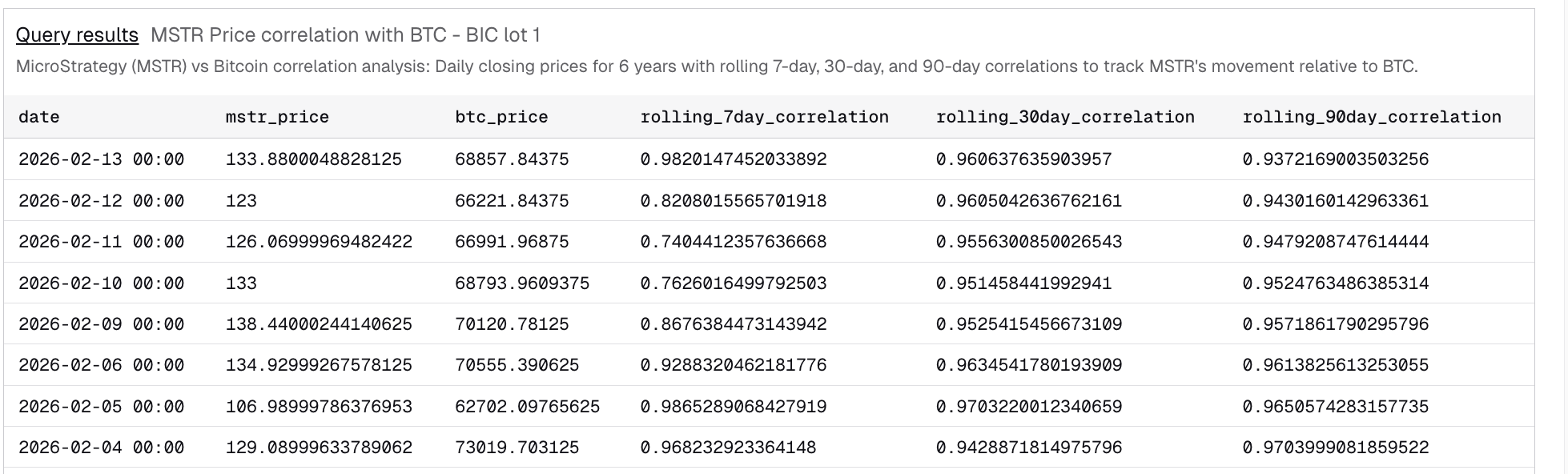

New information exhibits that MicroStrategy and Bitcoin are transferring nearly identically once more. The 7-day rolling correlation has surged to 0.98, close to excellent alignment. This tight hyperlink means the MicroStrategy value prediction going ahead in 2026 could rely closely on Bitcoin’s subsequent transfer. On the similar time, momentum indicators and quantity alerts present early warning indicators that the current MSTR value bounce could face strain.

Sponsored

Sponsored

MicroStrategy’s Bitcoin Correlation and RSI Sign Correction Danger

Rolling correlation measures how intently two belongings transfer collectively over a set interval. The present 7-day correlation of 0.98 means MicroStrategy and Bitcoin are transferring in almost the identical route. That is the very best stage since early February. When correlation reaches this stage, value strikes in a single asset typically carry over to the opposite.

This creates a threat as a result of Bitcoin has weakened just lately whereas MicroStrategy inventory moved larger. Such gaps typically shut when markets reopen, inflicting delayed corrections.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

On the similar time, the Relative Energy Index (RSI) is exhibiting a hidden bearish divergence. RSI measures shopping for and promoting momentum by evaluating current positive aspects and losses. Between December 9 and February 13, the MicroStrategy value appears to be forming a decrease excessive.

Nonetheless, throughout the identical interval, the Relative Energy Index (RSI), a momentum indicator, has already flashed a better excessive. This sample known as hidden bearish divergence. It exhibits that regardless that momentum seems stronger, the underlying value construction stays weak. Sellers should be in management.

Sponsored

Sponsored

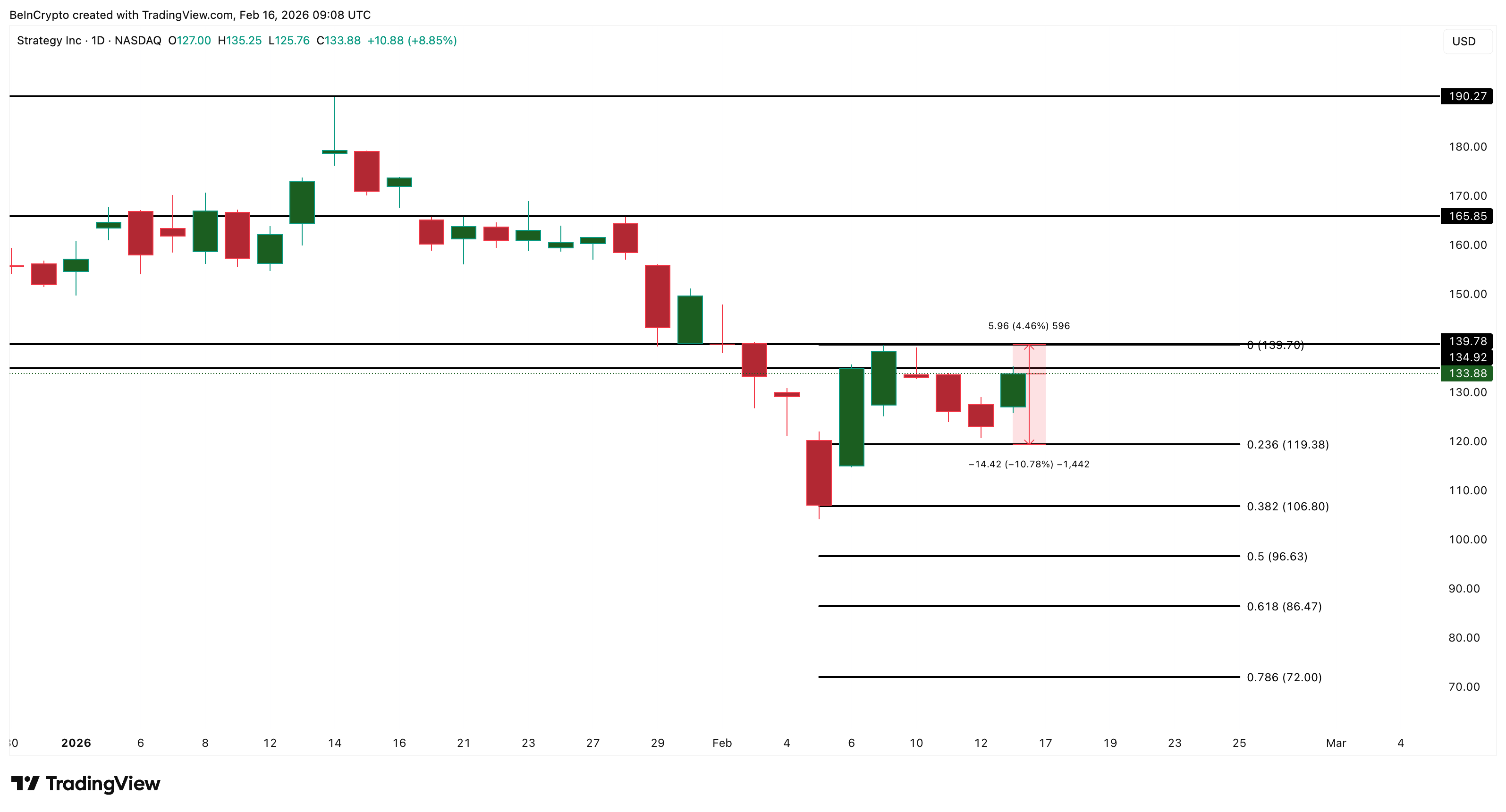

An analogous divergence fashioned earlier between December and February. After that sign, MicroStrategy inventory dropped almost 14%. The identical setup is now showing once more.

The important thing stage to observe is $133 ($133.88 to be precise). If the subsequent MicroStrategy (Technique) inventory value candle stays under this stage, the correction threat stays energetic. A transfer above it might weaken this bearish sign (the hidden divergence) for now and will additional the bounce. However that may additionally imply that Bitcoin’s affect would weaken quickly.

Institutional Shopping for Helps Value, Whereas Retail Promoting Weakens Conviction

Regardless of the bearish momentum sign, institutional buyers are exhibiting a distinct habits. The Chaikin Cash Movement (CMF) indicator tracks massive cash flows into and out of an asset. Since November 21, the MSTR value has trended decrease total. However CMF has steadily moved larger and is now above zero.

Which means that massive buyers have continued to purchase at the same time as the worth has struggled. Institutional accumulation can scale back draw back threat and stabilize costs throughout corrections.

Sponsored

Sponsored

Nonetheless, retail buyers are exhibiting the alternative pattern.

The On-Stability Quantity (OBV) indicator tracks cumulative shopping for and promoting quantity. Not like CMF, OBV has been trending decrease since November, aligning with the worth. This exhibits that smaller buyers have been promoting throughout current months.

This creates a battle. Institutional consumers are supporting the worth, however retail buyers are probably lowering publicity. The important thing OBV stage now sits close to 972 million. If OBV fails to interrupt above this stage, it might affirm continued retail weak spot. This may enhance correction threat and assist the forming bearish divergence sign.

This battle between institutional and retail buyers leaves MicroStrategy’s value prediction unsure within the quick time period.

Sponsored

Sponsored

MicroStrategy Value Prediction Is determined by $139 Breakout or $119 Breakdown

The MSTR value ranges now present the clearest information to the subsequent transfer. On the draw back, the primary key assist stage sits at $119. This stage aligns with the 0.236 Fibonacci retracement and represents a possible 10% decline from present ranges. This goal additionally matches the dimensions of earlier divergence-driven corrections.

If MicroStrategy inventory falls under $119, the subsequent assist sits close to $106. This may symbolize a deeper correction and make sure vendor management.

On the upside, crucial restoration stage is $133, as talked about earlier, adopted by $139. This resistance has capped current rallies. A confirmed breakout above $139 would sign renewed power.

If this breakout occurs, MicroStrategy inventory may transfer towards $165. A stronger rally may prolong towards $190 if Bitcoin additionally recovers. Nonetheless, if Bitcoin weak spot continues, MicroStrategy may observe decrease as a result of robust correlation.

For now, MicroStrategy inventory stays at a essential level. The extraordinarily excessive correlation with Bitcoin means its subsequent transfer could rely upon Bitcoin’s route. If Bitcoin weak spot continues, the MicroStrategy inventory value may face a delayed correction. But when institutional shopping for continues and resistance breaks, the bullish pattern may nonetheless resume for MSTR.