- Bitcoin Surges Amid World Uncertainty: BTC surpassed $109K as traders flee conventional belongings like U.S. Treasurys as a result of rising yields and mounting debt issues. U.S. 30-year bond yields hit 5.15%, revealing cracks in confidence.

- Japan’s Shift Provides Stress: Japan, the biggest overseas holder of U.S. debt, is mountaineering charges, elevating its long-term bond yields and probably unwinding its U.S. Treasury publicity.

- Bitcoin Positive aspects Twin Enchantment: Institutional traders are flocking to Bitcoin ETFs, pushing AUM over $104B. BTC is now seen each as a high-growth asset and a protected haven, signaling a serious shift in market conduct.

Bitcoin has climbed above $109,000, catching a tailwind from rising international monetary uncertainty. In a twist of irony, the very macro circumstances—like rising bond yields and slowing financial development—that after weighed down Bitcoin at the moment are serving to to push it up. The U.S. debt scenario, particularly, is rattling traders, with rising Treasury yields placing the nation’s $36.8 trillion debt beneath extra strain than ever.

Surging Yields and a Shaky Bond Market

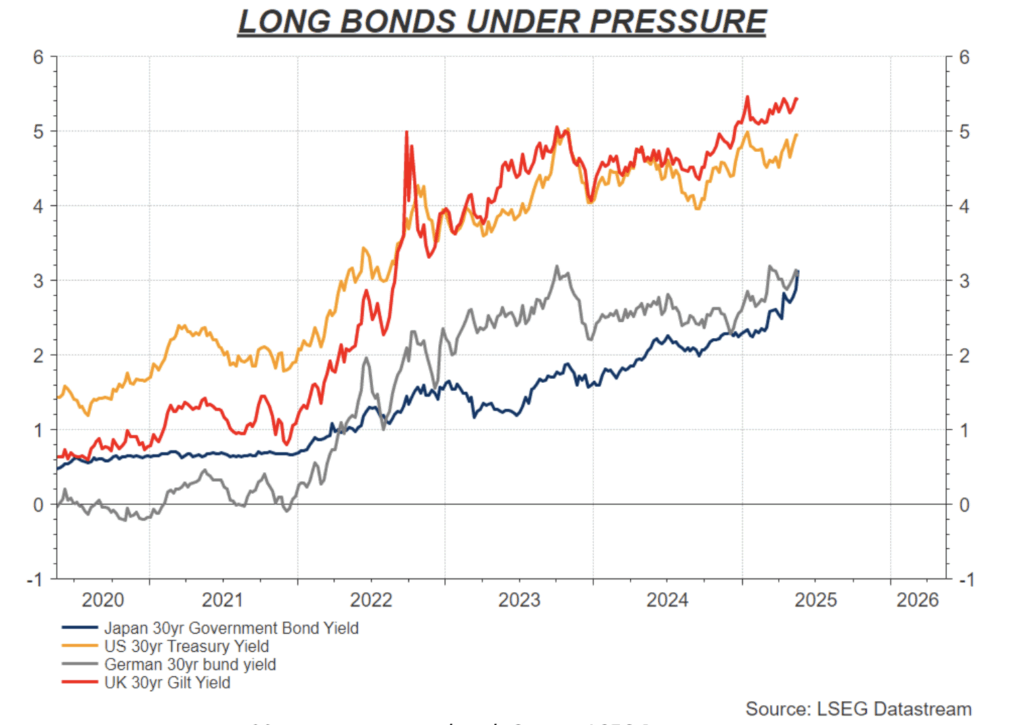

Yields on U.S. bonds are climbing quick. The 30-year hit 5.15%—a stage not seen since 2007. The shorter maturities are additionally climbing however at a slower tempo, with the 5-year now at 4% and the 2-year round 3.9%. What’s worrying is that this surge is going on whereas investor religion in U.S. bonds is eroding, made worse by the latest downgrade of the U.S. authorities’s credit standing.

In the meantime in Japan, the biggest overseas holder of U.S. Treasurys, issues are additionally shifting. The Financial institution of Japan has began lifting rates of interest, pushing the yield on its 30-year bonds to a file 3.1%. That’s led to fears that Japanese establishments might start pulling cash out of U.S. bonds, including extra stress to an already fragile system.

Bonds Out, Bitcoin In?

Up to now, rising bond yields meant unhealthy information for threat belongings like Bitcoin. Not anymore. As traders develop more and more cautious of presidency debt and central financial institution insurance policies, many are turning to Bitcoin—not only for beneficial properties, however for stability. U.S. equities are dropping favor, with institutional traders underweight shares at ranges not seen in a 12 months.

Spot Bitcoin ETFs are exploding with inflows, now holding over $104 billion in belongings. This alerts rising perception in Bitcoin’s function not simply as a threat asset, however as a form of “digital gold” in a world the place belief in fiat foreign money is fading. Whereas its whole market cap nonetheless lags far behind gold and the bottom U.S. greenback provide, Bitcoin’s momentum reveals it’s now not a fringe hedge—it’s turning into a part of the core technique.

Bitcoin’s Twin Identification: Secure Haven or Speculative Wager?

What’s fascinating is how Bitcoin is pulling off each roles without delay. It’s appearing like a high-growth tech inventory and a protected haven like gold. That was once a contradiction, however in right this moment’s upside-down market, it could be the brand new regular. Because the outdated playbooks lose relevance, Bitcoin’s mixture of decentralization, predictability, and rising adoption might make it one of many defining belongings of the subsequent monetary period.