After investing $500 million to purchase Bitcoin (BTC), GameStop is taking a step additional in its crypto comeback journey with a potential funds rail.

The electronics retail firm noticed its crypto ventures shut down previously amid regulatory issues.

GameStop To Settle for Crypto Funds with Bitcoin As Inflation Edge

Bitcoin’s attract as a hedge towards inflation and greenback debasement continues to draw extra gamers, with GameStop teasing because the potential subsequent entrant.

In an interview with CNBC, GameStop CEO Ryan Cohen stated the electronics agency was contemplating accepting crypto funds.

“There’s a possibility to purchase buying and selling playing cards and to take action utilizing cryptocurrency. So, we’ll see how a lot there’s on the precise demand aspect for that type of product,” Cohen revealed.

The pivot comes because the online game retailer strikes to cut back its dependence on {hardware}, citing rising prices. As such, the change would see GameStop double down on buying and selling playing cards and collectibles, payable utilizing crypto.

Notably, the acquisition choices would issue a number of crypto tokens, not essentially adopting Bitcoin alone.

“We’re going to have a look at all cryptocurrencies…The utility of crypto past investing is a hedge towards inflation. I feel thus far that’s been the largest demand for crypto, and so, the flexibility to really use crypto inside transactions is one thing that is a chance and it’s one thing that we’re taking a look at,” Cohen added.

It comes barely a month after the agency reloaded its Bitcoin warfare chest with a $500 million buy. The curiosity in Bitcoin raised hypothesis that GameStop was amongst corporations adopting the Saylorization pattern.

Cohen Denies Adopting Saylorization Pattern

Nonetheless, Cohen articulated that this was not the play, noting that for them, this was only a means to hedge towards inflation and world cash printing.

“We now have our personal distinctive technique, and we’ve got a really sturdy stability sheet of over $9 billion in money and marketable securities, and we are going to deploy that capital responsibly as I might my very own capital,” he defined.

However, it’s inconceivable to not separate GameStop’s strategy from that of Technique (previously MicroStrategy).

SEC filings present GameStop’s current $450 million BTC buy was facilitated by way of bond issuance, rising complete funds raised from its mid-June 2025 providing to $2.7 billion.

This mechanism mimics Technique’s convertible bond issuances, with GameStop’s zero-interest bonds maturing in 2032. Notably, upon maturity, they are often transformed into shares.

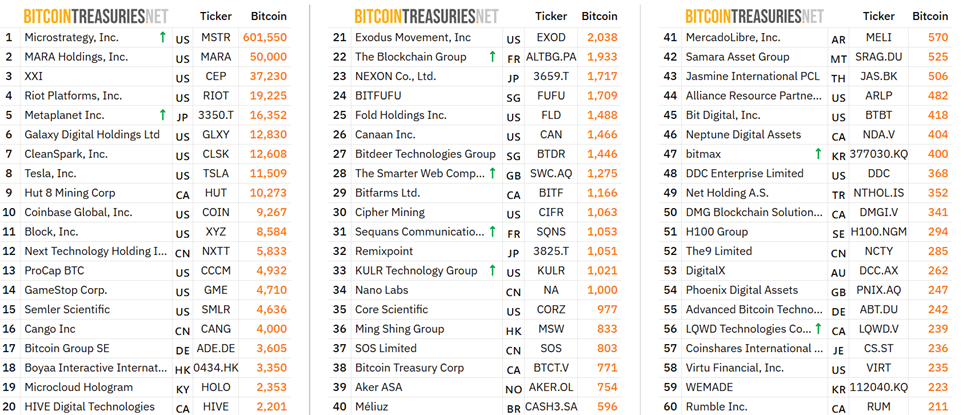

In the meantime, information on Bitcoin Treasuries reveals that GameStop holds 4,710 BTC tokens, that are valued at roughly $559 million at present charges.

With this, it’s successfully the 14th largest public firm holding BTC, after Antony Pompliano’s ProCap and simply earlier than Semler Scientific.

“…corporations worldwide are optimizing their monetary infrastructure round Bitcoin. We’re not simply seeing stability sheet hedges anymore, however full treasury engines constructed on laborious cash rules…Bitcoin isn’t changing the system, however turning into an essential hedge for corporations pondering past short-term market cycles,” Joe Burnett, Director of Bitcoin Technique at Semler Scientific, lately informed BeInCrypto.

Will Bitcoin Right Earlier than the Subsequent Upside?

In keeping with the BTC/USDT buying and selling pair on the on-day timeframe, Bitcoin worth could also be due for a correction earlier than the subsequent upside. This comes after the worth breached the higher boundary of the Bollinger indicator at $121,388, indicating an overbought market.

The RSI (Relative Power Index) place at 69 additionally accentuates this outlook, with an asset thought of overbought when the index hits 70.

As such, the market might have to chill off earlier than the subsequent upside, with the general pattern nonetheless bullish as Bitcoin worth consolidates inside an ascending parallel channel. Because the market cools off, late bulls may capitalize on potential entry factors.

For starters, the 78.6% Fibonacci retracement stage at $114,949, adopted by the mid-line of the ascending parallel channel. In case these fail to carry as help, Bitcoin worth may see extra shopping for energy because of the midline of the Bollinger indicator at $111,714 or the 50-day SMA (Easy Transferring Common) at $107,995.

Within the dire case, the help confluence between the decrease boundary of the ascending parallel channel and essentially the most essential Fibonacci retracement stage, 61.8%, at 106,298 may present help.

Conversely, elevated shopping for strain above present ranges may see Bitcoin worth make one other go towards a breakout, probably ascending to market the subsequent all-time excessive (ATH) at $125,968. Such a transfer would represent a 6% transfer above present ranges.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.