On-chain information reveals the Bitcoin long-term holders have participated in a significant selloff lately, an indication that is probably not superb for BTC’s worth.

Bitcoin Lengthy-Time period Holders Have Been Distributing Not too long ago

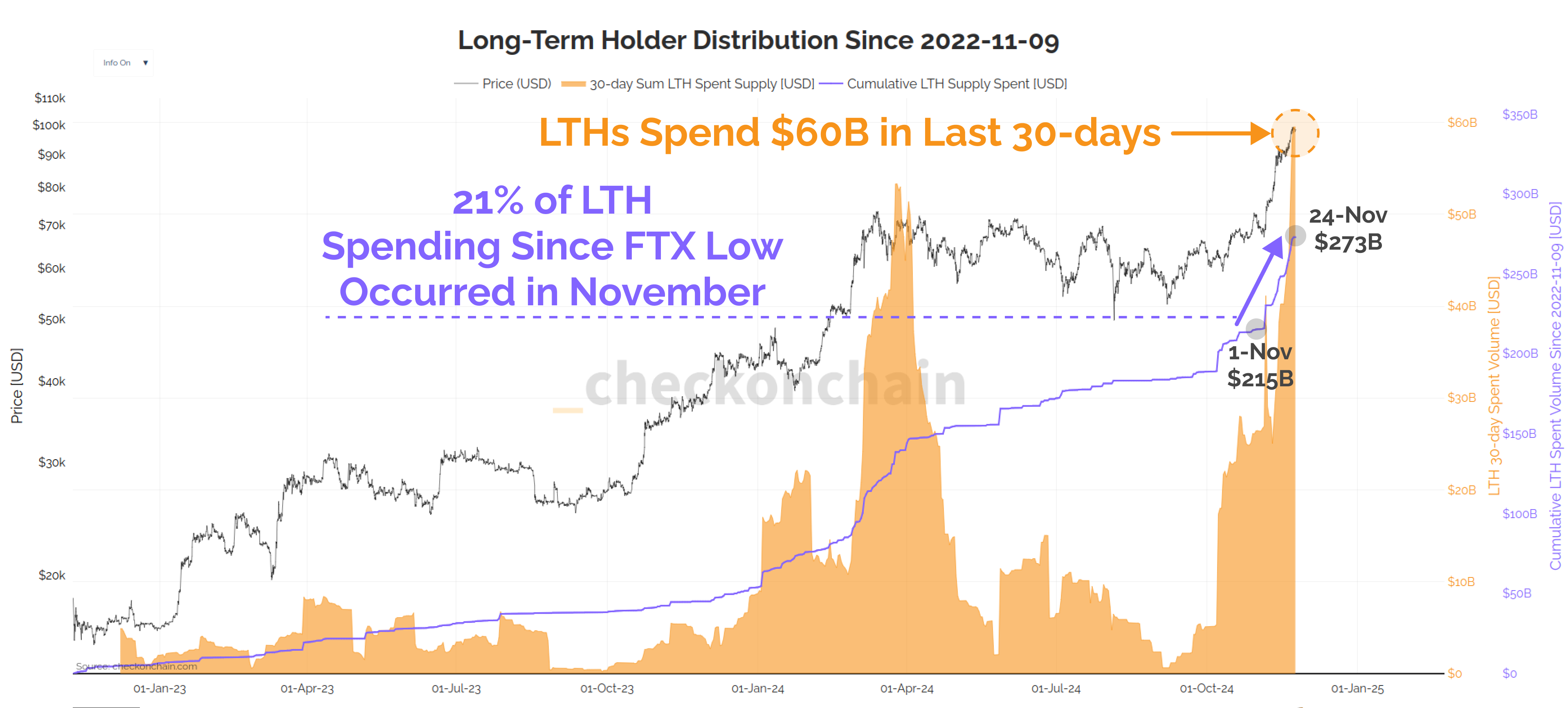

As defined by on-chain analyst Checkmate in a brand new submit on X, the Bitcoin long-term holders have simply proven their heaviest profit-taking occasion of the continuing cycle.

The “long-term holders” (LTHs) consult with the BTC traders who’ve been holding onto their cash since greater than 155 days in the past. This cohort makes up for one of many two essential divisions of the sector carried out on the idea of holding time, with the opposite group being often called the “short-term holders” (STHs).

Statistically, the longer an investor holds onto their cash, the much less doubtless they change into to promote stated cash at any level. As such, the LTHs could be thought of to incorporate the diamond arms of the market, whereas the STHs encompass the weak arms.

Though the LTHs don’t promote too usually, it could seem that the newest worth rally has been too good a profit-taking alternative for even these HODLers to overlook out on.

There are a number of methods to trace the conduct of this cohort, with one such being the quantity of provide that they’re ‘spending.’ Beneath is the chart shared by the analyst that reveals the pattern in each the 30-day and the cumulative worth of this Bitcoin metric since November 2022.

The worth of the metric seems to have been fairly excessive in latest days | Supply: @_Checkmatey_ on X

As is seen within the graph, the Bitcoin LTHs have seen their 30-day spent provide spike to excessive ranges lately. In complete, these traders have transferred round $60 billion value of tokens throughout the previous month.

Typically, each time these traders resolve to interrupt their dormancy, it’s for promoting functions, so all this motion is more likely to correlate to a selloff from the group.

Naturally, with this spike within the 30-day spent provide, the cumulative worth of the spent provide has shot up as nicely. Within the context of the present chart, this latter metric is monitoring the cumulative worth of the quantity of distribution that the LTHs have been doing since November 2022.

The rationale Checkmate has picked this month because the cutoff is that BTC discovered the underside of its final bear market in that month following the FTX crash. In different phrases, the month serves as the beginning for the ‘present’ cycle of the asset.

At current, the indicator is sitting at $273 billion. Which means that the LTH distribution from the previous month has made up for about 21% of all the provide spent for the reason that begin of the cycle.

From the chart, it’s obvious that these diamond arms had additionally participated in an enormous selloff within the first quarter of the yr and it was maybe this promoting that compelled Bitcoin right into a part of consolidation.

Given this pattern, it could be fascinating to see whether or not the latest promoting would have an identical impact on BTC or if demand this time round is excessive sufficient to beat this impediment.

BTC Value

On the time of writing, Bitcoin is buying and selling round $95,500, up greater than 8% during the last week.

Appears to be like like the worth of the coin has seen a plunge over the previous day | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, checkonchain.com, chart from TradingView.com