Just lately, Ethereum (ETH) confirmed indicators of falling beneath $3,000 however held agency as bulls defended the altcoin.

Now buying and selling at $3,480, right here’s what could possibly be subsequent for ETH.

Ethereum Nonetheless Has Extra Room to Develop

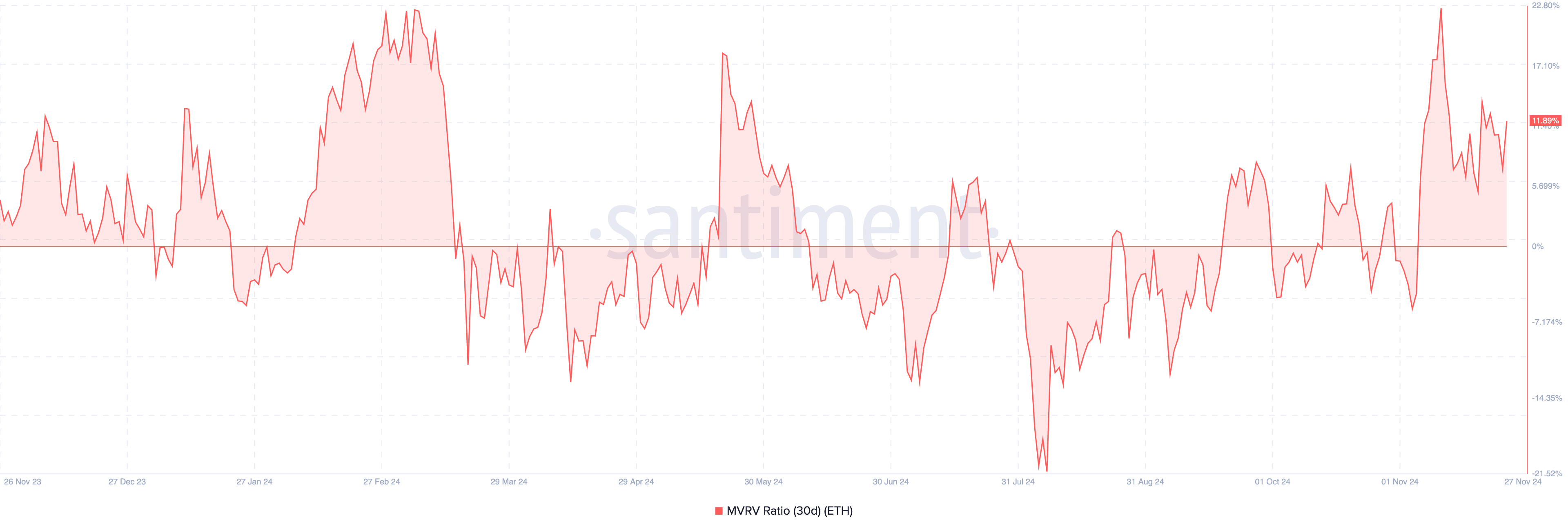

One metric that has constantly confirmed dependable for analyzing Ethereum is the Market Worth to Realized Worth (MVRV) ratio, a software for assessing the profitability of holders and figuring out potential market tops or bottoms. The MVRV ratio compares a cryptocurrency’s market worth to its realized worth, providing insights into whether or not the asset is overvalued or undervalued.

When the MVRV ratio rises, it signifies that extra holders are in revenue. Nevertheless, if it climbs to an excessive excessive, it suggests the asset could also be overvalued, growing the danger of a worth correction. Conversely, when the MVRV ratio declines, it factors to lowered profitability.

If the ratio hits an excessive low, it alerts undervaluation, which may current a sexy accumulation alternative for traders. For ETH, the 30-day MVRV ratio has risen to 11.89%. Nevertheless, this ratio shouldn’t be near the native high, which is often round 18% and 22%. Subsequently, this growth means that Ethereum’s worth.

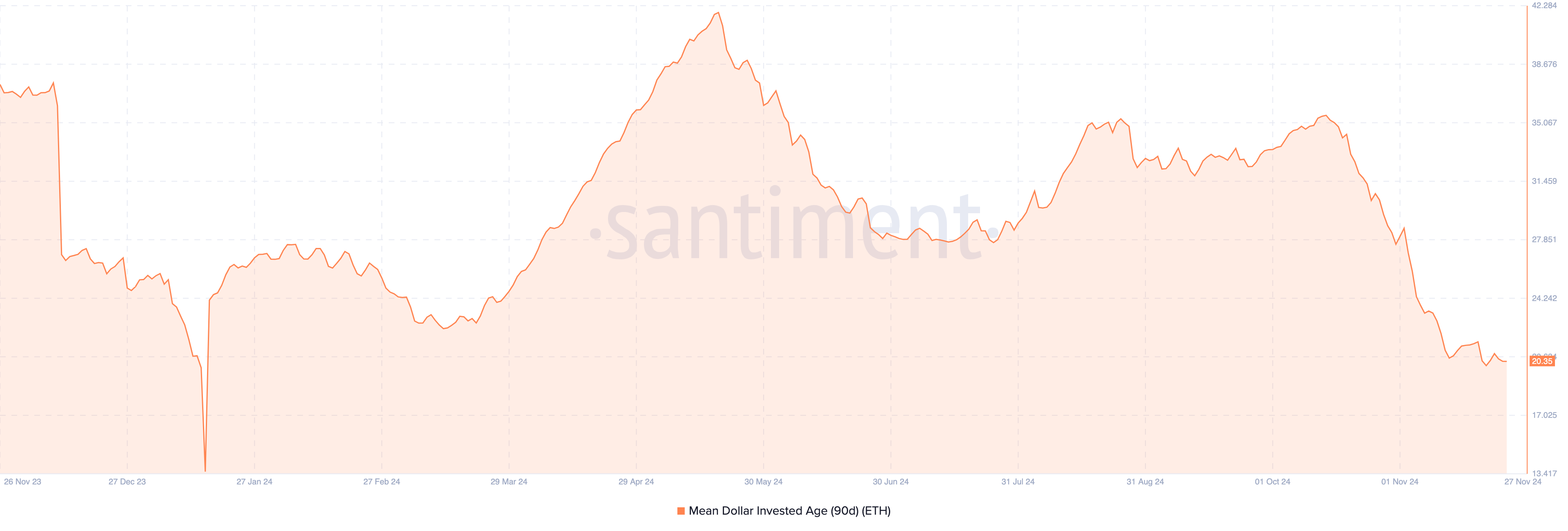

Past the MVRV ratio, the Imply Greenback Invested Age (MDIA) additionally means that Ethereum could keep away from an extra worth drop. MDIA measures the typical age of all cash on a blockchain, weighted by their buy worth.

A rising MDIA signifies that cash have gotten extra stagnant, lowering the chance of a big worth surge.

Conversely, a declining MDIA means that beforehand dormant cash are shifting, signaling elevated buying and selling exercise, which is the case with ETH. If this pattern persists, it may enhance Ethereum’s possibilities of a worth rally.

ETH Worth Prediction: $4,000 Might Be Coming

On the each day chart, Ethereum’s worth has shaped an inverse head-and-shoulders sample. This sample sometimes emerges after a chronic downtrend, signaling a possible sellers’ exhaustion level.

The sample includes three key components: the left shoulder, which marks the primary uptrend; the pinnacle, signaling the top of the downtrend; and the fitting shoulder, indicating the rebound.

With ETH trending in an uptrend, the cryptocurrency is more likely to rise towards $4,000 within the brief time period. However, if promoting strain rises, this would possibly change, and ETH may decline to $3,206.

Disclaimer

According to the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.