Hedera (HBAR) confronted a bearish August, with promoting strain dominating a lot of the month. Outflows weighed closely on the asset, pulling costs decrease and limiting restoration makes an attempt.

Nonetheless, historic knowledge present that HBAR has sometimes rebounded after prolonged weak point, suggesting September may present some reduction if circumstances enhance.

Hedera Has An Fascinating Historical past

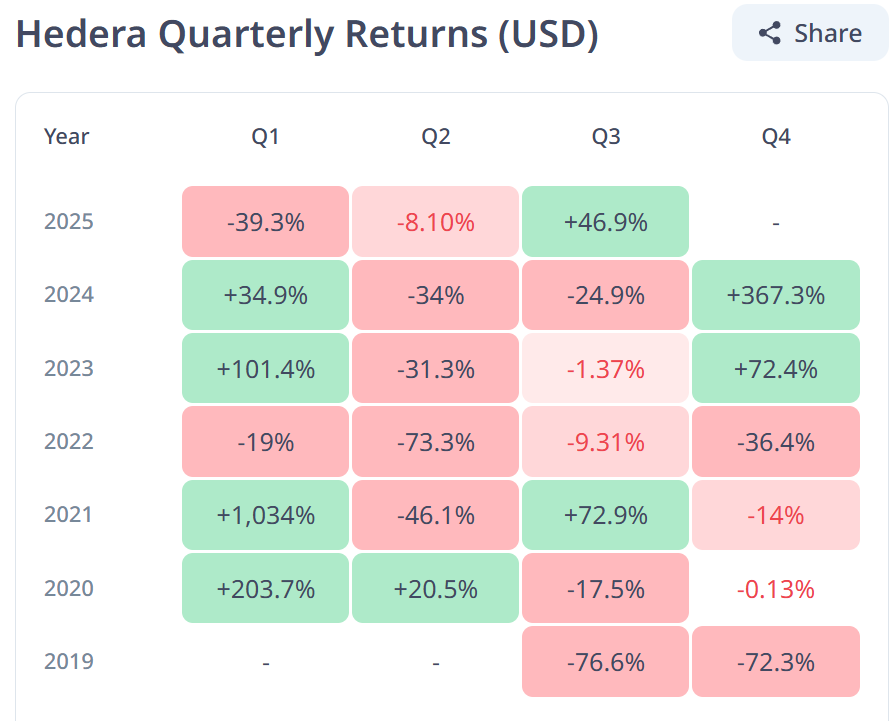

HBAR’s quarterly efficiency this yr has been notably stronger in contrast with the earlier three years. Regardless of the struggles in August, the token has held up higher than in previous cycles, reflecting gradual enhancements in resilience. A inexperienced Q3 would mark a major milestone for the community’s progress.

If HBAR closes Q3 in revenue, it might symbolize the primary optimistic quarter in 4 years. Extra importantly, it might even be the primary quarter of 2025 to finish within the inexperienced. Such an consequence may sign enhancing investor sentiment, at the same time as short-term volatility continues to influence efficiency.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

Technical indicators level to challenges forward. The Chaikin Cash Movement (CMF) reveals robust outflows dominating HBAR for the previous two months. This sustained promoting strain has been one of many key causes for the token’s decline, limiting any momentum that may have emerged from community progress or broader adoption.

Outflows point out two key issues: rising investor skepticism and broader market-driven promoting. Bitcoin’s sharp decline has amplified strain, as HBAR maintains a excessive 0.92 correlation with BTC. This shut connection means Hedera’s efficiency is closely influenced by Bitcoin’s trajectory, making September’s outlook depending on BTC’s means to stabilize.

HBAR Value Faces Problem

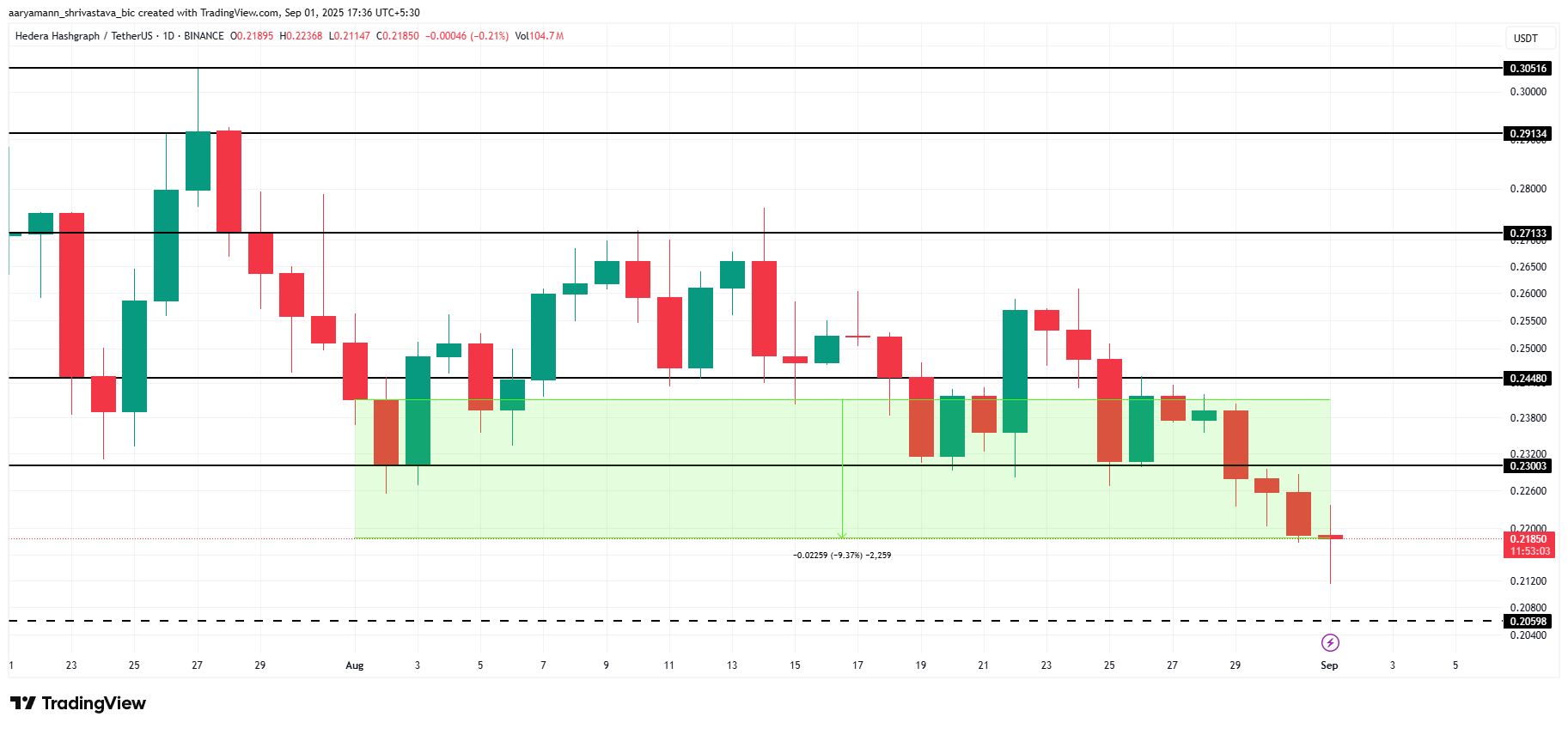

On the time of writing, HBAR trades at $0.218, down 9% over the previous month. The persistent outflows counsel continued weak point, leaving the altcoin weak to additional decline. Ought to promoting proceed, HBAR may slip to $0.205, extending its drawdown and reinforcing bearish momentum within the brief time period.

Traditionally, September has been a poor month for HBAR. On common, the token has declined 10% throughout this era, with a median drop of 5%. Primarily based on this sample, the chance of one other drawdown stays elevated, aligning with present technical indicators that spotlight weakening help ranges.

If influx returns and investor sentiment improves, HBAR may bounce again to reclaim the $0.230 help. Holding this degree could be essential for triggering restoration. A whole reversal would require the token to climb towards $0.271 or greater, signaling renewed energy after months of bearish market exercise.

Disclaimer

According to the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.