Korean retail buyers are dramatically reshaping US fairness markets. In August, they pulled a document $657 million from Tesla Inc. whereas concurrently pouring over $12 billion into US-listed cryptocurrency corporations this 12 months.

This alerts a basic shift in funding preferences amongst considered one of America’s most influential international retail bases, which is capturing Wall Road’s consideration.

Tesla Loses Its Korean Crown

In line with Bloomberg calculations of depository knowledge, the unprecedented exodus from Tesla represents probably the most important month-to-month outflow since early 2023. This marks a stark reversal for Korean buyers, who as soon as served as essential amplifiers of the electrical automobile maker’s inventory rallies.

Particular person Korean merchants, holding roughly $21.9 billion in Tesla shares—making it their high international fairness holding—are more and more questioning the corporate’s synthetic intelligence narrative and progress prospects.

The promoting strain from Korean buyers stems from mounting considerations over Tesla’s deteriorating fundamentals and management dangers. Analysts level to intensified competitors from Chinese language rivals and declining electrical automobile gross sales attributed to “Musk threat” as key elements behind Tesla’s poor efficiency. Tesla’s inventory volatility has been exacerbated by CEO Elon Musk’s conflicts with President Trump, contributing to repeated sharp declines.

Mirae Asset Securities researcher Park Yeon-ju famous that whereas Tesla beforehand supplied robust medium-term prospects in autonomous driving and humanoid robotics regardless of short-term EV gross sales weak point, “the current AI growth has intensified competitors from China and Europe, lowering anticipated margins and market share.”

The promoting strain prolonged past Tesla’s frequent inventory, with the double-leveraged Tesla ETF (TSLL) experiencing its largest month-to-month outflow since early 2024, shedding $554 million in August alone. This complete retreat from Tesla-related investments underscores the depth of Korean buyers’ disillusionment with the corporate’s present trajectory and future prospects.

Aggressive Crypto Shopping for Captures World Consideration

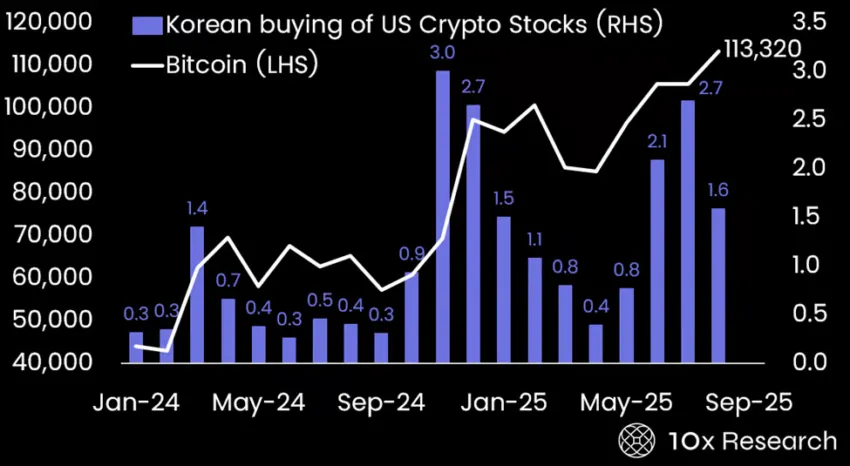

Whereas abandoning Tesla, Korean buyers have embraced US-listed cryptocurrency corporations with unprecedented aggression, buying over $12 billion price of shares in crypto-related corporations this 12 months. Information launched by 10x Analysis reveals the gorgeous scale of this exercise: in August alone, Korean buyers bought $426 million price of Bitmine Immersion Applied sciences Inc., $226 million price of Circle inventory, and $183 million price of Coinbase shares.

Past particular person crypto corporations, Korean buyers additionally allotted $282 million to a 2x Ethereum ETF throughout the identical interval, demonstrating their subtle strategy to gaining leveraged publicity to digital property by means of conventional fairness markets. This aggressive shopping for exercise is reshaping international capital flows and garnering important consideration from Wall Road analysts carefully monitoring Korean retail investor conduct.

The shift displays broader cryptocurrency adoption patterns in South Korea, the place roughly 20% of the inhabitants—roughly one in 5 residents—now invests in digital property, considerably exceeding international averages. Amongst youthful demographics aged 20 to 50, cryptocurrency possession charges climb even greater, reaching 25-27%, creating substantial demand for crypto-linked funding automobiles accessible by means of conventional brokerage accounts.

Regulatory Tailwinds Gasoline Funding Surge

The timing of those huge funding flows coincides with favorable regulatory developments which might be offering robust tailwinds for Korean capital allocation into cryptocurrency-related property. South Korea is creating rules for stablecoins, STOs, and crypto ETFs. Tax frameworks stay beneath dialogue amongst policymakers. Not like earlier excessive warning, political circles and trade now agree on institutionalization wants.

Korean buyers’ affect extends far past particular person inventory choice. They rank among the many largest international buyers in American equities general. Their concentrated shopping for energy can considerably affect particular person inventory efficiency, significantly in unstable sectors the place their collective actions create noticeable market actions that ripple by means of international buying and selling classes.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.