After a robust begin to the week, Bitcoin is seeing a pointy pullback as macroeconomic headwinds are again in play.

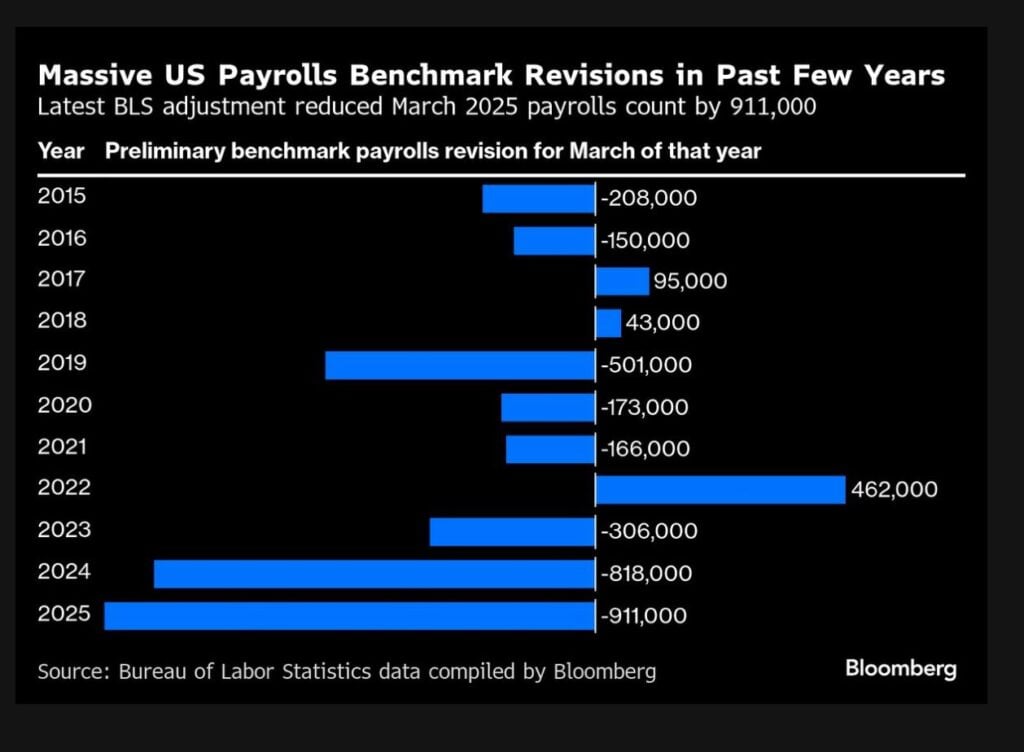

Preliminary annual benchmark revisions present that nonfarm payrolls for the 12-month interval ending in March 2025 had been lowered by 911,000 jobs, the most important downward revision since 2000.

In easier phrases, practically 40% of the roles the US Bureau of Labour Statistics reported from April 2024 to March 2025 by no means really materialized.

This newest jobs knowledge confirms a major slowdown within the US labour market, one of many basic indicators of a broader recession.

After buying and selling as excessive as $113,200 early on Tuesday, the Bitcoin value fell under $111,000 following the roles revision. Ethereum and the altcoins have additionally reversed a lot of this week’s positive factors, with Solana meme cash and ETH ecosystem tokens rejecting at key resistance ranges.

Sidelined buyers ought to chorus from shopping for the dip earlier than this week’s CPI and PPI inflation knowledge. Nevertheless, with three fee cuts now locked on this yr, the stage is ready for an explosive fourth-quarter crypto bull run.

How Does The Newest Jobs Knowledge Have an effect on Crypto Costs?

The US economic system added 911,000 fewer jobs than beforehand anticipated within the 2024 monetary yr.

The huge downwards revision signifies that the US labour market wasn’t as robust as reported. The weak point is now obvious, with the most recent jobless claims, nonfarm payroll for July, and ADP figures all confirming the unfavorable pattern.

Notably, the deteriorating jobs market signifies that the Federal Reserve could already be too late for a dovish pivot.

Unsurprisingly, the CME FedWatch is now projecting three fee cuts for this yr. This can be a decidedly bullish improvement for crypto costs as Bitcoin tends to carry out higher throughout looser financial circumstances.

Nevertheless, it’s crucial that the cracks within the jobs market don’t materialize right into a full-blown recession.

Will Thursday’s CPI Outcome In One other Bitcoin Worth Crash?

It’s unlikely that this week’s inflation knowledge, Wednesday’s PPI and Thursday’s CPI, may have any long-term impact on crypto costs.

Exterior of unforeseeably disastrous inflation knowledge, the Fed will possible pivot to aggressive fee cuts and quantitative easing.

Nevertheless, leverage merchants ought to stay cautious of heightened volatility each forward of and following this week’s CPI and PPI releases.

Bitcoin Worth Prediction: Purchase The Dip?

The Bitcoin value continues to reject under $112,500 resistance degree.

Sidelined buyers ought to be cautious of shopping for BTC if it fails to reclaim this degree, which may end in a correction to $107,000, and even $100,000.

Nevertheless, consultants consider that BTC is on the cusp of a large uptrend, particularly because it has shaped a bullish divergence in its weekly timeframe.

Greatest Altcoins To Make investments In

Altcoins that proceed to point out bullish power regardless of the weak point in BTC have excessive latent demand and have a tendency to outperform as soon as the broader market outlook improves.

As an illustration, Worldcoin is seeing a robust rally after Ethereum treasury agency BitMine introduced the acquisition of a stake in Eightco Holdings, the brand new WLD treasury firm. The WLD value is up by 110% over the previous 7 days.

Quite the opposite, Solana meme coin Bonk has rejected from a key resistance degree, as has Ethereum meme coin Pepe. These aren’t good investments on the present stage.

Among the many low-caps, Bitcoin Hyper (HYPER) continues to be the perfect crypto presale funding, having already raised practically $15 million behind robust whale and retail funding.

HYPER is a layer-2 coin and is anticipated to point out a robust correlation with its layer-1 token, Bitcoin. With BTC projected to hit $150,000 this yr, Bitcoin Hyper is a superb wager for outsized returns.

As such, the highest layer-2 cash have a tendency to succeed in multibillion-dollar valuations. Unsurprisingly, consultants are viewing HYPER as the subsequent 10x crypto.

In the meantime, MaxiDoge (MAXI) can be in excessive demand, having already raised practically $2 million.

MAXI is being seen as a low-cap various to Dogecoin, which is one other altcoin that’s on the cusp of an explosive breakout.

Owing to its satirical portrayal of crypto degens, MAXI is gaining vital traction amongst them. Most of the early consumers are good cash buyers and low-cap hunters, who’re eyeing as much as 100x returns from it.

Go to MaxiDoge Presale

This text has been offered by one in all our business companions and doesn’t mirror Cryptonomist’s opinion. Please remember our business companions could use affiliate applications to generate revenues by the hyperlinks on this text.