Be a part of Our Telegram channel to remain updated on breaking information protection

The Avalanche Basis is in superior talks to launch two crypto treasury corporations within the US as a part of a $1 billion fundraising push.

That’s based on a Monetary Instances report that stated one deal, led by Hivemind Capital with SkyBridge’s Anthony Scaramucci as an adviser, goals to boost as much as $500 million by means of a Nasdaq-listed firm.

One other $500 million increase is being deliberate by way of a particular function acquisition automobile backed by Dragonfly Capital, the report stated, citing two sources conversant in the matter. The story stated the offers are anticipated to shut within the coming weeks.

Each of the businesses will then buy tens of millions of AVAX, which is the native token of the Avalanche blockchain, at a reduced worth, the report stated.

Analysts Warn Crypto Treasury Firms Are At Threat

The AVAX treasury plan comes as analysts warn that digital asset treasury corporations (DATs) are going through dangers from falling crypto and share costs which can be compressing premiums and making fundraising more durable, the report stated.

New York Digital Funding Group (NYDIG) warned in a Sept. 5 report that “a bumpy trip could also be forward” for DATs as incoming mergers and financing offers danger a “substantial wave of promoting” from shareholders.

It famous investor anxiousness over upcoming token unlocks, and stated elevated share issuance, profit-taking, and restricted differentiation methods might all be behind the squeeze on premiums.

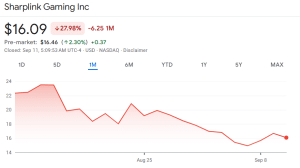

SharpLink Gaming, the second-largest company holder of Ethereum (ETH) globally, has seen its share worth plummet over 27% within the final month, information from Google Finance reveals.

SharpLink Gaming share worth (Supply: Google Finance)

BitMine Immersion Applied sciences (BMNR) has tumbled greater than 22%, whereas Technique (MSTR) has slumped over 18%.

Avalanche Neighborhood Nonetheless Bullish On AVAX Treasury Plans

Nonetheless, the Avalanche neighborhood appears to have responded positively to the reported AVAX treasury plans.

Within the final 24 hours, the value of AVAX has soared greater than 7% to commerce at 5:20 a.m. EST, in accordance to CoinMarketCap information. This has added to the crypto’s optimistic weekly efficiency, boosting the altcoin’s 7-day acquire to 16%.

AVAX/USD day by day chart (Supply: GeckoTerminal)

Trying on the day by day chart for AVAX, the crypto has managed to interrupt out of a medium-term consolidation channel between $22.92 and $26.05.

That has opened up a chance for AVAX’s worth to try a problem on the $29.52 resistance stage. Clearing this technical barrier would possibly result in a continued climb to as excessive as $32.74 within the quick time period. Including to the bullish outlook is the potential purchase stress from the aforementioned AVAX DATs.

Trying on the indicators on the day by day chart, momentum appears to nonetheless be in favor of bulls. The Transferring Common Convergence Divergence (MACD) line is breaking away above the MACD Sign line, which is a basic signal of strengthening bullish momentum.

Along with that, the shorter 9 Exponential Transferring Common (EMA) is positioned above the 20 EMA. Each EMAs are additionally rising and appearing as dynamic assist ranges for AVAX’s worth.

Lastly, the Relative Power Index (RSI) has been on the rise in current days, and reveals there’s nonetheless room for AVAX to rise earlier than it enters overbought situations.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection