- Bitcoin should maintain above $114K to draw new institutional flows and ensure bullish momentum.

- Revenue-taking by short-term holders and weaker ETF inflows are limiting upside power.

- Derivatives markets are supporting stability, however spot demand must return for a sustained rally.

Bitcoin’s worth is standing at a crossroads once more. On-chain knowledge reveals that if BTC can’t reclaim and maintain above the $114,000 zone, recent institutional liquidity might keep on the sidelines, leaving the market caught inside its present consolidation vary.

Glassnode’s newest Sept. 11 report identified how momentum has light because the mid-August all-time excessive. That cooling pattern pushed Bitcoin again into what analysts name the “air hole” zone — the vary between $110,000 and $116,000 the place provide retains shifting fingers. The massive query now could be whether or not this consolidation is wholesome accumulation or the calm earlier than one other drop.

On-Chain Knowledge Reveals Essential Provide Clusters for Bitcoin Merchants

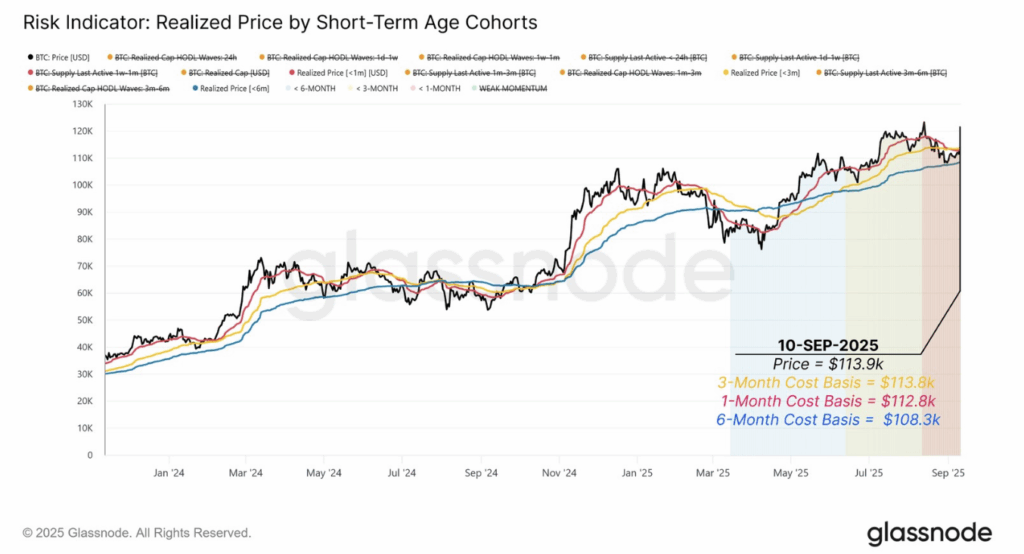

In response to Glassnode’s Price Foundation Distribution, three investor teams are shaping the value motion proper now. Current high consumers are holding round $113,800, dip-buyers have their value foundation close to $112,800, and the six-month short-term holders sit nearer to $108,300.

If Bitcoin can push previous $113,800, it places these high consumers again in revenue — a sign that would reignite momentum. However a breakdown beneath $108,300 dangers dragging short-term holders again into losses, presumably opening the door to $93,000. Earlier in September, a bounce from $108,000 confirmed clear buy-the-dip demand, however sustaining ranges above $114K is what actually issues to revive confidence.

Revenue-Taking and Weak ETF Inflows Stress Bitcoin’s Momentum

Whereas dip-buyers helped BTC recuperate, profit-taking from short-term holders has been a drag. Glassnode knowledge reveals the three-to-six-month cohort cashed out almost $189 million day by day, about 79% of all short-term earnings. In the meantime, newer consumers realized losses of $152 million per day, echoing stress intervals from earlier in 2024 and 2025.

On high of that, U.S. spot Bitcoin ETF inflows have slowed dramatically. From fueling rallies earlier this yr, day by day flows now hover round 500 BTC — far decrease than the cycle’s peak. With ETFs being such a giant driver of institutional demand, the slowdown leaves the market extra fragile.

How Bitcoin Futures and Choices Are Influencing Market Stability

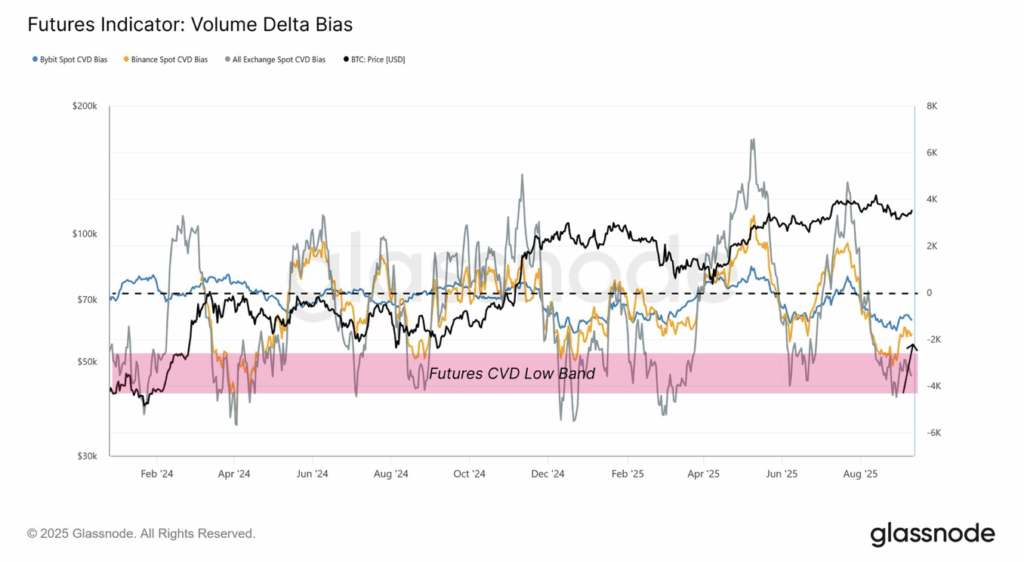

With spot demand softening, derivatives markets are enjoying a bigger function in holding Bitcoin’s construction collectively. Knowledge reveals vendor exhaustion on exchanges like Binance and Bybit, with futures positioning balanced and leverage demand regular however not excessive.

Choices exercise can also be booming, with document open curiosity exhibiting establishments are managing threat via hedges like places and coated calls as an alternative of direct ETF publicity. This shift highlights how derivatives are actually carrying a lot of the load in stabilizing BTC’s worth motion.

Bitcoin Forecast: Can BTC Maintain $114K or Drop Towards $93K?

On the time of writing, BTC trades at $115,076 — simply above that crucial $114,000 stage. Holding right here might flip current top-buyers again into revenue and unlock recent momentum. Lose it, although, and the market dangers one other take a look at of $108,000 or worse, $93,000.

Proper now, Bitcoin feels caught in a fragile steadiness. Revenue-taking, slowing ETF demand, and cautious liquidity are holding again the upside. However with derivatives markets exhibiting resilience, the groundwork for one more transfer increased continues to be there. The $114K mark isn’t only a technical barrier — it’s a psychological battleground that would determine whether or not establishments step again in or keep away.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.