The XRP worth is in a powerful uptrend as Ripple Swell’s star-studded lineup is fueling hypothesis of main developments for the cryptocurrency.

Specifically, Maxwell Stein (BlackRock’s Director of Digital Property) and Adena Friedman (Nasdaq CEO) headlining Ripple’s flagship convention has intensified talks that BlackRock might be coming into the spot XRP ETF sweepstakes.

The XRP worth has climbed over 18% from its September low, buying and selling as excessive as $3.18 on Saturday.

With the continued broader market rally and the September 18th launch of REX-Osprey’s XRP ETF, specialists predict that XRP is poised for a rally to $3.60 and subsequently to new all-time highs.

Will BlackRock Unveil A Spot XRP ETF At Ripple Swell?

Ripple Swell is the corporate’s annual flagship convention, bringing collectively international leaders in finance, crypto, and regulation to debate the way forward for funds and digital belongings.

A few of Ripple Swell’s headline audio system embrace Brad Garlinghouse (CEO, Ripple), Chris Larsen (Co-Founder & Govt Chairman), Monica Lengthy (President), and Stuart Alderoty (Chief Authorized Officer).

Different notables are Sandy Kaul of Franklin Templeton, Cynthia Lo Bessette of Constancy Digital Asset Administration, and Hunter Horsley of Bitwise.

Nonetheless, two names are particularly stirring hypothesis: Maxwell Stein (Director of Digital Property at BlackRock) and Adena Friedman (Chair & CEO of Nasdaq).

https://twitter.com/scottmelker/standing/1966550890824749320

Notably, Nasdaq is the itemizing venue for BlackRock’s iShares Bitcoin and Ethereum ETFs, and the one which information the important thing 19b-4 proposals with the SEC.

That makes the presence of Nasdaq CEO Adena Friedman at Ripple Swell particularly intriguing, as traders speculate whether or not an identical path might open for a BlackRock XRP ETF.

Again in August, a BlackRock spokesperson clarified that the agency had no fast plans to broaden its crypto ETF lineup past Bitcoin and Ethereum.

Nonetheless, ETF Institute’s Nate Geraci is assured {that a} BlackRock spot XRP ETF is coming, citing the asset’s regulatory readability and its mainstream demand.

https://twitter.com/NateGeraci/standing/1960861258120397280

If REX-Osprey’s XRP ETF, set to launch on September 18th, data robust inflows, BlackRock and Constancy might be compelled to hitch the XRP’s spot ETF sweepstakes. Notably, Constancy Digital Asset Administration’s Cynthia Lo Bassette can even converse at Ripple Swell.

XRP Worth Prediction: How Excessive Can It Go In 2025?

The XRP worth has reclaimed $3, buying and selling as excessive as $3.18 on Friday. It has staged a surprising 18% rally from the $2.69 September low.

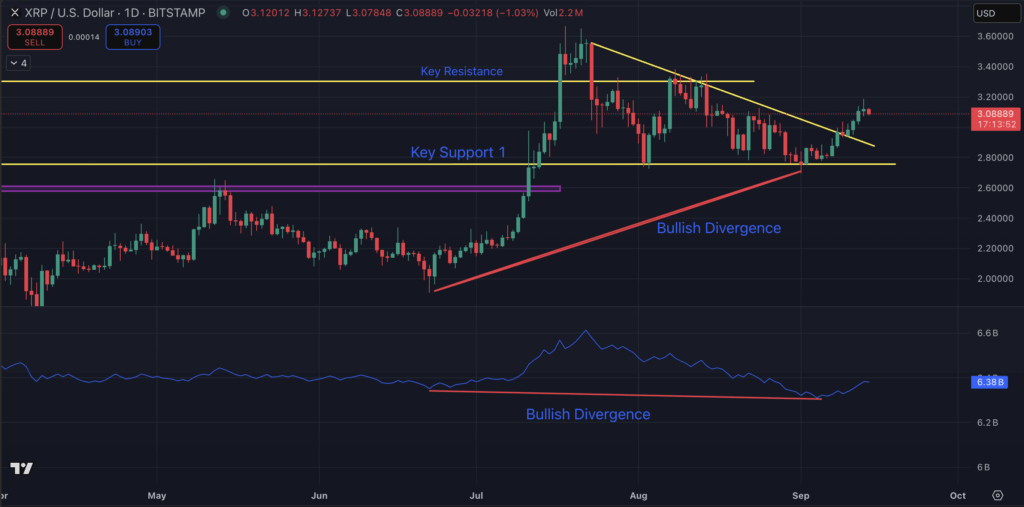

As obvious from the XRP worth chart above, it has damaged out of a multi-month descending trendline. This coincides with a bullish divergence between its worth and on-balance quantity (OBV), which is all the time a superb “purchase” sign for sidelined traders.

XRP now faces a key resistance degree at $3.30. A bullish breakout right here would pave the way in which for a brand new all-time excessive.

Outstanding analyst Ali Martinez predicts that the XRP worth is poised for a rally to $3.60 if it secures a weekly shut above $3.

In the meantime, Stedar Crypto’s Dario Suveljak claims that the token is on the cusp of breaking out of a weekly bull flag, which might give mid-term and long-term worth targets of $6, $13 and $23.

https://twitter.com/stedas/standing/1966702124005265446

Bitcoin Hyper Tipped As The Finest Low-Cap Crypto To Purchase Now

XRP is undoubtedly probably the greatest large-cap crypto investments. In the meantime, Bitcoin Hyper (HYPER) has emerged as the most popular low-cap crypto asset in the marketplace.

The HYPER presale has already raised almost $16 million in its ICO, owing to a string of six-figure investments from whales.

The venture goals to mix Bitcoin’s safety with the pace, programmability, and scalability of contemporary blockchains.

Powered by the Solana Digital Machine (SVM) execution atmosphere and zero-knowledge rollup structure, it proposes a full Layer-2 answer for BTC, enabling good contracts, DeFi, NFTs, and quick micro-payments, whereas periodically anchoring state again to Bitcoin’s base layer.

Its canonical bridge mechanism permits BTC to be locked (on Bitcoin L1) and wrapped/minted on Layer-2, then freely withdrawn later, preserving belief and decentralization.

Notably, a brand new crypto bull market is on the horizon, and Bitcoin seems poised for a rally to $150,000. This would offer the best backdrop for BTC layer-2 cash like HYPER, contemplating they present a powerful correlation with Bitcoin.

Furthermore, its audited good contracts, staking rewards and community-centric tokenomics separate it from different new low-cap crypto belongings. In truth, many are eyeing it as the subsequent 100x crypto.

Go to Bitcoin Hyper Presale

This text has been offered by one among our industrial companions and doesn’t mirror Cryptonomist’s opinion. Please bear in mind our industrial companions might use affiliate applications to generate revenues by means of the hyperlinks on this text.