Solana’s had one hell of a journey this yr. We noticed SOL explode to an all-time excessive (ATH) of $295.83 in January earlier than it offered off via spring. However since April, SOL has been quietly grinding larger, with some quick pullbacks alongside the best way.

The token’s regular climb again up tells you one thing necessary about the place we’re within the present market cycle. As a substitute of untamed value swings pushed by hype, SOL’s been creating assist ranges that stick. That sample often occurs earlier than the actually huge strikes happen.

Everybody’s now speaking a couple of potential spot Solana ETF – and the items are beginning to line up. Regulatory approval is rarely assured, however the groundwork is there for these funds to go reside earlier than the tip of 2025 – and that alone is sufficient to maintain institutional patrons serious about SOL.

That’s additionally why initiatives constructed on Solana are seeing severe capital inflows. Take the Snorter (SNORT) presale, for instance – it’s raised practically $4 million from traders who see this buying and selling bot undertaking as a fantastic alternative. And with a DEX itemizing for SNORT on the horizon, they may be proper.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t answerable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page.

SOL Takes a Breather After Weekend Highs

After hitting $249 on Saturday – its highest value since January – Solana has pulled again to $232, down about 7% from its weekend peak. It looks as if traditional profit-taking after such an aggressive run.

On-chain information exhibits what’s taking place behind the scenes. Final week, one whale transferred over 620,000 SOL – value roughly $117 million – onto exchanges like OKX and Binance. Once you see these sorts of alternate flows, promoting often follows.

Additionally, SOL’s alternate reserve ratio jumped to eight.2% – a 30-day excessive – whereas futures merchants bought wrecked prior to now day with $19 million in lengthy liquidations. Spot volumes are manner up too, which confirms all of the promoting strain we’re seeing.

However zoom out, and this pullback isn’t stunning. SOL is up 33% over the past 26 days, so some profit-taking was inevitable. The weekly pattern remains to be intact, and most merchants are watching $218 as the subsequent assist stage for a possible rebound.

Wall Road’s Getting Critical About Spot SOL ETFs

The $300 goal for SOL isn’t wishful considering anymore. The analyst Real Degen dropped some data at this time about Galaxy Digital investing billions in SOL, which helped gas these weekly positive factors we simply noticed. He believes reaching $300 is feasible if this pattern continues.

Plus, Mike Novogratz calling Solana “tailored” for monetary markets has added to the thrill. The Galaxy CEO is aware of what institutional traders need to hear, and when he’s backing one thing this tough, they pay attention.

Time for one more bullish @solana week! 🚀

Galaxy Digital simply loaded up on $1.35B in $SOL, fueling an enormous rally to $235+!

With 19.4% weekly positive factors and Mike Novogratz calling Solana “tailored” for monetary markets, the $SOL ETF approval in 2026 may ship us to $300! pic.twitter.com/GmdO203eYM

— real (@GenuineDegen) September 15, 2025

However the true game-changer may very well be ETF approval. A number of huge gamers like Bitwise, 21Shares, and Franklin Templeton have lively filings with synchronized amendments – which often means they’re having productive conversations with regulators.

The SEC just lately pushed its Bitwise and 21Shares ETF choices to October 16, with Franklin Templeton’s deadline being November 14. Though these delays may appear bearish, they’re really traditional SEC habits – and recommend the regulator is working via the ultimate particulars of approval.

Snorter Presale Capitalizes on Solana’s Momentum, Nears $4M Milestone

With SOL doubtlessly on monitor to hit $300, there’s one other story enjoying out that good cash is positioning for – Snorter (SNORT). The undertaking’s presale has raised $3.9 million up to now, with SNORT tokens priced at simply $0.1045.

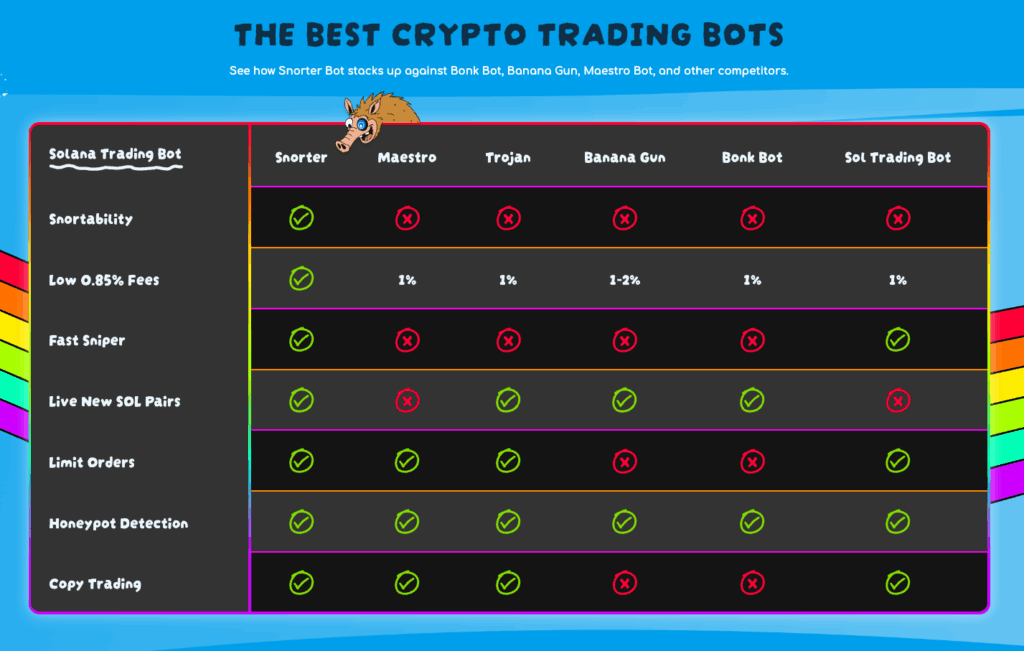

Snorter is a brand new buying and selling bot for Solana that’s built-in into Telegram. It provides instruments like copy buying and selling, rug-pull detection, restrict orders, sniping, and extra. These instruments mainly make it a “sidekick” for meme coin merchants.

The bot’s success is instantly tied to Solana’s progress. When SOL rallies, DEX volumes and meme coin exercise sometimes explode throughout the community. That’s exactly when merchants want buying and selling bots essentially the most – when markets are shifting quick and each second counts.

Snorter’s tokenomics are interesting, too. Holding SNORT unlocks discounted swap charges at 0.85% versus the standard 1-1.5% most bots cost, plus you get premium options and large staking rewards (with APYs as much as 118%). Extra bot exercise throughout a Solana bull run means extra folks wanting these charge reductions – driving SNORT demand larger.

And since Snorter has a hard and fast provide, any actual surge in adoption throughout Solana’s subsequent bull run may transfer the SNORT value massively. The present ICO momentum means that traders are already betting this precise state of affairs will play out.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t answerable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, instantly or not directly, for any harm or loss brought about or alleged to be brought on by or in reference to use of or reliance on any content material, items or providers talked about.