Key Takeaways

- Excessive-profile investor Jeffrey “Machi Massive Brother” Huang bought his complete $25.8 million Hyperliquid (HYPE) place at a $4.45 million loss, citing issues over the token’s upcoming vesting schedule.

- The sale follows an analogous exit by different massive buyers and happens as Hyperliquid’s HYPE market share within the decentralized alternate (DEX) area has fallen sharply to rising rivals.

- The shift in capital from HYPE to opponents like Aster and Lighter alerts a rising sense of investor uncertainty and an intensifying competitors throughout the decentralized perpetuals market.

In a transfer that underscores the rising investor unease across the Hyperliquid ecosystem, high-profile investor and movie star Jeffrey “Machi Massive Brother” Huang has bought his complete $25.8 million HYPE place at a realized lack of $4.45 million.

The On-Chain Sign of an Investor Exodus

Jeffrey Huang, generally known as “Machi Massive Brother,” is a well known determine within the crypto area, with a status for daring, high-stakes bets. His on-chain actions are sometimes intently watched by the group as a sign of market sentiment. His determination to promote his HYPE tokens at a big loss, slightly than maintain for a possible restoration, speaks volumes about his long-term outlook on the venture.

The transfer alerts that even a seasoned investor is unwilling to face the “Sword of Damocles” — the upcoming token unlock that’s anticipated to introduce an enormous provide of latest tokens into the market.

Analysts from BitMEX co-founder Arthur Hayes’ household workplace fund, Maelstrom, have warned that the HYPE token’s upcoming vesting schedule shall be its “first true check.”

The schedule, which begins on November 29, will distribute an estimated $11.9 billion value of HYPE tokens to crew members over a 24-month interval.

A DEX Market in Flux

The investor exits should not taking place in a vacuum; they’re occurring because the decentralized alternate (DEX) panorama undergoes a big shift. Hyperliquid’s HYPE perpetual futures market share has fallen sharply, dropping from a excessive of 65% in mid-July to only 33% on Tuesday.

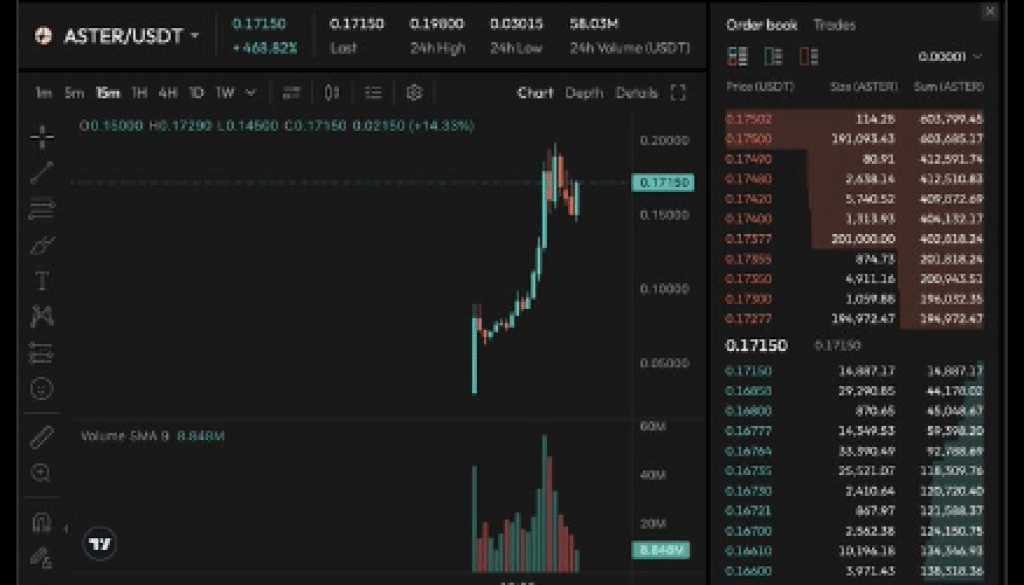

Hyperliquid’s HYPE lack of market share is straight benefiting its rivals. Throughout the identical interval, Aster, a decentralized perpetuals alternate linked to Binance co-founder Changpeng Zhao, noticed its market share rise from 1.3% to twenty%, whereas Lighter’s share climbed from 12.8% to 17.1%.

Aster’s transient crossing of the $2 billion Complete Worth Locked (TVL) milestone additional validates its place as a critical competitor. Because the DEX sector evolves, platforms that may handle challenges like sustainable liquidity and price effectivity will probably emerge as the brand new leaders.

Remaining Ideas

The HYPE token’s current struggles underscore the delicate nature of market management in a quickly evolving area. The exits of influential figures like Arthur Hayes and Machi Massive Brother, mixed with a pointy decline in market share, sign a vital turning level for the Hyperliquid ecosystem because it prepares for its largest problem but.

Regularly Requested Questions

What’s the Hyperliquid (HYPE) token unlock?

The HYPE token unlock is a vesting schedule that may start on November 29, distributing almost $12 billion in tokens to core contributors over a 24-month interval, doubtlessly creating important promote strain.

What’s “Machi Massive Brother”?

“Machi Massive Brother” is the web alias of Jeffrey Huang, a Taiwanese music movie star and high-profile digital asset investor recognized for his massive, on-chain cryptocurrency bets.

What’s a “DEX” market share?

DEX market share refers back to the proportion of whole buying and selling quantity or exercise {that a} explicit decentralized alternate (DEX) instructions inside its particular market, comparable to decentralized perpetual futures.