- Bitcoin dropped 5% in October, marking its first purple month since 2018, however traditionally positive factors 42% on common in November.

- The Fed’s price cuts and easing U.S.–China tensions might enhance BTC’s restoration potential.

- Ongoing authorities shutdowns and ETF approval delays should weigh on Bitcoin’s short-term momentum.

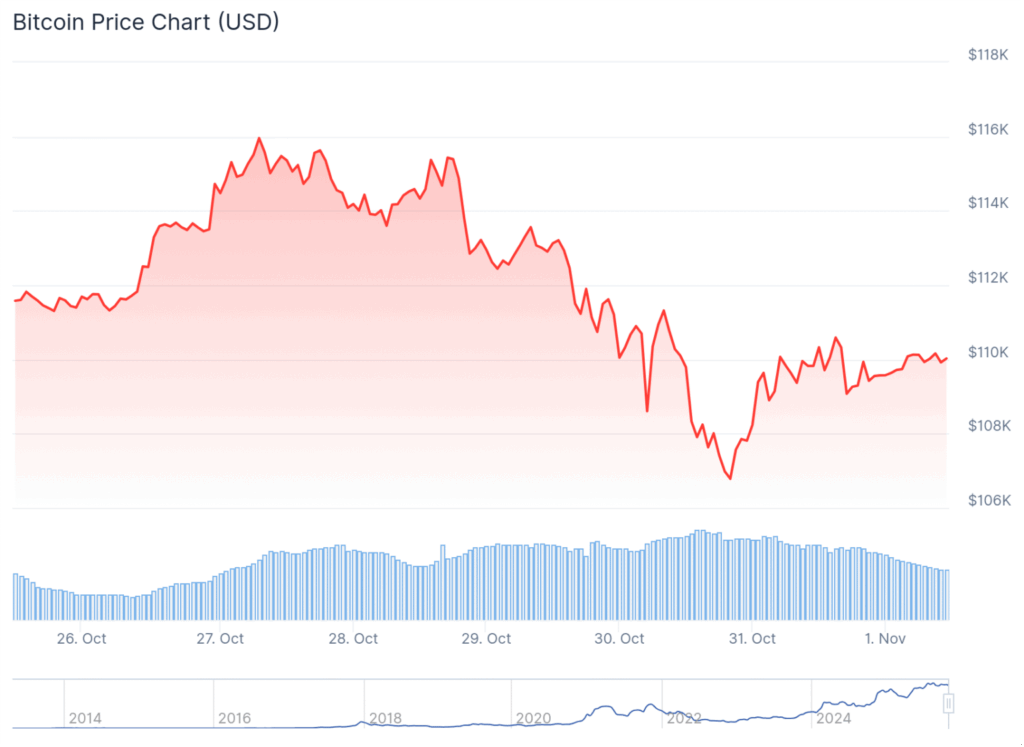

For the primary time since 2018, Bitcoin closed October within the purple, dropping almost 5% and snapping its seven-year profitable streak. The autumn adopted President Trump’s shock announcement of 100% tariffs on Chinese language imports, triggering $19 billion in crypto liquidations inside a single day. Nonetheless, BTC stays up over 16% year-to-date — and historical past suggests brighter days could also be forward as November begins.

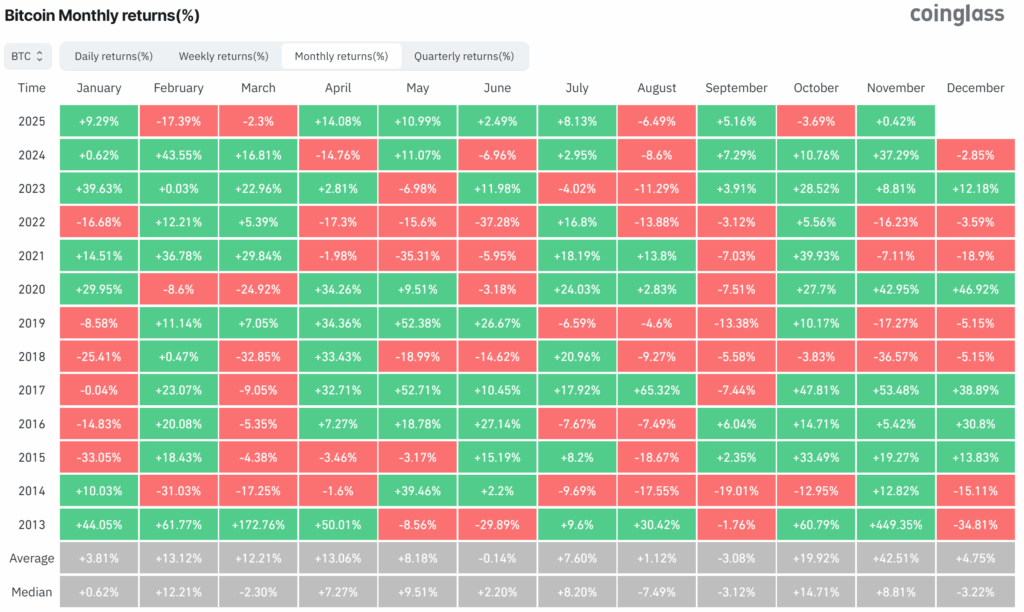

Historical past Favors the Bulls

In line with Coinglass knowledge, November has traditionally been Bitcoin’s strongest month, averaging a 42.51% acquire since 2013. If that development holds, BTC might climb above $160,000 earlier than month-end. Nonetheless, 10x Analysis’s Markus Thielen cautions that seasonal patterns alone aren’t sufficient. “They matter, however solely when supported by broader components,” he stated, hinting that macro circumstances could decide whether or not this rally sticks.

Commerce Tensions, Fed Cuts, and ETF Delays

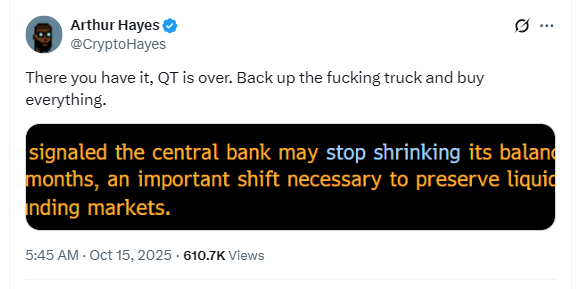

The continued U.S.–China commerce drama retains shaking international markets. Trump just lately met President Xi in South Korea, signaling actual progress on a deal that features tariff cuts and renewed soybean imports. In the meantime, the Federal Reserve reduce rates of interest by 0.25% and formally ended its quantitative tightening program on December 1 — each strikes that might inject new liquidity into markets and doubtlessly enhance Bitcoin’s outlook.

Even Arthur Hayes, the BitMEX co-founder, couldn’t maintain again his pleasure. He wrote on X:

What to Watch This Month

If historical past repeats itself, Bitcoin might be heading for a significant rebound by means of November. Decrease rates of interest, easing commerce tensions, and powerful seasonal patterns all set the stage for a possible rally. However with regulatory delays and lingering volatility, merchants will likely be watching carefully to see if BTC can flip its “Crimson October” right into a “Golden November.”

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.