At present, roughly $3 billion price of Bitcoin (BTC) and Ethereum (ETH) choices are set to run out, creating vital anticipation within the crypto market.

Expiring crypto choices typically results in notable worth volatility, prompting merchants and buyers to watch right this moment’s developments intently.

$2.87 Billion Bitcoin and Ethereum Choices Expiring

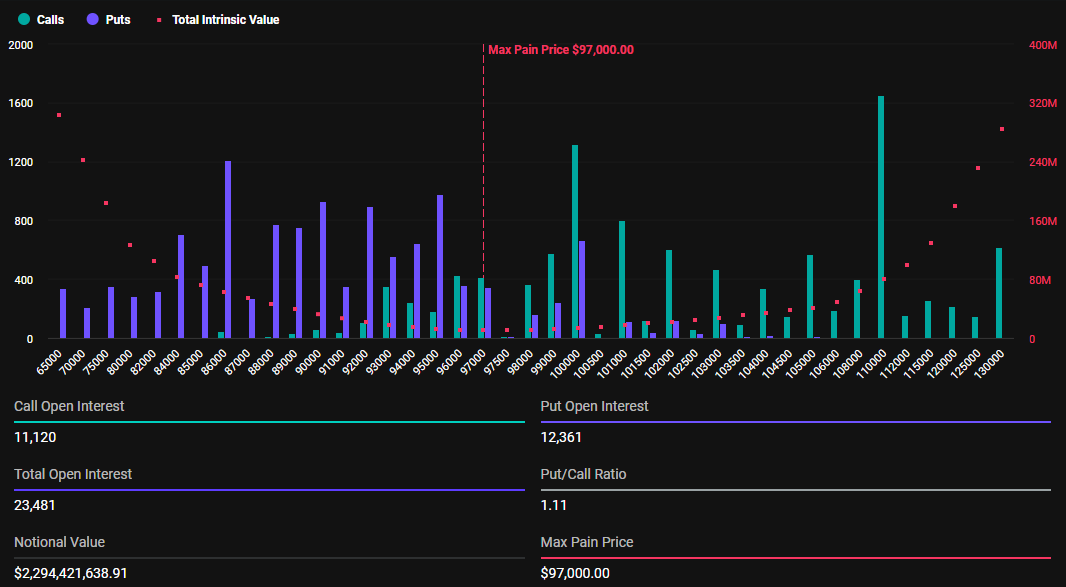

In response to Deribit’s information, 23,481 Bitcoin contracts, with a notional worth of roughly $2.29 billion, are set to run out right this moment. Bitcoin’s put-to-call ratio is 1.11. The utmost ache level — the worth at which the asset will trigger monetary losses to the best variety of holders — is $97,000.Right here, most contracts will expire nugatory.

Primarily based on this, analysts at Greeks.dwell defined the present state of the crypto market by way of its official account on X (previously Twitter).

“Bitcoin managed to hit $100,000 from zero in a decade which created a legend. Trump tweeted his congratulations, taking crypto from geek to mass. Close to the top of the week, a pointy downward shot cleared a wave of leverage, different cash didn’t observe go well with. The lengthy facet of the general crypto market may be very robust…market sentiment may be very optimistic with stable lengthy forces within the spot bull market,” Greeks.dwell famous.

However, it’s not possible to disregard that prime funding charges for leveraged contracts, which counsel overextended bullish bets, enhance the chance of a market pullback. This aligns with BeInCrypto’s current report, which highlighted that Bitcoin choices merchants are hedging in opposition to potential declines. There’s rising curiosity in put choices.

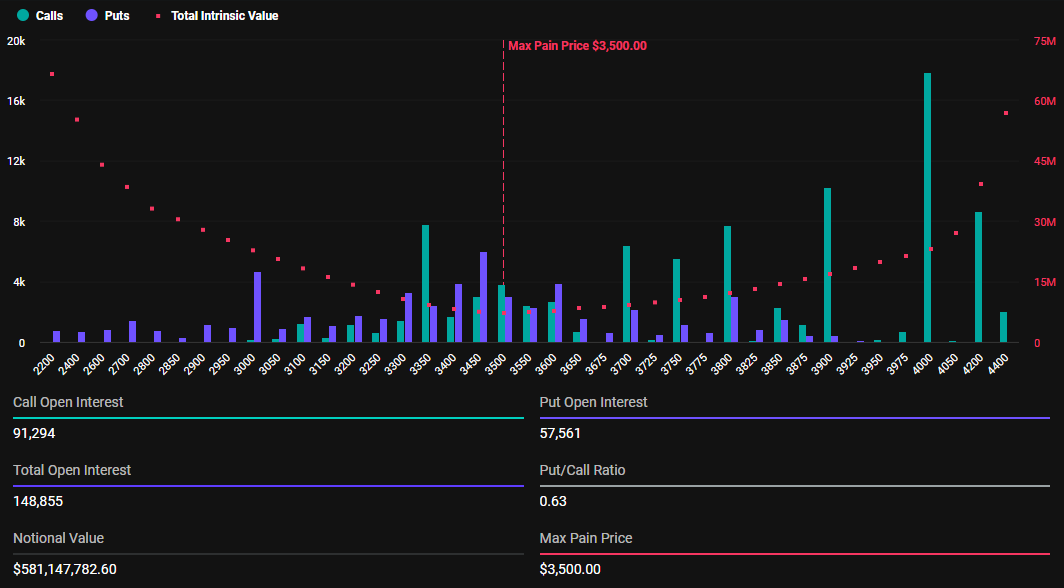

Bitcoin’s put-to-call ratio stays above 1, signaling a predominantly bearish sentiment. In distinction, Ethereum’s put-to-call ratio sits at 0.63, indicating a typically bullish market outlook for ETH.

Primarily based on Deribit information, over 148,733 Ethereum contracts will expire right this moment. These expiring contracts have a notional worth of roughly $581 million, with a most ache level of $3,500. Ethereum has seen a modest enhance of 0.73% since Friday’s session opened, to commerce at $3,902 as of this writing.

Bitcoin Choices Merchants Hedging In opposition to Potential Declines

Lately, Bitcoin established a neighborhood high across the $104,000 degree. Nonetheless, it has corrected to commerce for $97,693 as of this writing.

The speedy decline seems to be pushed by a number of elements. Amongst them is an overleveraged market, the place many merchants have been utilizing borrowed funds to guess on BTC’s worth enhance.

This prompted large liquidations when the worth dropped. Revenue-taking after the $100,000 milestone additionally contributed to the correction. Large promote orders across the $110,000 threshold can also have triggered revenue reserving.

In response to analysts at Greeks.dwell, almost two weeks of choices market information have proven warning amongst market makers. The affect of BTC shattering the $100,000 milestone, coupled with the most recent retracement, prompted short-term implied volatility (IV) to extend considerably.

“…market makers are avoiding publicity to show publicity to the market. The likelihood of the market continues to be extraordinarily bullish now,” they added.

As these Bitcoin and Ethereum choices contracts close to expiry, the costs are possible to attract in the direction of their most ache ranges. Nonetheless, markets should keep in mind that the choice expiration’s affect on the underlying asset’s worth is short-term. Usually, the market will return to its regular state thereafter and compensate for robust worth deviations.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.