- A Fed fee lower subsequent week is extremely doubtless, with debate between 25 or 50 foundation factors.

- Trump is anticipated to call a brand new Fed chair quickly, with Kevin Hassett seen because the frontrunner.

- Powell and Trump stay at odds, growing strain on the Fed throughout a delicate financial second.

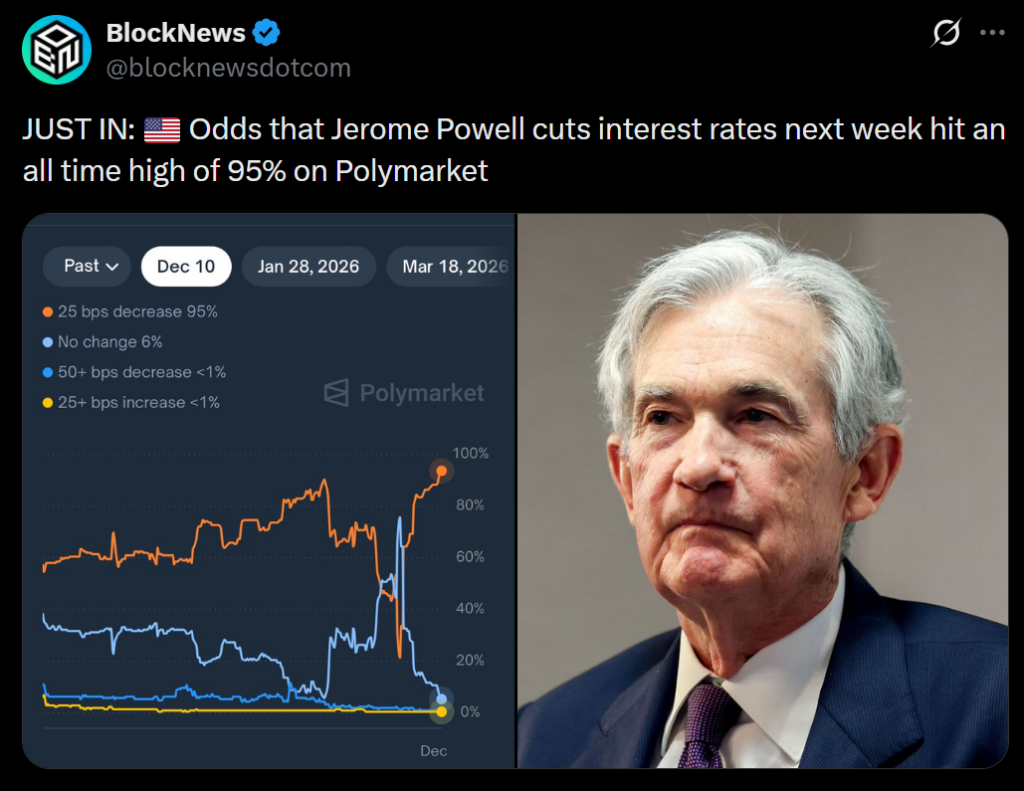

The Federal Reserve is heading into one in every of its most-watched conferences of the yr subsequent week, and all indicators are pointing towards one other fee lower — except Chair Jerome Powell decides the most recent batch of financial knowledge provides him an excuse to sluggish issues down once more. Former White Home Financial Advisor Steve Moore didn’t mince phrases this week, saying there’s a “excessive likelihood” the Fed eases coverage once more. The one debate, he added, is whether or not it’ll be a modest 25-basis-point trim or a extra aggressive 50-point transfer.

Markets Already Bracing for a Lower

Moore, talking with The Nationwide Information Desk, mentioned the markets appear absolutely ready for a lower. “I feel the markets do count on that fee lower to come back,” he mentioned, hinting that buyers have already priced in a softer coverage stance. With inflation cooling and progress wobbling a bit on the edges, the Fed is below strain to maintain monetary situations supportive heading into 2026 — particularly with political noise constructing across the central financial institution.

Trump Eyes Powell’s Alternative

Complicating the second is the rising rigidity between Powell and President Donald Trump, who has overtly criticized Powell for months, urging him to slash charges quicker. Trump is anticipated to announce his nominee for the subsequent Fed chair early subsequent yr, and the shortlist is already stirring loads of hypothesis. Steve Moore identified that Trump has strongly hinted at Kevin Hassett — at present serving as director of the Nationwide Council — as a number one contender, alongside Treasury Secretary Scott Bessent.

“There’s plenty of excessive intrigue,” Moore mentioned, including that Hassett could be a “very high quality economist” and certain an “glorious selection.” If Hassett will get the nod, Powell may very well be out earlier than summer time, marking a dramatic shift on the nation’s strongest monetary establishment.

Fee Cuts, Politics, and a Heated Fed Transition

Moore mentioned there’s “no love loss” between Trump and Powell, describing their relationship as long-standing friction. “Trump is keen to get him out and get somebody in who he feels will assist develop this financial system. And Trump would love extra fee cuts,” he mentioned.

Even so, Moore burdened what the Fed should maintain entrance and middle — inflation. Regardless of political strain, he mentioned the U.S. has managed “fairly modest inflation” this yr, giving the central financial institution some room to maneuver with out shedding credibility.

A Excessive-Stakes Resolution Coming Subsequent Week

With the Fed’s December assembly simply days away, the stakes are unusually excessive. A lower appears doubtless, a management change is looming, and political strain is heavier than at any level in Powell’s tenure. Whether or not the Fed goes 25 or 50 factors could set the tone for the primary half of 2026 — and probably for Powell’s remaining chapter on the central financial institution.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.