Consultants are more and more signaling a possible crypto bull run within the first quarter (Q1) of 2026, pushed by a convergence of macroeconomic elements.

Analysts counsel Bitcoin might surge between $300,000 and $600,000 if these catalysts materialize.

5 Macro Traits Fueling a Potential Rally in Q1 2026

A mixture of 5 key developments is creating what analysts describe as a “excellent storm” for digital belongings.

Sponsored

Sponsored

1. Fed Stability Sheet Pause Removes Headwind

The Federal Reserve’s quantitative tightening (QT), which drained liquidity all through 2025, ended not too long ago.

Merely halting the liquidity drain is traditionally bullish for threat belongings. Knowledge from earlier cycles counsel Bitcoin can rally as much as 40% when central banks cease contracting their stability sheets.

Analyst Benjamin Cowen indicated that early 2026 may very well be the time when markets start to really feel the affect of the Fed ending its QT.

2. Price Cuts Might Return

The Federal Reserve not too long ago lower rates of interest, with its commentary and Goldman Sachs forecasts indicating rate of interest cuts might resume in 2026, doubtlessly bringing charges down to three–3.25%.

Decrease charges sometimes improve liquidity and enhance urge for food for speculative belongings corresponding to cryptocurrencies.

Sponsored

Sponsored

3. Improved Brief-Finish Liquidity

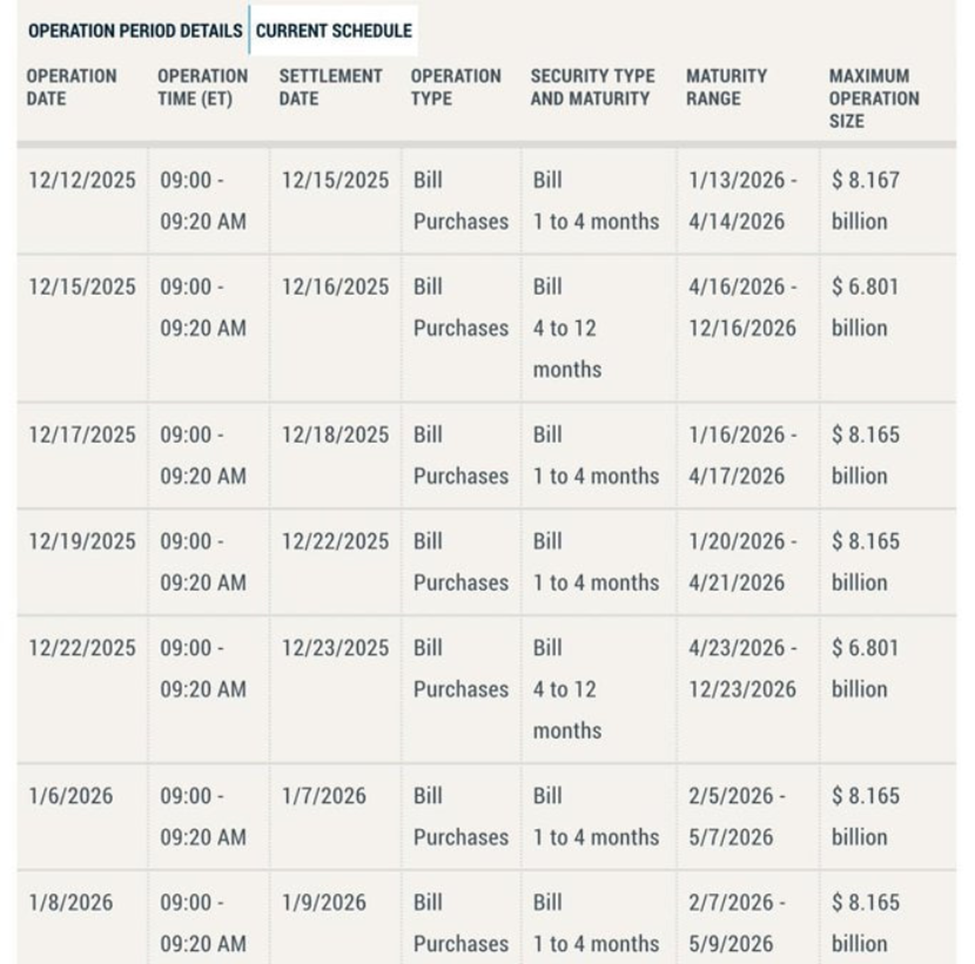

Elevated Treasury invoice purchases or different help on the brief finish of the yield curve might ease funding pressures and cut back short-term charges. The Fed says it would begin technical shopping for of Treasury payments to handle market liquidity.

“[buying is] solely for the aim of sustaining an ample provide of reserves over time, thus supporting efficient management of our coverage charge…these points are separate from and haven’t any implications for the stance of financial coverage,” mentioned Fed Chair Jerome Powell.

The Fed periodically is available in throughout short-term funding markets amid situations of liquidity imbalances. These imbalances manifest within the in a single day repo market, the place banks borrow money in alternate for Treasuries.

Lately, a number of indicators level to a rising short-term funding stress, together with:

- Cash market funds sitting on elevated ranges of money,

- T-bill issuance tightening because the Treasury shifted its borrowing combine, and

- Rising seasonal demand for liquidity.

The Fed initiated a managed buy plan of Treasury payments to stop short-term rates of interest from deviating from the goal Federal Funds Price. These are the shortest-maturity authorities securities, sometimes starting from a number of weeks to at least one yr in length.

Whereas not a basic QE transfer, this measure might nonetheless function a major liquidity tailwind for crypto markets.

Sponsored

Sponsored

For Q1 2026, the broader implications for threat belongings, corresponding to crypto and equities, are typically constructive however average, stemming from a shift in Fed coverage towards sustaining or regularly increasing liquidity.

4. Political Incentives Favor Stability

With US midterm elections scheduled for November 2026, policymakers are more likely to favor market stability over disruption.

This surroundings reduces the danger of sudden regulatory shocks and enhances investor confidence in threat belongings.

“If the inventory market within the USA falters earlier than the midterm elections, the present US administration can be held accountable – therefore they may do every little thing they will to maintain issues moving into equities (and crypto,” wrote macro researcher Thorsten Froehlich.

Sponsored

Sponsored

5. The Employment “Paradox”

Weakening labor market knowledge, corresponding to gentle employment or modest layoffs, typically triggers dovish Fed responses.

Softer labor circumstances improve stress on the Fed to ease coverage, not directly creating extra liquidity and favorable circumstances for cryptocurrencies.

Professional Outlook Suggests Bullish Sentiment Rising

Trade observers are aligning with the macro view. Alice Liu, Head of Analysis at CoinMarketCap, forecasts a crypto market comeback in February and March 2026, citing a mixture of constructive macro indicators.

“We’re going to see a market comeback in Q1 of 2026. February and March can be a bull market once more, primarily based on a mixture of macro indicators,” Binance reported, citing mentioned Alice Liu, Head of Analysis, CoinMarketCap

Some analysts are much more optimistic. Crypto commentator Vibes predicts Bitcoin might attain $300,000 to $600,000 in Q1 2026. This displays excessive bullish sentiment amid enhancing liquidity and easing macro circumstances.

Presently, market participation stays muted. Bitcoin open curiosity has declined, reflecting cautious dealer sentiment.

Nevertheless, if these macroeconomic tailwinds materialize, consolidation might rapidly give option to a major surge, setting the stage for a historic begin to 2026 within the crypto markets.