- Bitcoin’s NVT sign suggests a uncommon valuation reset, with utilization holding up whilst value compresses.

- Ethereum reveals heavy trade withdrawals and treasury accumulation, regardless of spot ETF outflows pressuring sentiment.

- XRP stands out with regular each day ETF inflows and rising AUM, hinting at quiet institutional positioning.

Capital is now not transferring by crypto as a single wave. As a substitute, Bitcoin, Ethereum, and XRP are beginning to inform noticeably completely different tales as valuation fashions, ETF flows, and provide habits pull buyers in separate instructions. This isn’t a risk-on market, and it doesn’t really feel like panic both. It’s selective, virtually cautious, with cash drifting towards belongings for very particular causes.

Bitcoin has slipped right into a uncommon valuation zone, Ethereum is seeing quiet however significant provide shifts, and XRP retains pulling in ETF capital day after day. Put collectively, these alerts counsel buyers are positioning with intention, not momentum. The query now isn’t which coin pumps subsequent, however which setup really holds up heading into 2026.

Bitcoin Valuation Alerts Trace at a Reset, Not a Breakdown

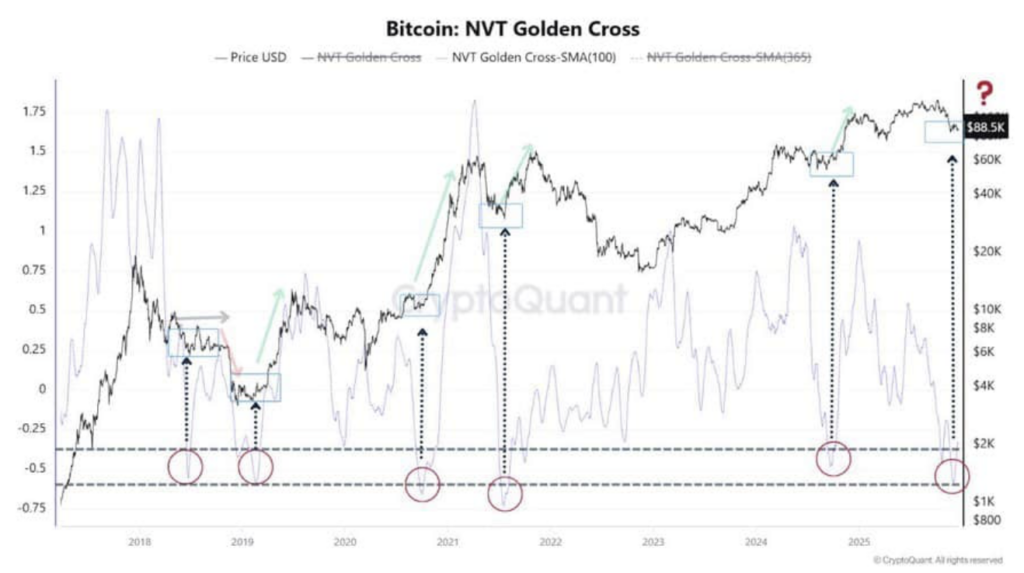

Bitcoin’s NVT Golden Cross has moved into a spread that traditionally doesn’t present up fairly often. When it does, it often means value has fallen sooner than precise community utilization. That’s essential, as a result of it tells us demand hasn’t vanished, regardless that value has taken a success.

In previous cycles, this type of divergence confirmed up throughout pressured promoting and leverage unwind phases. Worry rises, weak arms exit, and long-term holders quietly take up provide. What stands out this time is that on-chain exercise hasn’t collapsed. Transactions are nonetheless taking place. The community remains to be getting used.

This makes the present compression really feel extra like a reset than structural harm. Bitcoin seems to be low cost relative to utilization, however that doesn’t imply it instantly turns larger. Traditionally, these phases have a tendency to steer into slower accumulation intervals earlier than any actual pattern change reveals up.

Ethereum Provide Tightens At the same time as ETF Outflows Proceed

Ethereum’s state of affairs is extra sophisticated, and a bit extra attention-grabbing. On one aspect, ETH spot ETFs have been seeing web outflows, which on the floor seems to be bearish. However beneath the hood, giant quantities of ETH are leaving exchanges and transferring into treasuries and long-term constructions.

Resolve Labs pulled greater than 13,000 ETH off Binance in a matter of days. Bitmine adopted with a single transaction price over 30,000 ETH. That doesn’t seem like panic promoting. It seems to be like redeployment.

ETF outflows usually mirror portfolio rebalancing quite than outright rejection of an asset. In the meantime, trade balances hold shrinking. That stress suggests short-term strain pushed by ETF mechanics, whereas underlying provide dynamics stay quietly supportive. It’s messy, however not essentially unfavorable.

XRP ETFs Preserve Pulling Capital With out Hesitation

XRP continues to behave in another way from the remainder of the market. Since launch, spot XRP ETFs have recorded inflows each single day, pushing complete belongings beneath administration past $1.16 billion. No dramatic spikes, no sudden exits, simply regular accumulation.

That form of consistency often factors to establishments constructing publicity methodically, not chasing value. Not like BTC and ETH, XRP’s ETF flows haven’t swung wildly with sentiment. They’ve stayed calm, even whereas the broader market wobbles.

Worth hasn’t reacted a lot but, however traditionally, sustained ETF accumulation tends to indicate up in charts later, not instantly. The construction being constructed now feels extra deliberate than speculative.

Which Asset Has the Edge Going Into 2026?

At this stage, there isn’t a single clear winner. Bitcoin is buying and selling at a valuation low cost relative to utilization, a setup that has usually preceded long-term accumulation. Ethereum reveals tightening provide regardless of near-term ETF strain, hinting at power beneath the floor. XRP, in the meantime, continues to draw regulated capital with virtually no hesitation.

Which one leads into 2026 will rely on what issues most. If valuation resets dominate, Bitcoin seemingly regains favor. If on-chain deployment and provide absorption take heart stage, Ethereum might shine. And if institutional allocation by regulated merchandise turns into the principle driver, XRP might find yourself with the benefit.

For now, capital is selecting rigorously. And that, greater than value motion alone, is the true sign.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.