Bitcoin stays in a spread state, with current value motion exhibiting consolidation quite than directional continuation. Momentum has slowed, and the market is at the moment reacting to close by liquidity and technical ranges.

Technical Evaluation

By Shayan

The Every day Chart

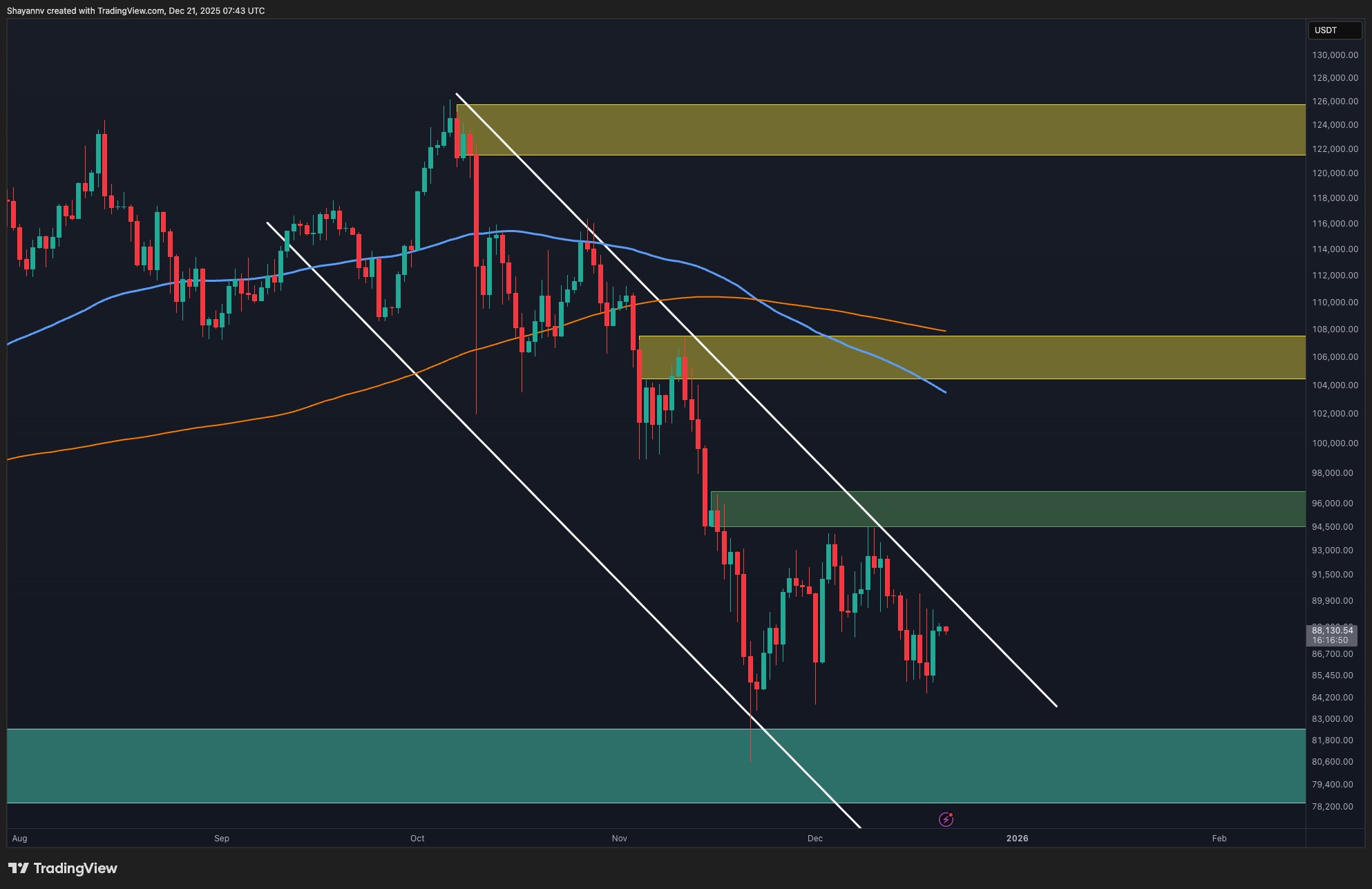

On the day by day timeframe, Bitcoin continues to commerce under a well-defined descending trendline that has acted as dynamic resistance all through the current decline. Every try and reclaim larger ranges has been capped under this trendline, confirming that sellers are nonetheless defending rallies aggressively.

The worth is at the moment consolidating under a key provide zone across the $95K area, the place earlier breakdowns have occurred. This space aligns intently with a choice level, reinforcing its significance as a resistance cluster. So long as Bitcoin stays under this zone, upside strikes are prone to be corrective quite than impulsive.

On the draw back, the first day by day help is situated across the $80K space. This stage has lately absorbed promote strain and acted as a brief base, stopping quick continuation towards deeper help. A day by day shut under this area would weaken the present construction and open the door for an additional decline.

Total, the day by day chart displays a market in consolidation beneath resistance, with construction favoring endurance quite than development continuation till a transparent breakout or breakdown happens.

The 4-Hour Chart

On the 4-hour timeframe, Bitcoin is buying and selling inside a compressed construction following the sharp selloff from current highs. It has fashioned a rising corrective sample contained in the broader downtrend and has lately damaged under it.

Latest makes an attempt to push larger have stalled close to the $90K area, the place short-term sellers have repeatedly stepped in. This has resulted in an absence of follow-through and continued sideways-to-lower value motion. The shortcoming to reclaim the descending trendline means that bullish momentum stays weak within the brief time period.

If Bitcoin fails to carry above the present consolidation vary and loses acceptance under $85K, draw back strain may speed up towards the decrease day by day help. Conversely, a clear reclaim and maintain above $90K can be required to shift short-term momentum and problem larger resistance ranges.

Sentiment Evaluation

By Shayan

The two-week Bitcoin liquidation heatmap highlights a big liquidity cluster positioned simply above the $90K threshold. This space stands out as a dense focus of leveraged positions, indicating a excessive chance of value interplay on this zone.

Moderately than signaling quick continuation larger, this liquidity cluster suggests a possible absorption zone. The asset transferring into this space might set off liquidations and compelled place closures, permitting bigger gamers to soak up liquidity quite than provoke a sustained breakout. This habits is in line with range-bound or corrective circumstances quite than development growth.

Till the liquidity above $90K is meaningfully cleared and the value exhibits sturdy acceptance above it, Bitcoin stays weak to additional consolidation or renewed draw back strikes. The presence of untested liquidity under the present value additionally retains the chance of a deeper sweep towards decrease demand zones firmly on the desk.

In abstract, Bitcoin is at the moment balancing between technical resistance and concentrated liquidity. With no decisive structural shift, the market stays in a neutral-to-bearish posture, with value prone to proceed reacting to close by liquidity ranges earlier than a transparent directional transfer emerges.

The put up Bitcoin Value Evaluation: Is BTC within the Calm Earlier than the Storm? appeared first on CryptoPotato.