Bitcoin stays below short-term stress as the worth continues to consolidate beneath key resistance ranges. Whereas volatility has compressed, a number of technical and on-chain indicators counsel the market is approaching a decisive section.

Technical Evaluation

By Shayan

The Each day Chart

On the each day timeframe, BTC has just lately skilled a rejection at its main descending trendline that has constantly acted as dynamic resistance throughout current makes an attempt to recuperate. Every rally into this trendline has been met with promoting stress, reinforcing its technical significance.

On the identical time, Bitcoin is holding above a essential demand zone within the $82K–$84K vary, which has acted as a dependable assist space in the course of the current decline. This zone continues to soak up draw back stress, stopping deeper continuation to the draw back for now.

The broader each day construction suggests Bitcoin is trapped between descending resistance and powerful horizontal assist, leading to a range-bound surroundings. A decisive each day shut above the descending trendline can be required to shift momentum in favour of patrons, whereas a clear breakdown beneath the $82K area would expose Bitcoin to greater corrective threat.

The 4-Hour Chart

Zooming into the 4-hour timeframe, BTC’s current value motion reveals weakening bullish momentum following a number of failed restoration makes an attempt. The asset just lately tried to push greater alongside an ascending intraday trendline however was stopped close to the $89K–$90K area, forming a neighborhood decrease excessive.

This rejection led to a breakdown again beneath short-term construction, confirming the transfer as a failed breakout relatively than a sustained reversal. Since then, Bitcoin has continued to print decrease highs, holding bearish stress intact within the quick time period.

So long as the worth stays beneath the descending 4-hour trendline, upside makes an attempt are prone to be corrective. A sustained reclaim above $90K can be wanted to invalidate the bearish construction and open the door for a broader restoration.

On-chain Evaluation

By Shayan

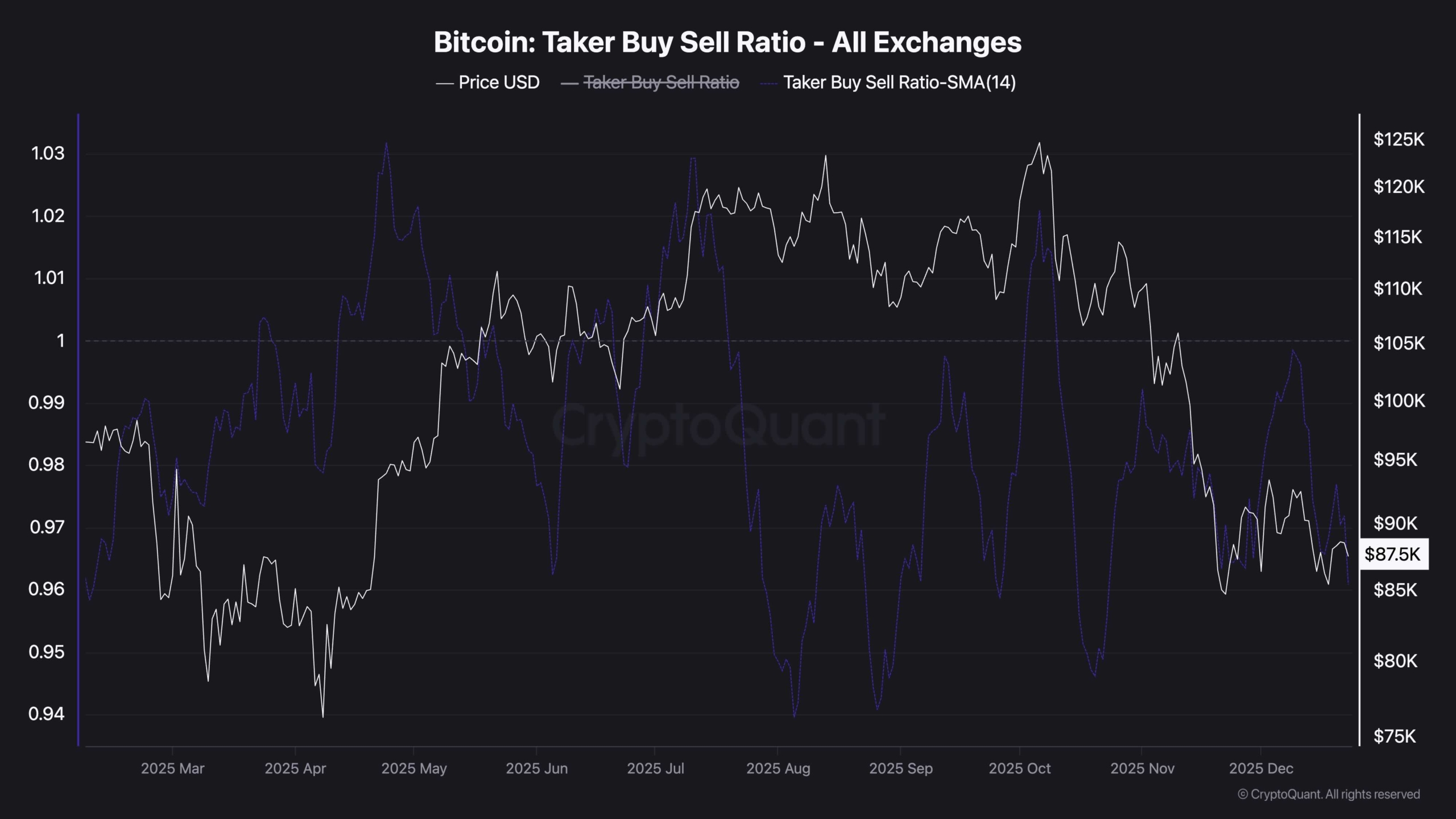

The taker purchase–promote ratio continues to replicate a market surroundings dominated by sell-side aggression. All through current value motion, the ratio has remained beneath its impartial equilibrium, indicating that market promote orders have constantly outweighed purchase orders. This habits means that rallies are being met with energetic distribution relatively than robust demand, holding upside makes an attempt capped.

Even throughout short-term rebounds, the ratio has didn’t maintain a transfer again into optimistic territory. These transient reactions spotlight reactive shopping for relatively than initiative-driven demand, reinforcing the view that patrons lack conviction at present ranges. So long as the taker purchase–promote ratio stays suppressed, Bitcoin’s construction favors consolidation or additional draw back relatively than a clear bullish continuation.

The publish Bitcoin Worth Evaluation: What’s the Most Probably BTC Situation Over Christmas? appeared first on CryptoPotato.