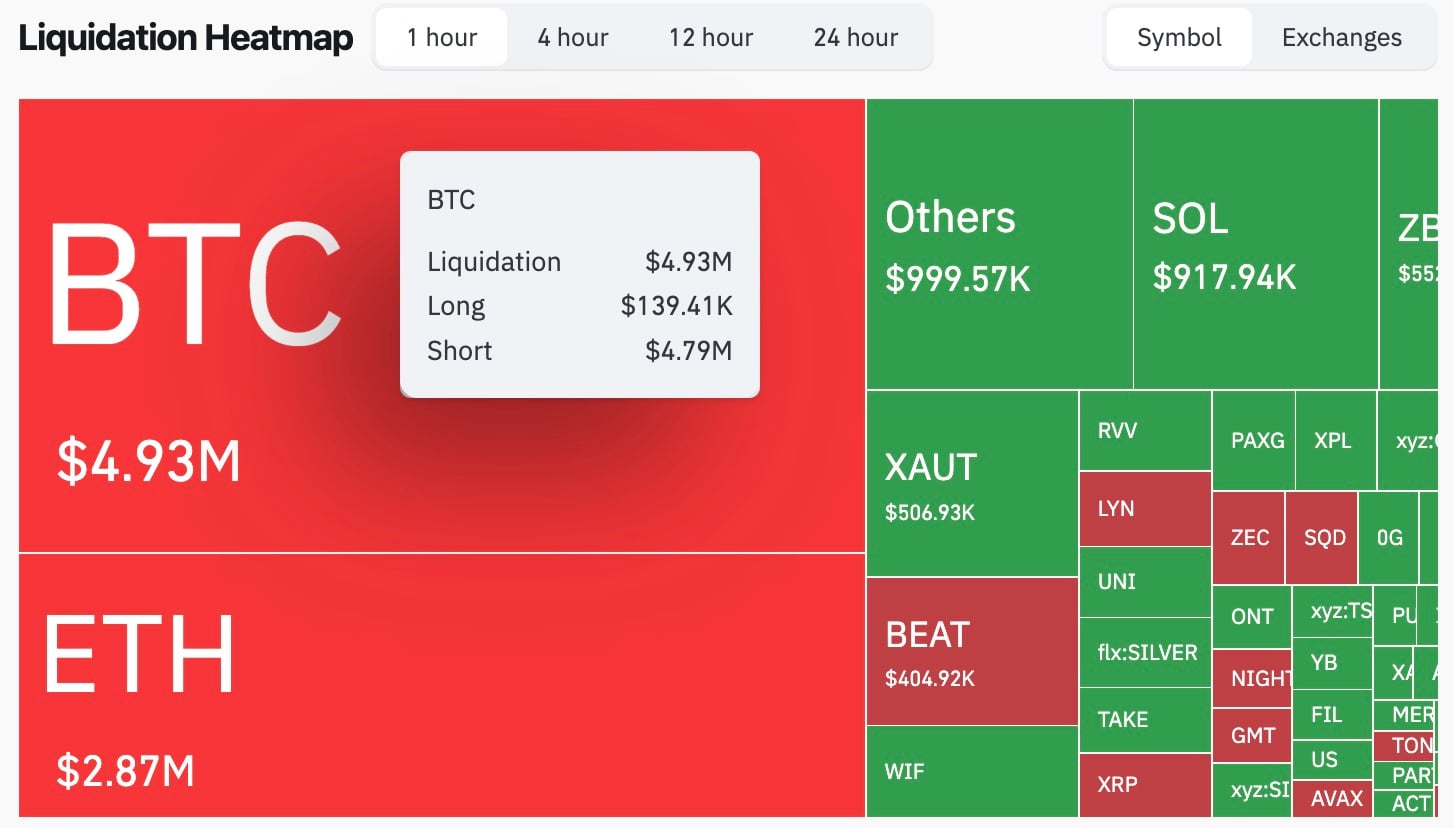

The Bitcoin liquidation information of the final hour revealed a surprising ratio, with shorts being pressured out at a charge of about $4.79 million in comparison with simply $139,410 in longs, leading to a 3,436% imbalance. Total, complete liquidations for the main cryptocurrency reached $4.93 million, in keeping with CoinGlass.

Whereas it reads like a squeeze, it occurred on a market additionally watching its “security commerce” crack. The gold spot was down about 3.1% for the day. The remainder of the metals advanced appeared worse: silver was down about 8.37%, platinum was down about 12.67% and palladium was down about 16.07% — all of those metals hit contemporary intraday lows.

That combo is the setup that merchants look ahead to rotation: when the winners get hit laborious in a single session, the primary response is profit-taking, and the second is capital searching for the following liquid venue that has not been the hero commerce.

Gold remains to be up 64.9% yr thus far, and silver is up 132.5% even after right now’s hit, whereas Bitcoin is down 6.5% over the identical time interval, the underperformer of the yr, which makes BTC the plain “catch-up” board when metals begin leaking.

Is that this the flippening?

The liquidation imbalance issues right here as a result of it exhibits positioning getting flipped in actual time. Shorts in BTC have been punished, longs barely received touched in that one-hour window and that form of pressured purchase strain typically pulls contemporary spot curiosity behind it.

During the last 24 hours, 95,012 merchants have been liquidated for a complete of $293.55 million, with longs at $153.88 million and shorts at $139.67 million. A standout hit was printed on Hyperliquid: a single BTC/USD liquidation value $5.23 million — the form of commerce that turns a chart right into a headline.