- Portugal blocked Polymarket after election bets surged forward of official outcomes.

- The transfer seems pushed extra by narrative management than by playing considerations.

- Prediction markets unsettle establishments as a result of they reveal sentiment sooner than official channels.

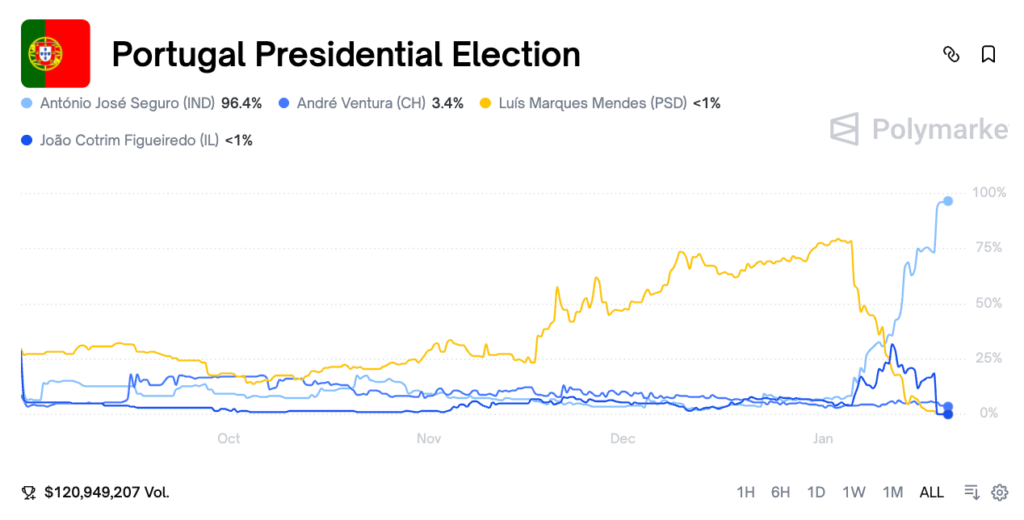

Portugal’s regulator moved shortly to dam entry to Polymarket after a sudden surge of cash flowed into election contracts simply earlier than official outcomes had been introduced. On the floor, the reason was simple: unlicensed playing and a nationwide ban on political betting. However the timing tells a extra sophisticated story. When tens of millions all of the sudden cluster round one consequence, it highlights how skinny the data barrier actually is — and that’s what tends to make establishments uneasy.

Markets Don’t Leak Info, They Mixture It

Authorities floated considerations about leaked exit polls or entry to private information. That’s potential, however it’s not the one rationalization. Prediction markets are designed to soak up 1000’s of small indicators directly — conversations, turnout cues, native chatter, quiet shifts in sentiment — and switch them right into a worth. If insiders had been leaking delicate information, that factors to weaknesses in election safeguards, not proof that prediction markets themselves are doing one thing mistaken.

Blocking Entry Doesn’t Remedy the Drawback

Community-level blocking looks like punishing the messenger. Prediction markets don’t create outcomes, they floor expectations. Shutting them down doesn’t defend democracy, it protects appearances. Much more regarding is the warning that customers may not be capable of retrieve funds after entry is blocked. That form of regulatory whiplash doesn’t appear to be client safety, it appears to be like reactive and unsure.

This Isn’t Only a Portugal Story

Portugal isn’t alone right here. Related scrutiny has appeared throughout France, Germany, Hungary, and even components of america. The sample is acquainted. When a market produces indicators sooner than establishments can reply, enforcement all of the sudden accelerates. It’s exhausting to not discover how usually regulation tightens exactly when prediction markets make officers look outpaced.

Why This Makes Regulators Nervous

Prediction markets are blunt, typically messy, and sometimes uncomfortable. That’s their energy. They floor collective perception in actual time, with out ready for press conferences or official affirmation. Portugal’s transfer suggests a deeper concern — not of betting, however of data escaping conventional channels. If democratic techniques can’t tolerate clear indicators about public expectation, the difficulty isn’t the market. It’s confidence within the system watching it.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.