Binance Analysis’s latest report, “The ETH Worth Debate,” analyzes Ethereum’s shifting function within the crypto ecosystem.

Whereas it highlights Ethereum’s foundational function in blockchain innovation, the report notes its place is now below scrutiny as a consequence of rising rivals and evolving market dynamics.

Binance Analysis Analyzes Ethereum

Binance Analysis’s report highlights a number of bullish developments for Ethereum in 2024. Key developments embody the discharge of the Dencun replace, geared toward considerably decreasing charges, and the approval of Ethereum ETFs within the US, unlocking new funding alternatives.

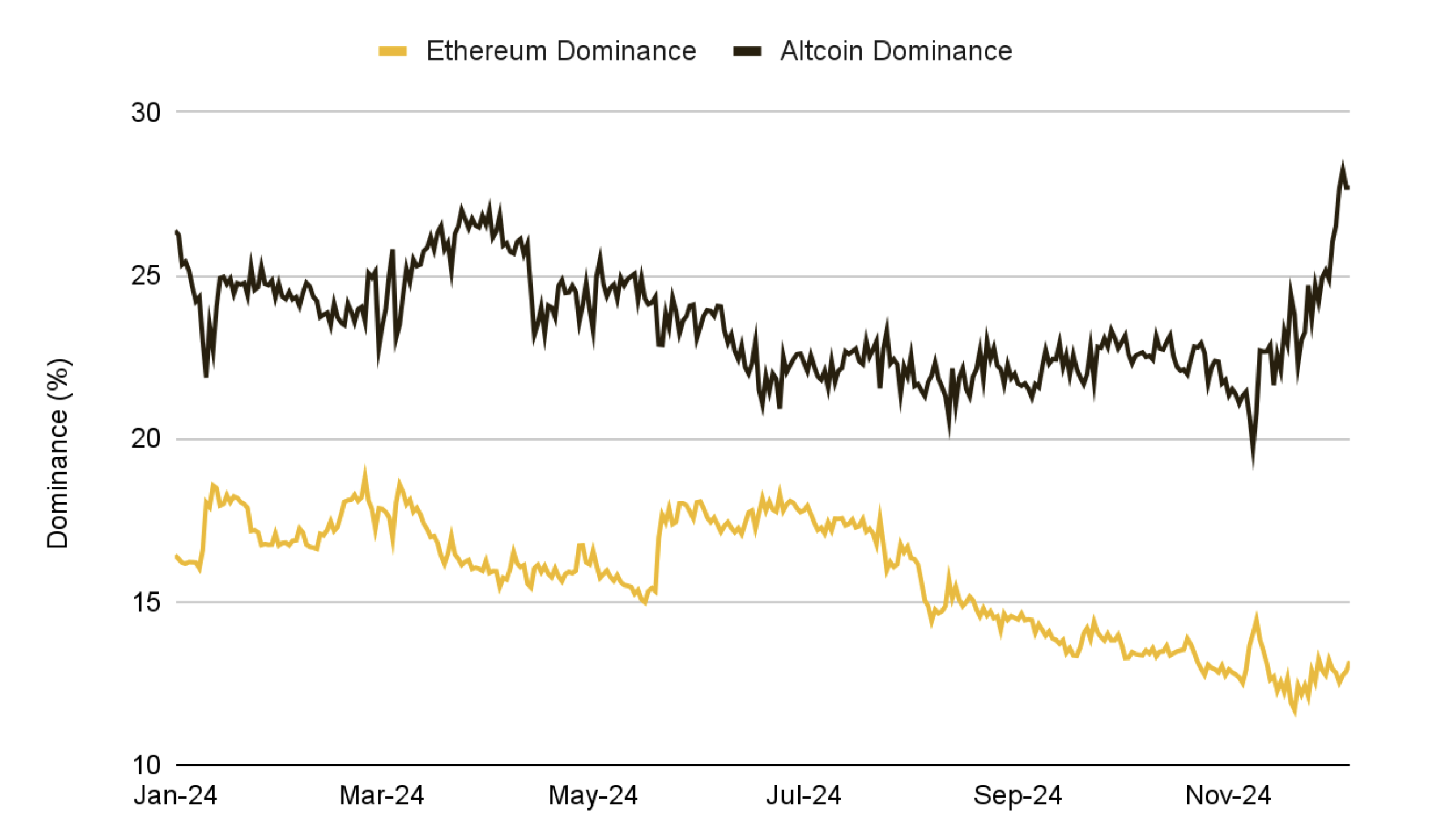

Regardless of these achievements, Ethereum’s market dominance has continued to say no, hitting a multi-year low of 13.1%. This drop displays rising competitors and evolving dynamics throughout the cryptocurrency ecosystem.

“Ethereum’s dominance, measured as its market cap relative to the full crypto market cap, has been on a downward trajectory all year long, reaching multi-year lows of 13.1%. This decline is especially placing in opposition to a bullish macro backdrop, the place risk-on sentiment has surged,” the report claimed.

Following the Dencun improve, Ethereum’s income dropped 99%, pushed by the rising recognition of Layer-2 options. As well as, the protocol has proven noticeably diminished community exercise. Binance Analysis characterised these developments in stark phrases, stressing the challenges Ethereum faces in sustaining its place.

The launch of Spot ETH ETFs in July 2024 initially garnered restricted curiosity however gained momentum after the US election, surpassing $1.7 billion in internet flows. Regardless of this, Ethereum’s buying and selling volumes and search curiosity have stayed flat, lagging behind the rising exercise of other Layer-1s comparable to Solana.

This ongoing debate displays Ethereum’s rising want for prioritization. Some imagine it ought to scale by way of Layer-2 options, enhancing worth seize and solidifying ETH’s function as non-sovereign cash.

Others argue for maximizing Layer-1 capabilities by driving fee-based demand and supporting a robust decentralized utility financial system. A transparent path ahead shall be essential for its future success.

“Ambiguity in Ethereum’s goals — between a rollup-centric roadmap and broader objectives — creates market uncertainty. Aligning on a cohesive mission assertion would strengthen Ethereum’s narrative and product technique,” Binance Analysis acknowledged.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.