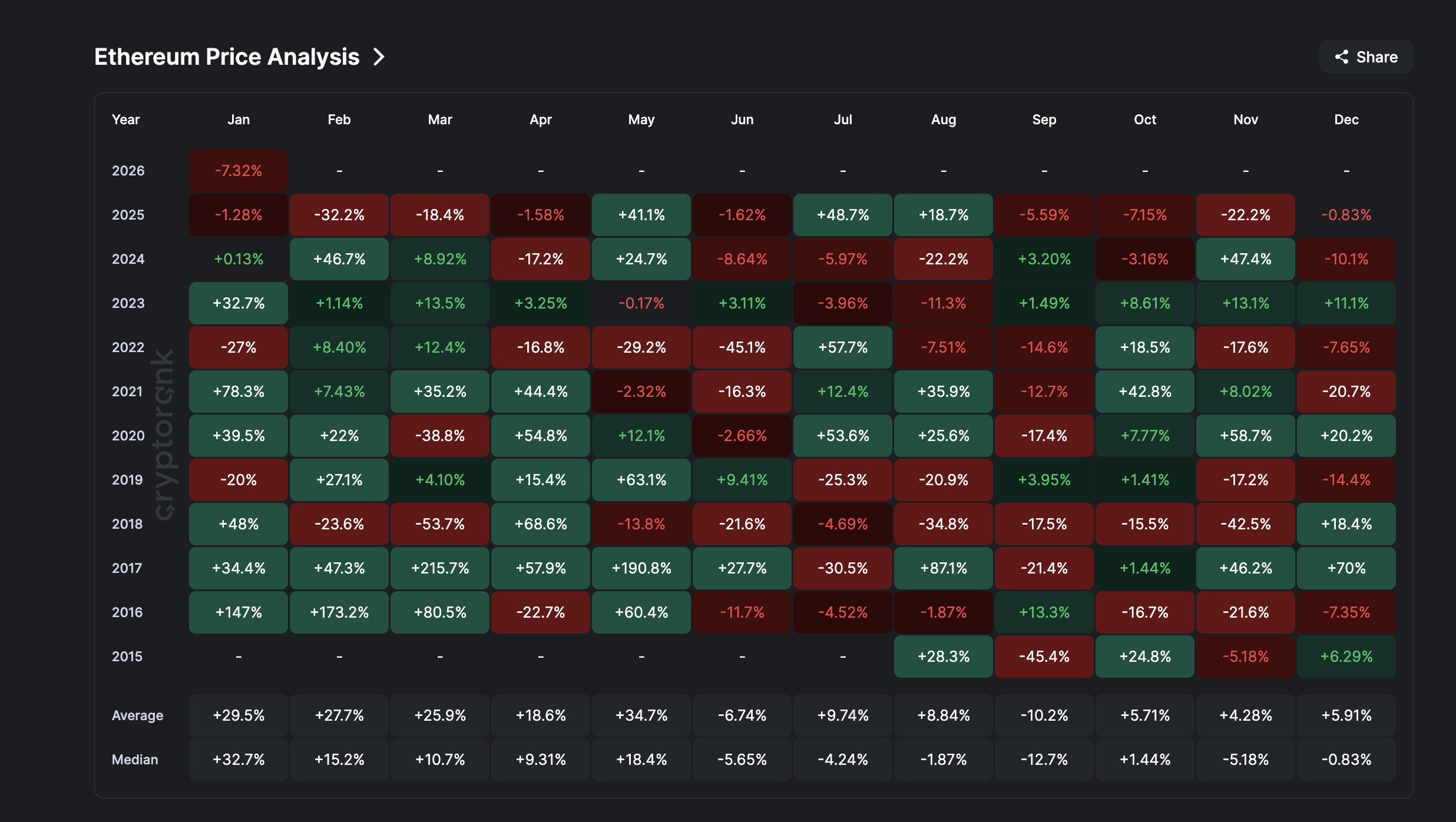

The Ethereum value is getting into February 2026 at a vital crossroads. After shedding practically 7% in January, ETH is closing the month in clear distinction to its historic development. January’s median return stands close to +32%, but this 12 months has moved in the other way. February, in the meantime, has delivered median features of round +15% since 2016.

The final time Ethereum entered February in the same place was in 2025. That 12 months, weak spot prolonged right into a 32%-37% month-to-month decline. Whether or not 2026 follows that path or breaks away from it is going to depend upon how the technical construction, on-chain information, and institutional flows work together within the coming weeks.

Ethereum’s February Historical past and a Falling Wedge Set Up a Excessive-Stakes Check

long-term information helps body expectations. Since 2016, Ethereum has posted a median February return of about +15%. It isn’t the strongest month, nevertheless it has delivered extra features than losses.

January tells a special story this 12 months.

As a substitute of following its +32% median acquire, ETH is closing January 2026 down roughly 7%. That places it nearer to 2025’s sample, when early weak spot carried right into a February decline.

Sponsored

Sponsored

So Ethereum enters February at a crossroads.

Nevertheless, not all analysts consider seasonality needs to be handled as a dependable information.

The analytics staff at B2BINPAY, an all-in-one crypto ecosystem for companies, cautions towards relying too closely on historic patterns.

“Historic patterns usually are not one thing one ought to depend on blindly. Most of them exist for pretty apparent causes,” they stated.

Additionally they added that ETH presently lacks quick progress catalysts

“However there isn’t a actual cause to imagine that February should convey progress. Based mostly on this, it makes little sense to count on February to protect any ‘historic’ bullish significance,” they highlighted.

Additionally they level to final 12 months as proof:

“Even when we take a look at February 2025 for example, Ethereum fell by 37%,” they stated.

That skepticism is mirrored within the present chart construction.

On the two-day timeframe, the ETH value stays inside a falling wedge. A falling wedge types when the worth makes decrease highs and decrease lows. It typically alerts weakening promoting strain and the potential for reversal.

On this case, the wedge is extensive and unstable. A confirmed breakout would mission a transfer of roughly 60%. That could be a most goal, not a forecast.

Momentum provides one other layer.

Between December 17 and January 29, Ethereum is about to print decrease lows on value. Throughout the identical interval, the Relative Power Index (RSI) held close to 37. RSI measures whether or not consumers or sellers management momentum.

When the worth falls, however the RSI doesn’t, promoting strain is weakening. This creates early bullish divergence.

If the following ETH value candle holds above $2,690 and RSI stabilizes, reversal odds enhance as a decrease low on value is confirmed. However affirmation continues to be lacking. That makes on-chain information vital.

Sponsored

Sponsored

On-Chain Knowledge Helps a Rebound, however Conviction Is Fading

On-chain metrics present the primary main validation take a look at. One key indicator is Web Unrealized Revenue/Loss (NUPL). NUPL measures paper earnings/losses.

Ethereum’s NUPL presently sits close to 0.19, inserting it within the “hope–concern” zone.

This stage is necessary traditionally. In June 2025, NUPL fell close to 0.17, whereas ETH traded round $2,200. Over the next month, the worth surged towards $4,800, a acquire of greater than 110%.

So NUPL aligns with what the wedge and RSI are suggesting. Promoting strain is easing. Unrealized earnings are shrinking. That creates room for upside.

However the sign is incomplete. True market bottoms normally happen when NUPL turns destructive. In April 2025, it dropped close to −0.22, marking full capitulation.

As we speak’s studying stays far above that, which suggests extra promoting room stays. This means reduction rallies, not cycle resets.

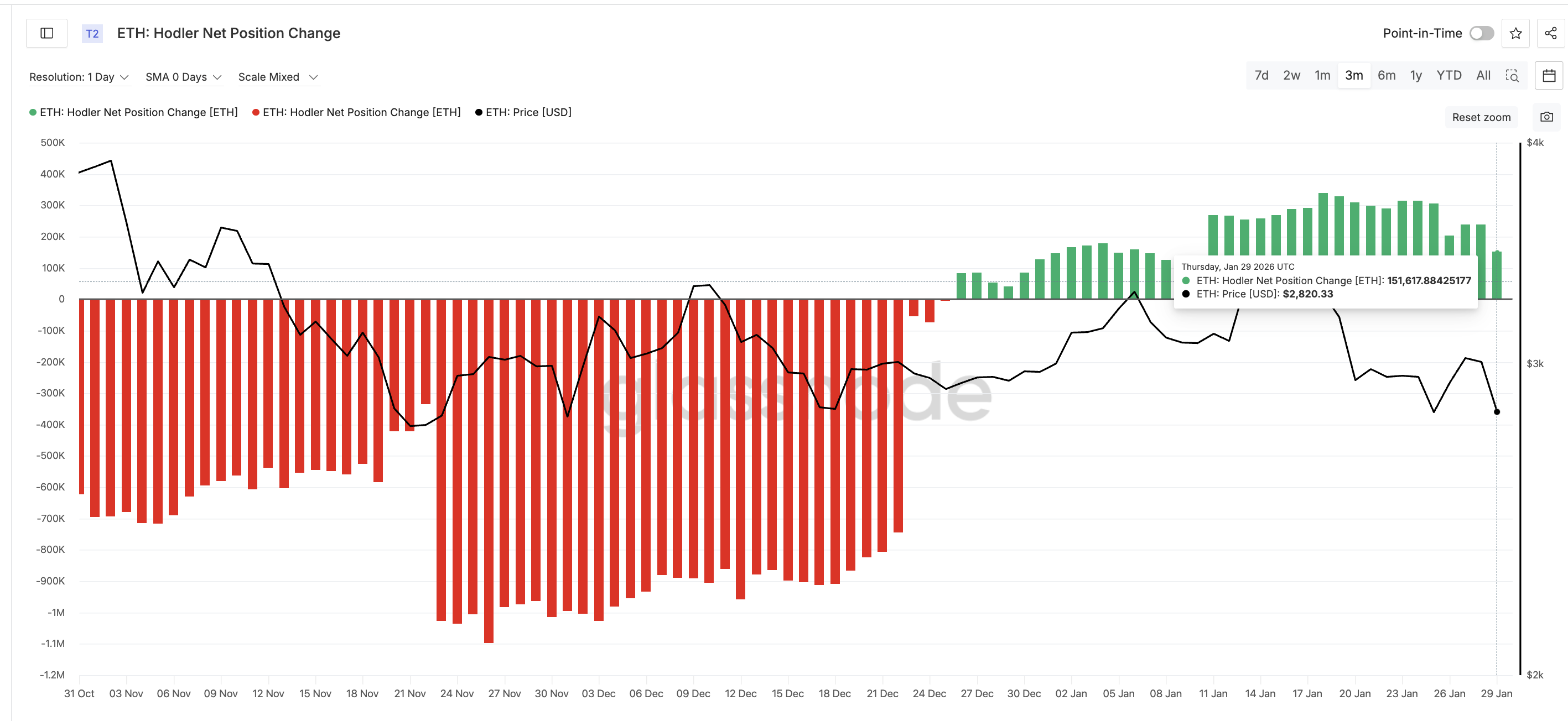

HODLer conduct reinforces this blended image. The Hodler Web Place Change metric tracks whether or not long-term buyers are accumulating or distributing. All through January, this metric stayed optimistic.

Accumulation peaked on January 18 at roughly 338,700 ETH. By January 29, it had dropped to round 151,600 ETH. That represents a decline of greater than 55%. So holders are nonetheless shopping for, however with far much less conviction.

This matches with how B2BINPAY analysts describe the broader market surroundings.

“Demand and provide are presently balanced: consumers are keen to purchase at roughly the identical ranges the place sellers are keen to promote….The market wants a transparent impulse both to the upside or to the draw back for the image to turn into clearer,” they stated.

Taken collectively, NUPL and holder exercise validate the rebound case, however present weakening conviction.

Sponsored

Sponsored

That shifts consideration to the following deciding group: massive cash!

Whales Are Accumulating, however ETFs Are Nonetheless Lacking

Giant holders are sending a stronger sign than institutional buyers.

Knowledge on provide held by whales exhibits regular January accumulation. In the beginning of the month, whales managed about 101.18 million ETH. By month-end, that determine had risen to roughly 105.16 million ETH.

That is a rise of practically 4 million ETH. This displays lively shopping for throughout weak spot.

Whereas value declined from mid-January highs, massive wallets continued including publicity. That helps the ETH rebound case advised by NUPL and the wedge.

This contrasts sharply with 2025.

On the finish of January 2025, whale holdings stood close to 105.22 million ETH. By the top of February, that determine had fallen to round 101.96 million ETH. That distribution coincided with Ethereum’s 32% February collapse. Final 12 months, whales bought. This 12 months, they’re accumulating.

Nevertheless, inconsistent ETF flows inform a extra cautious story. A number of sturdy influx days have been adopted by main outflows. Late January noticed withdrawals exceeding 70,000 ETH equivalents.

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto E-newsletter right here.

This implies ETFs haven’t joined the rebound commerce decisively.

Sponsored

Sponsored

John Murillo, Chief Enterprise Officer of B2BROKER, a worldwide fintech options supplier for monetary establishments, argues that January’s ETF conduct displays tactical positioning moderately than outright exit.

“The mid-January outflows from spot-ETH ETFs look much less like a structural exit and extra like tactical rebalancing. The late-month reversal, led by massive inflows into Constancy’s FETH, means that institutional conduct is more and more two-sided.

…Moderately than a wholesale discount of threat, flows seem fragmented throughout issuers,” he stated.

In Murillo’s view:

“January’s ETF dynamics level to maturation moderately than outright retreat,” he talked about.

Murillo warns that if this continues, derivatives might take management of value discovery, a key threat to cost:

“If Feruary brings uneven or subdued ETF flows whereas derivatives exercise continues to broaden, the steadiness of affect might shift from spot demand to leverage-driven value discovery.

February is more likely to take a look at whether or not Ethereum’s value is anchored extra by institutional spot allocation or by derivatives momentum,” he talked about.

For now, whales are optimistic. Establishments stay cautious. That mixture helps rebounds, however limits sustainability.

Ethereum Worth Ranges That Will Resolve February 2026

NUPL from earlier exhibits this isn’t a confirmed backside. Draw back threat stays.

The primary vital ETH value help sits close to $2,690.

This aligns with the latest two-day help and prior consolidation. A clear shut under $2,690 would sign sellers regaining management. That opens draw back towards $2,120.

On the upside, Ethereum should reclaim $3,000 first. That is each a psychological and structural barrier. Worth has repeatedly failed right here since December.

Holding above $3,000 would sign confidence returning.

Subsequent resistance stands close to $3,340. This stage has capped rallies since December 9. A breakout would mark a significant shift within the ETH value construction.

Above that, $3,520 turns into vital. A sustained break and maintain above $3,520 would affirm momentum restoration and open upside towards $4,030.