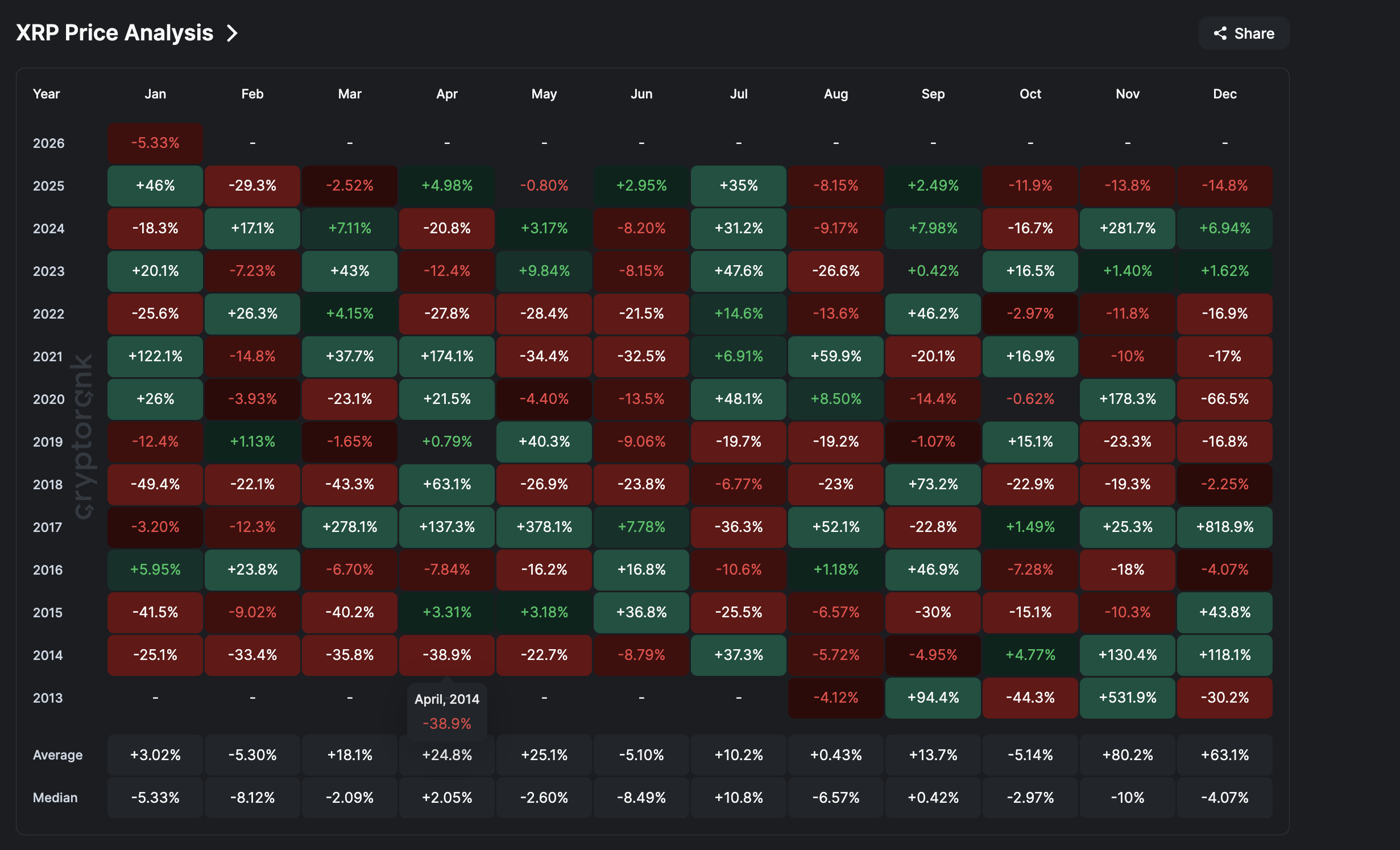

XRP is getting into February below strain. The token is down practically 7% previously 24 hours and about 5% over the previous month, reflecting rising weak point throughout the market. Traditionally, February has been a tough month for the XRP value. Information reveals its median February return stands at −8.12%, with a median decline of −5%. In 2025, the token fell by virtually 29% throughout the identical interval.

This yr, technical and on-chain indicators counsel comparable dangers are constructing. On the similar time, selective accumulation and early momentum indicators trace that restoration remains to be potential. Here’s what the info reveals.

Why the Worth Pullback Was Anticipated

XRP continues to commerce inside a long-term descending channel on the two-day chart. A falling channel is a bearish construction the place value makes decrease highs and decrease lows inside parallel trendlines.

Since mid-2025, this sample has stored rallies capped and pushed costs steadily decrease. As traditionally weak February approaches, XRP is drifting nearer to the channel’s decrease boundary, rising draw back danger.

Sponsored

Sponsored

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

Vasily Shilov, Chief Enterprise Growth Officer at SwapSpace, mentioned seasonal patterns nonetheless matter however are now not decisive on their very own.

“ETF flows are at present extra dependable directional drivers,” he defined.

“Vary-bound motion is the more than likely final result if macro readability doesn’t emerge,” he additionally added.

This technical weak point was not sudden, although.

Between October 2 and January 5, XRP shaped a decrease excessive in value, whereas the Relative Power Index (RSI) made a better excessive. RSI measures momentum, exhibiting whether or not shopping for or promoting strain is strengthening.

This mismatch is known as hidden bearish divergence. It typically indicators that upside energy is fading earlier than a correction begins. That sign flashed in early January and was adopted by a virtually 30% decline.

Now, a brand new setup is forming.

Between October 10 and January 29, the XRP value printed a decrease low (lively at press time) whereas RSI is trying to type a better low. This creates the idea for a bullish divergence, which may sign development exhaustion.

For this sign to substantiate:

- The subsequent 2-day XRP value candle should type above $1.71, confirming the decrease low value setup

- RSI should stay above 32.83

If each situations are met, draw back momentum weakens and rebound potential improves. In the event that they fail, the bearish channel stays in management.

Sponsored

Sponsored

Cash Circulate And Whale Exercise Present Blended Alerts

Whereas the XRP value developments decrease, capital circulation information paints a extra complicated image.

The Chaikin Cash Circulate (CMF), which tracks institutional and large-wallet shopping for strain, has been rising between January 5 and January 25, whilst the value fell. This kinds a bullish divergence.

It means that bigger, probably institutional gamers have been accumulating XRP quietly in the course of the pullback.

ETF circulation information helps this development. Though January’s total ETF flows stay internet damaging resulting from heavy outflows on January 21, internet inflows have improved steadily towards the month-end. Latest inexperienced bars present renewed curiosity from institutional channels.

Shilov mentioned that January’s ETF volatility displays broader macro warning moderately than structural weak point in XRP demand.

He defined that whereas macro pressures pushed buyers towards safer belongings like gold and silver, XRP spot ETFs have nonetheless attracted greater than $1.3 billion in whole inflows since launch and haven’t recorded a month of internet redemptions.

“The size and persistence of inflows counsel a development reversal is unlikely for now,” he talked about

Nevertheless, this optimism is being challenged by trade information.

XRP’s trade circulation stability has flipped sharply greater since January 17, shifting from −7.64 million to +3.78 million. Extra regarding is the sample.

Sponsored

Sponsored

Three consecutive influx peaks appeared on January 25, 27, and 29. The same construction shaped earlier this month on January 4, 8, and 13. After that, XRP fell from $2.10 to $1.73, a drop of about 18%. This makes the present influx construction a transparent danger sign regardless of ETF optimism.

Shilov added that ETF demand alone remains to be not robust sufficient to totally isolate XRP from broader market forces. Primarily based on SwapSpace buying and selling information, he mentioned XRP’s short-term strikes proceed to trace Bitcoin’s development and macro danger sentiment when ETF flows flip unstable.

“BTC’s path, macro stress, and derivatives positioning are prone to dictate danger urge for food within the close to time period,” he famous.

XRP Whales Current An Fascinating Perspective

Whale habits provides one other layer.

Wallets holding over 1 billion XRP have been steadily accumulating since early January, when the value correction began. Their holdings elevated from 23.35 billion to 23.49 billion XRP, representing important capital deployment throughout weak point.

In contrast to final yr, when mega whales waited till late February to purchase, they’re constructing positions earlier this cycle. This reduces the chance of a deep collapse however doesn’t take away short-term draw back danger.

Shilov cautioned that large-holder accumulation should be seen in context. He mentioned present patterns resemble tactical positioning moderately than agency conviction.

“Regular accumulation should persist alongside secure ETF inflows,” he mentioned.

“In any other case, shopping for can dry up shortly if macro strain will increase.”

Sponsored

Sponsored

The indicators are conflicting, which explains the 5% dip in January and never one thing as aggressive as close to 15% in December 2025.

Key Assist Ranges, Draw back Dangers, and XRP Worth Restoration Eventualities

The XRP value construction now makes the crucial ranges clear. The primary zone XRP should defend is $1.71–$1.69. A two-day shut beneath this space would weaken the channel assist and open room for a bigger breakdown.

If this occurs, the following main assist sits close to $1.46. A sustained transfer beneath $1.46 might set off accelerated promoting and expose XRP to deeper declines towards $1.24.

This situation turns into extra seemingly if trade inflows proceed rising and ETF demand fails to strengthen.

On the upside, restoration hinges on one stage. XRP should reclaim $1.97 on a two-day closing foundation. This could signify a breakout above short-term resistance and sign that consumers are regaining management. This XRP stage was highlighted yesterday by BeInCrypto analysts.

A confirmed transfer above $1.97 might open the trail towards $2.41, which aligns with key Fibonacci and channel resistance ranges.

Trying forward, Shilov mentioned the strongest affirmation of a bullish breakout can be a return of sustained ETF inflows just like November’s launch interval.

“Weekly inflows between $80 million and $200 million would construct robust momentum above $2.10,” he mentioned.

He additionally hinted at a potential breakdown stage, which aligns completely with our evaluation:

“Additional deterioration in international geopolitical or macro situations might worsen the XRP dip and push the asset beneath $1.70,” he highlighted.

The battle now facilities on $1.69 assist and $1.97 resistance. Whichever breaks first is prone to outline the XRP value path for the remainder of February.