The XRP worth was caught within the newest crypto market-wide selloff, falling to an intraday low of $1.57 throughout the previous 24 hours. The sudden drop brings into focus XRP’s higher-timeframe construction, which is teasing a break under the 33-month exponential shifting common.

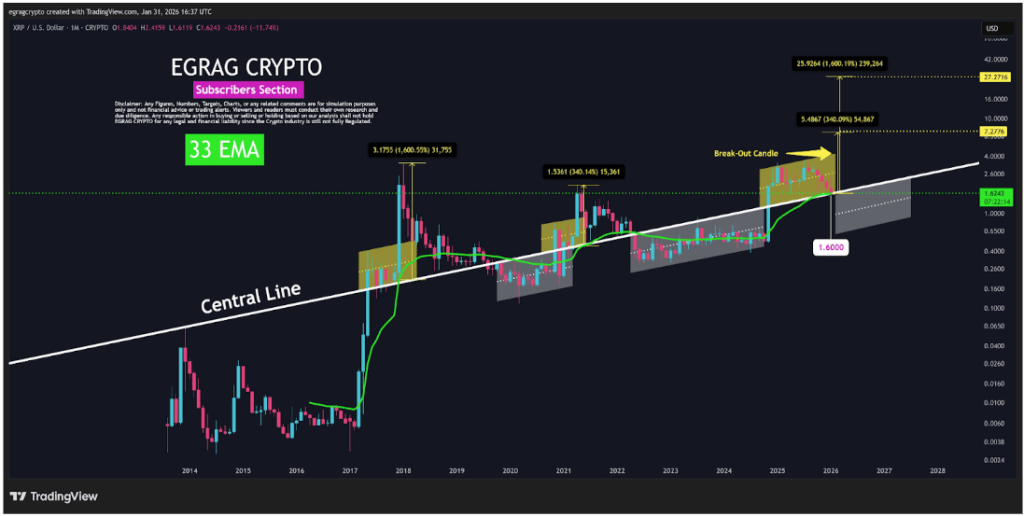

In response to a technical evaluation shared on X by crypto analyst Egrag Crypto, the current drop under the 33-month exponential shifting common doesn’t routinely sign the top of XRP’s cycle, however XRP should shut above an actual stage to keep away from a macro bearish affirmation.

Associated Studying

The 33 EMA Breakdown Sign

On the time of writing, XRP is again to buying and selling round $1.65, stabilizing after a unstable few hours that pressured many merchants to reassess the broader construction. Nonetheless, based on technical evaluation by Egrag Crypto, the latest crash noticed XRP breaking a bit under the 33 EMA on the month-to-month candlestick timeframe chart.

Egrag based mostly the current worth motion round one essential situation: a confirmed month-to-month shut under $1.60 and the 33 EMA. In response to the analyst, such an in depth would mark a macro bearish affirmation based mostly on historic construction, not sentiment or opinion.

The chart he shared highlights how XRP has revered the 33 EMA as a long-term development reference throughout a number of cycles, with violations usually previous prolonged corrective phases. As proven within the chart under, the XRP worth has been buying and selling above the 33-EMA since early 2025, even in periods of corrections. Nonetheless, XRP is now buying and selling dangerously near this EMA, and there’s now a threat of a breakdown.

XRP Value Chart. Supply: @egragcrypto On X

What This Means For XRP’s Value Construction

There’s a threat that XRP can transition right into a macro bear construction. On the similar time, there’s sufficient motive to recommend an upside bounce for the cryptocurrency. A significant level in Egrag’s evaluation is historic efficiency that reveals XRP’s strongest upside expansions didn’t require a clear bull-market setting.

Due to this fact, there are two historic analogs of how XRP can play out from its present vary round $1.60. The primary is a repeat of the 2021-style transfer. This transfer, measured from comparable structural circumstances, would indicate an upside enlargement of roughly 340% with a worth goal across the $7 area.

The second is a repeat of the 2017 cycle. Comparability to the 2017 cycle initiatives a a lot bigger structural enlargement of about 1,600%, which might align with the $27 zone highlighted on the chart above. In each circumstances, the rallies originated from oversold circumstances and compression ranges, not from a robust bullish macro affirmation like many would count on.

Associated Studying

In response to the evaluation, a breakdown under $1.60 might nonetheless result in panic promoting and reinforce worry narratives of a macro bear market, but those self same circumstances have beforehand been the zones the place late sellers exit simply earlier than volatility expands upward.

Featured picture from Unsplash, chart from TradingView