After 4 straight weekly losses, market focus is on Bitcoin value at this time because it trades slightly below key short-term averages and close to a fragile assist space.

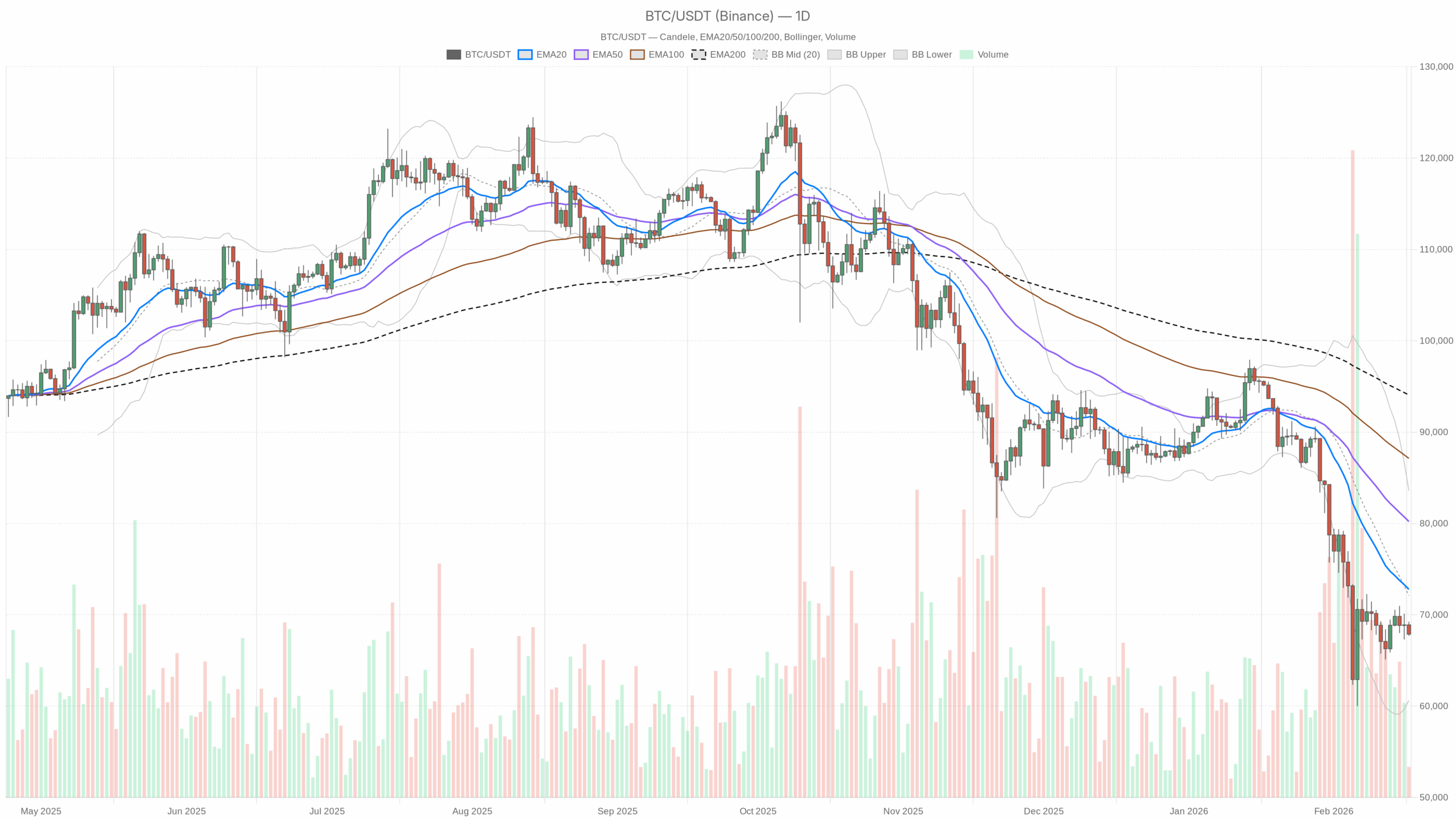

Day by day Chart (D1): Major Bias – Bearish, however Late within the Transfer

Pattern Construction: EMAs

Knowledge:

– Value (shut): $67,874

– EMA 20: $72,785

– EMA 50: $80,211

– EMA 200: $94,063

– Regime flag: bearish

All the important thing EMAs are stacked above spot value and fanned out bearishly (20 < 50 < 200, with value under all of them). That may be a basic, established downtrend construction, not the start of 1. The hole between spot and the quick EMA (about $5k beneath the 20-day) additionally reveals we're stretched from imply reversion already.

Translation: The pattern is down, however we aren’t early shorts anymore. That is the middle-to-late stage of a corrective leg the place chasing recent draw back will get progressively riskier except momentum re-accelerates.

Momentum and Exhaustion: RSI (14)

Knowledge: RSI 14 on D1: 34.8

Day by day RSI has pushed into the low 30s however has not hit textbook oversold but. It’s clearly under the midline, so bears nonetheless management momentum. Nevertheless, the indicator is now within the zone the place prior selloffs have usually began to lose steam or not less than transfer into uneven consolidation.

Translation: Sellers nonetheless have the higher hand, however the threat/reward of recent aggressive shorts on the each day is getting worse. That is the place pattern followers are normally affected person and await both a bounce to promote or a capitulation flush to fade, quite than promoting blindly.

Pattern Momentum: MACD

Knowledge:

– MACD line: -4,729.8

– Sign: -5,084.3

– Histogram: +354.5

MACD is deep in damaging territory, which is what you count on after a big drawdown, however the histogram has turned constructive because the MACD line begins to curve again towards the sign line. That doesn’t imply the pattern is bullish. As a substitute, it means the charge of draw back is slowing and the downtrend is growing old.

Translation: The dominant pattern remains to be down, however the promoting wave is not accelerating. Bears are in management, however they aren’t hitting with the identical depth. This opens the door to a reduction rally or sideways base if consumers present up.

Volatility and Vary: Bollinger Bands & ATR

Bollinger Bands (20):

– Mid band: $72,101

– Higher band: $83,571

– Decrease band: $60,631

– Value: close to the decrease half of the band set

Value is buying and selling properly under the mid-band and within the decrease half of the Bollinger vary, however not hugging the decrease band itself. That’s in keeping with a downtrend that has already made a major transfer and is now oscillating close to the decrease facet quite than freshly breaking.

Translation: The market remains to be priced pessimistically however not in outright panic at this second. There may be room each to tag the decrease band nearer to $60.6k in a last flush or to mean-revert towards the mid-band round $72k if worry cools off.

ATR (14): $4,365 on the each day chart.

Day by day ATR north of $4k alerts elevated realized volatility. This isn’t the quiet, grinding bull market sort of tape. As a substitute, it’s a heavier, two-sided enviornment the place intraday swings of a number of thousand {dollars} are regular.

Translation: Place sizing and leverage matter rather a lot right here. Even if you’re directionally proper, being outsized right into a $4k each day buying and selling vary can knock you out earlier than the transfer performs out.

Day by day Pivots: Close to-Time period Battle Traces

Knowledge:

– Pivot level (PP): $68,269

– Resistance 1 (R1): $68,847

– Assist 1 (S1): $67,296

– Value: $67,874

Bitcoin is buying and selling simply beneath the each day pivot, sandwiched between PP and S1. That pins us in a delicate stability space: barely under the middle of gravity for the session, however not but on the first assist.

Translation: Bears have a marginal intraday edge on the each day map, however we aren’t in breakdown territory. A push again above the PP after which R1 can be the primary signal that consumers are keen to contest this downtrend, not less than within the quick run.

Hourly Chart (H1): Quick-Time period Circulation – Bearish however Tightening

Pattern and Construction: EMAs on H1

Knowledge:

– Value: $67,872

– EMA 20: $68,344

– EMA 50: $68,588

– EMA 200: $68,849

– Regime flag: bearish

On the 1-hour, value is buying and selling slightly below all three EMAs, and people averages are tightly clustered. The regime flag is bearish, however with EMAs so compressed, it appears extra like a short-term downtrend that’s coming into a consolidation band than an explosive new leg decrease.

Translation: Momentum sellers nonetheless management the intraday path, however the market is beginning to transfer sideways beneath resistance quite than cascading decrease. That’s normally a prelude to both a breakdown continuation or a squeeze increased. The EMAs themselves are usually not telling us which but, solely that the tape is coiling.

H1 Momentum: RSI & MACD

RSI 14 (H1): 40.3

RSI on the hourly is under the midline however not oversold. Promoting strain exists, however it’s managed, not panicky. There may be room for yet one more push decrease earlier than we hit ranges the place intraday dip consumers have a tendency to point out up.

MACD (H1):

– MACD line: -171.97

– Sign: -118.25

– Histogram: -53.72

MACD is damaging and the histogram can also be mildly damaging, pointing to ongoing bearish intraday momentum. Nevertheless, the magnitude right here is modest. We’re not seeing the type of massive, increasing damaging bars that accompany liquidation-style strikes.

Translation: Intraday, bears are in cost however they’re strolling, not sprinting. That is the type of atmosphere the place trend-following shorts nonetheless work, however they’re extra weak to sudden squeezes if information or flows flip.

H1 Volatility and Ranges: Bollinger Bands, ATR, Pivots

Bollinger Bands (H1):

– Mid: $68,342

– Higher: $69,070

– Decrease: $67,614

– Value: simply above the decrease band

Value is skimming the decrease band on the hourly, however not in a sustained band-walk. That usually aligns with a managed drift decrease quite than capitulation.

ATR 14 (H1): $419

Hourly ATR round $400 factors to first rate intraday buying and selling ranges, however not chaos. That traces up with the image of a gentle grind down quite than a vertical crash.

Pivots (H1):

– PP: $67,832

– R1: $67,975

– S1: $67,729

– Value: $67,872

On the 1-hour grid, BTC is sitting nearly precisely on the pivot, barely above it. R1 and S1 are tight, reflecting a compressed intraday vary.

Translation: The market is in a short-term choice zone. If value holds above the H1 pivot and pushes via R1, we will simply see a squeeze again towards the compressed EMAs round $68.3–68.8k. Lose S1, and the drift decrease doubtless resumes towards the decrease Bollinger band area.

Translation: The market is in a short-term choice zone. If value holds above the H1 pivot and pushes via R1, we will simply see a squeeze again towards the compressed EMAs round $68.3–68.8k. Lose S1, and the drift decrease doubtless resumes towards the decrease Bollinger band area.

15-Minute Chart (M15): Execution Context – Micro Bear Bias, Very Near Ranges

Quick-Time period Pattern: EMAs and Regime

Knowledge:

– Value: $67,872

– EMA 20: $68,087

– EMA 50: $68,283

– EMA 200: $68,692

– Regime: bearish

On quarter-hour, the EMAs are once more stacked above value and aligned bearishly, however distances are tight. It is a native downtrend grinding slightly below short-term resistance, not a freefall.

Translation: For lively merchants, rallies again into the 20/50 EMA band on M15 are nonetheless getting bought, however we’re shut sufficient {that a} minor push can flip the very quick time period from clear pattern to cut.

Micro Momentum: RSI & MACD

RSI 14 (M15): 35.6

RSI on the 15-minute sits within the mid-30s: weak however not totally washed out. It confirms that the very short-term tape favors the draw back, but nonetheless has room for a quick spike decrease earlier than intraday exhaustion kicks in.

MACD (M15):

– MACD line: -155.21

– Sign: -138.15

– Histogram: -17.06

MACD stays damaging with a small damaging histogram: the micro-trend remains to be down, however there isn’t a sturdy acceleration.

Translation: On the execution layer, bears nonetheless have the initiative, however they aren’t urgent laborious. That sometimes favors tactical fades at resistance quite than momentum breakout trades except one thing exterior modifications.

Quick-Time period Volatility and Ranges: Bands, ATR, Pivots

Bollinger Bands (M15):

– Mid: $68,125

– Higher: $68,526

– Decrease: $67,725

– Value: between decrease band and mid-band

Value is leaning to the decrease half of the band set on 15m, in keeping with a delicate, ongoing promote bias.

ATR 14 (M15): $169

Round $170 of anticipated 15-minute vary retains issues tradable intraday however not frantic. You might be improper by just a few dozen {dollars} with out immediately getting stopped out, however tight stops will nonetheless be weak.

Pivots (M15):

– PP: $67,886

– R1: $67,902

– S1: $67,855

– Value: $67,872

We’re basically sitting proper on the 15-minute pivot, inside a really slim intraday band.

Translation: Very quick time period, BTC is coiling. The following $100 transfer will doubtless determine whether or not we get a neighborhood pop towards the quick EMAs or one other leg down towards the decrease Bollinger band.

Macro Context: Dominance, Market Breadth, and Sentiment

Bitcoin dominance stands at ~56.4%, elevated by current requirements. When BTC dominance climbs whereas whole crypto market cap falls (~-0.8% over 24h and volumes down ~12%), it normally means capital is hiding in Bitcoin relative to alts, even because it exits the house general. That is basic defensive rotation.

The Worry & Greed Index studying of 10 (Excessive Worry) captures the temper: the market is scared, positioning is cautious, and narratives are targeted on draw back threat. For instance, we see headlines about $60k liquidation triggers and historic drawdowns presumably extending. Traditionally, excessive worry ranges usually coincide with late-stage down strikes or consolidation zones, however they don’t assure a direct reversal, as a result of worry can persist.

DeFi price income dropping sharply throughout main DEXs confirms that on-chain speculative exercise is cooling. Fewer trades, smaller bets, and decrease leverage urge for food sometimes weigh on altcoins greater than BTC, which inserts with the rising dominance story.

Placing It Collectively: Conflicting Alerts and Core Eventualities

Timeframes are broadly aligned: each day, hourly, and 15-minute all present a bearish regime. The battle isn’t between timeframes, it’s between pattern vs. exhaustion:

- The pattern is clearly down: value under all key EMAs on all frames, damaging MACD throughout the board, RSI under 50 in every single place.

- Exhaustion indicators are rising: each day RSI within the mid-30s, MACD histogram bettering on D1, value not hugging decrease Bollinger bands, and sentiment deeply fearful.

So the essential state of affairs proper now remains to be bearish on the each day, however it’s not a recent, high-conviction quick atmosphere. It’s a market the place the draw back thesis is more and more depending on both a brand new catalyst or a break of well-known assist ranges, notably the extensively watched $60k zone.

Clear Bullish State of affairs

For a correct bullish case to develop from right here, we would want to see pattern restore quite than only a dead-cat bounce.

Key steps for the bull facet:

- Maintain above the decrease Bollinger band on D1 (roughly >$60.6k) and keep away from a panic wick that closes deep under it. That may affirm that the present leg decrease is dropping power.

- Reclaim and maintain above the each day pivot (>$68.3k) after which flip the $72k mid-Bollinger/EMA-20 zone from resistance into assist. A each day shut above ~$72k can be the primary severe signal of a shift from pure trend-following promote strain to mean-reversion consumers taking management.

- On intraday frames, value should reclaim and experience above the 20/50 EMAs on H1 and M15, turning these from capping resistance into dynamic assist.

- RSI on D1 pushing again above 50 and MACD closing in on a bullish crossover would affirm not only a bounce, however a transition towards a neutral-to-bullish momentum regime.

If this performs out: A constructive upside path can be a transfer from todays ~$68k towards the $72–75k band, which is the each day mid-band and quick EMA cluster, adopted by a battle there. If bulls handle to ascertain a base above that zone, a medium-term goal towards the higher Bollinger band (~$83k) comes again into view.

What invalidates the bullish state of affairs?

A decisive break and each day shut under ~$60k, particularly if it comes with a spike in ATR and 15m/1h candles hugging or piercing the decrease Bollinger bands. That may sign renewed, aggressive liquidation and reset the bullish timeline solely, opening the door to a deeper corrective part.

Clear Bearish State of affairs

The bearish state of affairs is an extension of the present downtrend, with the market shifting from managed grind to renewed acceleration.

What bears need to see:

- Failure at or under the each day pivot and EMA-20 zone. If value repeatedly will get rejected within the $68–72k band and can’t shut above it, that retains the pattern construction firmly bearish.

- On H1 and M15, retests of the 20/50 EMAs that roll over, with native highs making decrease highs, reinforcing that each bounce is being bought.

- Day by day RSI staying pinned under 40 and turning again down, whereas the MACD histogram stalls in its restoration and begins increasing damaging once more. That may present that the slowdown in promoting was only a pause.

- A break under the decrease Bollinger band zone towards $60–61k, ideally accompanied by a spike in ATR (volatility growth), marking a capitulation-like extension of the downtrend.

If this performs out: The primary apparent draw back magnet is the $60k area, which information circulation is already framing as a key liquidation set off. A clear break there dangers a liquidation cascade that would simply push value into the mid-to-high $50ks, the place longer-term contributors must reassess their threat.

What invalidates the bearish state of affairs?

A sustained reclaim of $72k+ on a each day closing foundation, with value holding above the each day 20 EMA and turning it into assist. If that’s accompanied by each day RSI again above 50 and H1 EMAs flipping right into a bullish alignment (value > 20 > 50 > 200), the present bearish thesis begins to interrupt down.

Positioning, Danger, and Easy methods to Assume About This Tape

Bitcoin value at this time is in a late-stage downtrend with excessive worry and rising, however not frantic, volatility. Pattern followers are nonetheless in charge of the upper timeframe, however they’re not early. The simple a part of the transfer is probably going behind us. Imply-reversion merchants, then again, are beginning to watch carefully for indicators of vendor exhaustion, however they haven’t been totally rewarded but.

If you’re eager about positioning, the secret is recognizing that uncertainty is excessive on each side:

- Chasing draw back right here depends on a wager that the $60k space will fail and unleash recent liquidations, regardless of already stretched sentiment and distance from long-term averages.

- Fading the pattern depends on a wager that worry has overshot and that consumers will defend the present zone, despite the fact that the each day construction remains to be unambiguously bearish.

Whichever facet you lean towards, the mix of a each day ATR round $4,365 and intraday ATRs of a number of hundred {dollars} calls for tighter threat controls, smaller sizing, and a willingness to just accept being early or improper. The market can keep fearful longer than most merchants can keep solvent, and powerful developments don’t reverse cleanly on the primary try.

For now, the scoreboard is easy: bears nonetheless lead on construction, bulls are solely simply beginning to present up on exhaustion alerts. Till one facet pushes value decisively out of this $60–72k band, count on volatility, noise, and loads of entice potential for anybody overconfident in a single final result.