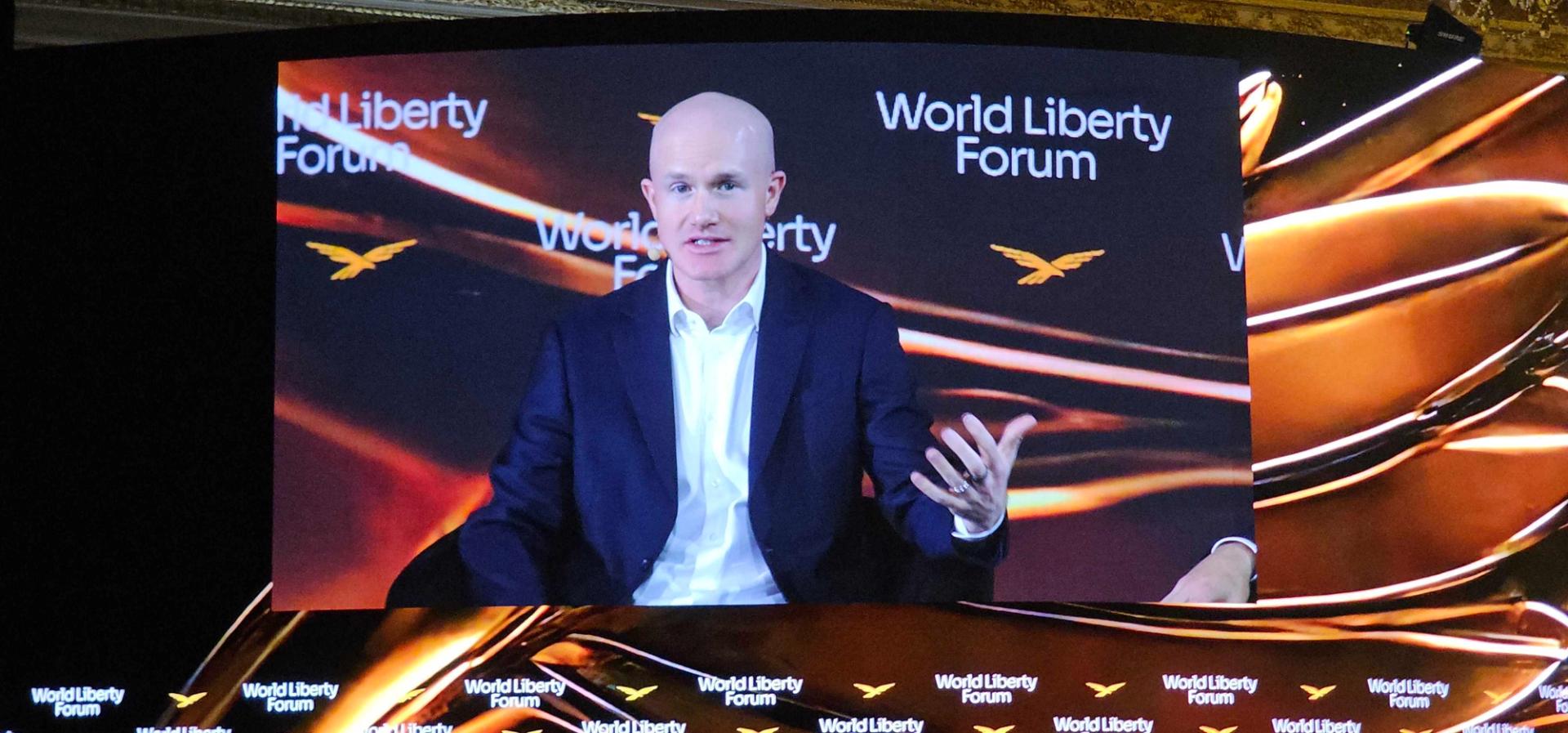

PALM BEACH, Fla. — Banking commerce teams, moderately than particular person banks, are mainly accountable for stalled negotiations on crypto market construction laws, Coinbase CEO Brian Armstrong stated.

Banks themselves are taking a look at crypto as a chance, he stated Wednesday on the World Liberty Discussion board hosted at Mar-a-Lago.

“For no matter cause, generally incumbent industries have commerce teams, and so they view the world with a zero-sum mindset [where they believe] for the banks to win, crypto has to lose,” he stated. “They are not viewing this as a optimistic [step].”

Banking commerce teams have represented the business in conferences with the crypto business hosted by the White Home because the Senate Banking Committee’s push to advance market construction laws final month fell aside. The newest such assembly, which passed off final week, noticed the banking business holding the road on its calls for that the invoice block stablecoin rewards.

The subsequent assembly is about to happen Thursday morning, people conversant in the plan advised CoinDesk.

Learn extra: Crypto’s banker adversaries did not need to deal in newest White Home assembly on invoice

Armstrong stated he did anticipate some type of compromise the place banks would have new advantages underneath a recent draft market construction invoice, although he didn’t elaborate. When the Digital Asset Market Readability Act stalled the night time earlier than a Senate Banking Committee listening to, it was after Armstrong publicly withdrew his firm’s assist.

Within the present talks, the Coinbase co-founder argued that particular person small and medium-sized banks didn’t actually worry deposit flight to stablecoin issuers, however moderately stated their extra pressing issues have been with deposit flight to bigger banks.

Main banks are leaning into crypto as effectively, he stated, including that Coinbase is supporting crypto infrastructure for “5 of the most important banks on this planet.”

Different banks are hiring for blockchain or crypto-focused staff on LinkedIn.

“We now stay on this world the place we now have regulated U.S. stablecoins with rewards,” he stated. “It’s a must to settle for that as a actuality and determine if you wish to deal with that as a chance or as a menace.”