Coinbase lately launched a report outlining its predictions for the cryptocurrency market in 2025. The report focuses on key areas resembling stablecoins, tokenization, ETFs, DeFi, and regulatory developments.

Experiences from different business gamers additionally recommend a constructive outlook for the crypto market in 2025.

A Favorable Regulatory Surroundings Will Drive Market Progress

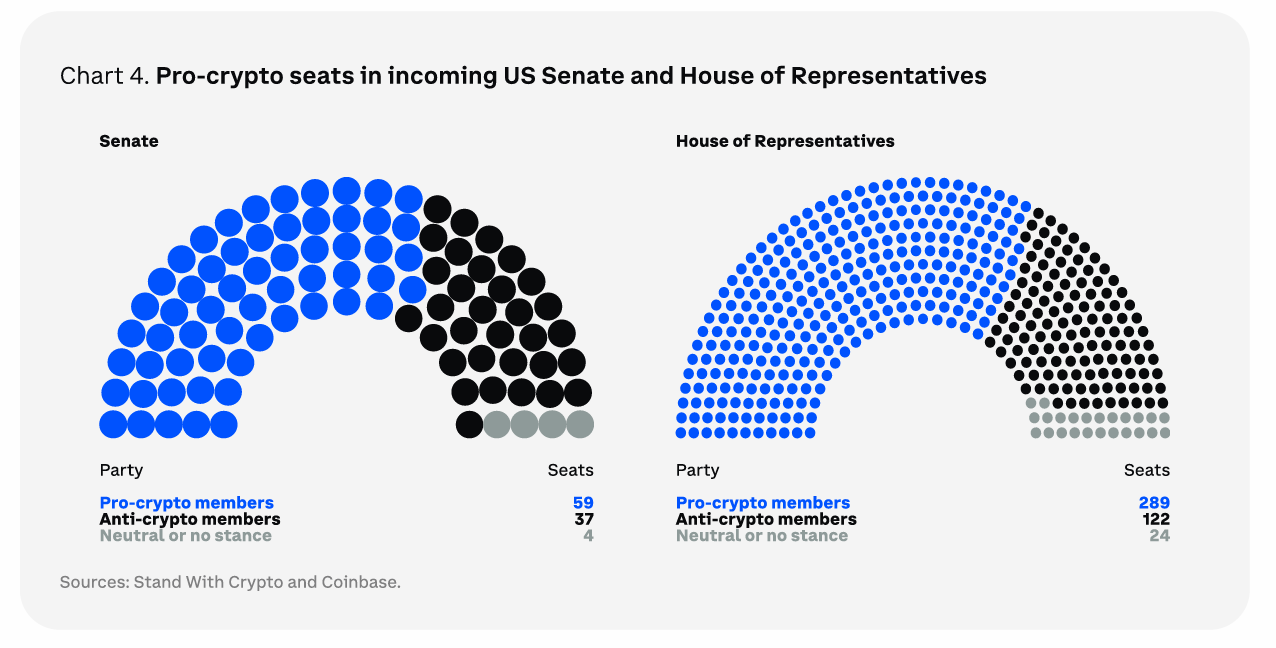

The primary main prediction highlights that regulatory modifications will profit the general crypto market. Coinbase refers back to the incoming US Congress as “The Most Professional-Crypto US Congress … Ever.” Amongst potential developments, the institution of a Strategic Bitcoin Reserve may develop into a actuality.

Notably, pro-crypto actions are usually not restricted to the US; areas resembling Europe, the G20, the UK, the UAE, Hong Kong, and Singapore are actively growing rules to help digital belongings.

Binance CEO Richard Teng additionally predicts that regulatory modifications within the US will act as a progress catalyst in 2025, with different international locations prone to observe swimsuit.

Constructive Developments for Crypto ETFs

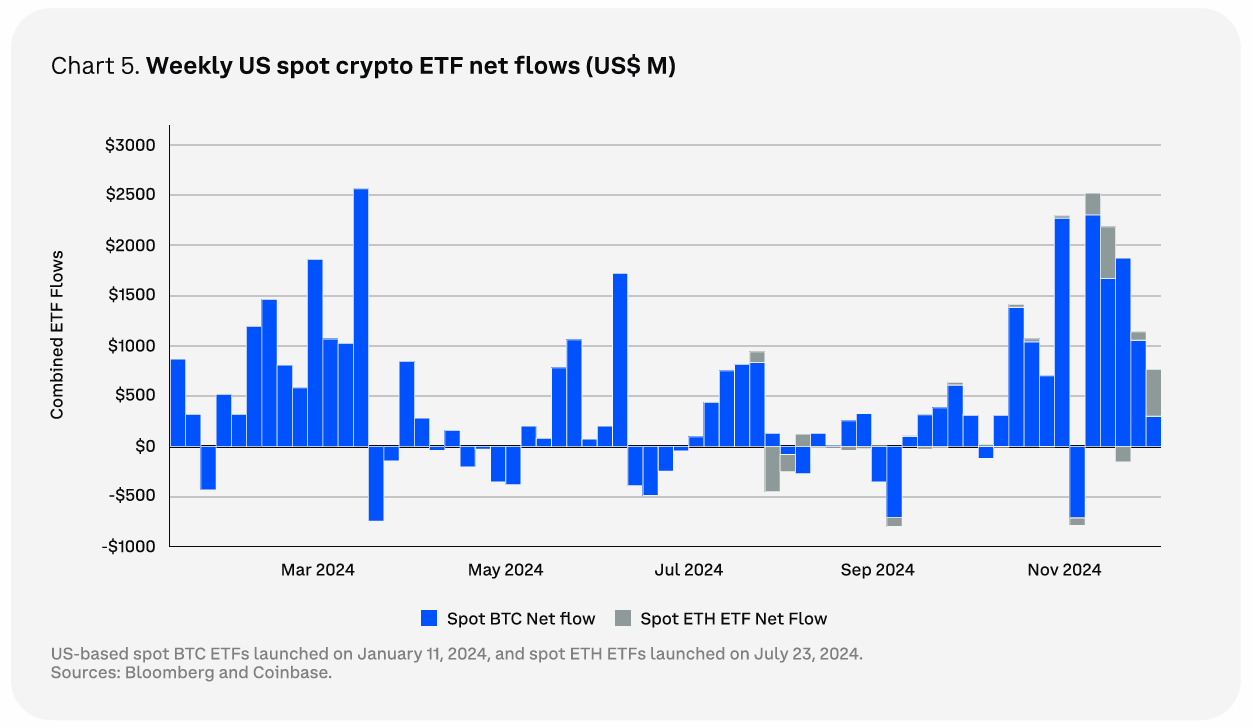

Coinbase highlights the importance of Bitcoin and Ethereum ETFs in attracting new capital. Knowledge reveals that internet inflows have reached $30.7 billion since their introduction.

The report additionally means that ETFs linked to belongings like XRP, SOL, LTC, and HBAR may achieve approval, though their advantages could possibly be short-term.

Crucially, Coinbase speculates that the SEC might approve staking in ETFs or eradicate the requirement for creating and redeeming ETF shares in money, probably broadening the ETF market. SEC Commissioner Hester Peirce has hinted that these developments may happen “early on.”

International Adoption of Stablecoins

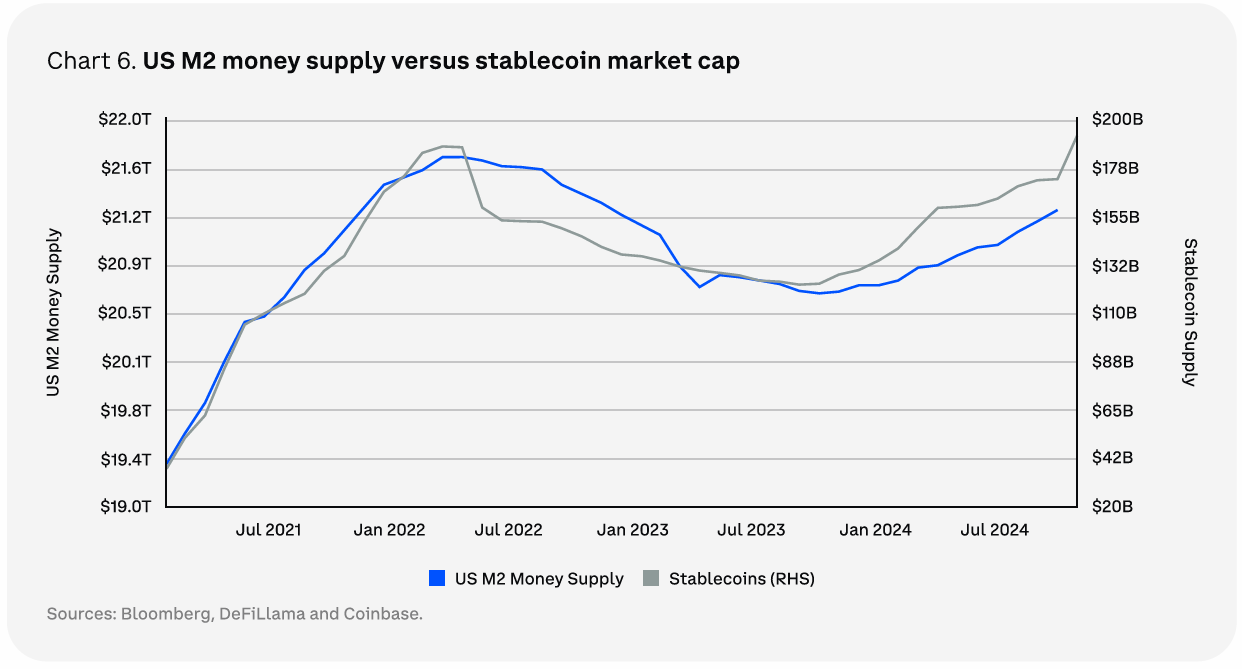

Coinbase tasks a extremely optimistic situation for the adoption of stablecoins. With a market capitalization exceeding $190 billion, stablecoins presently account for 0.9% of the US M2 cash provide.

The report anticipates stablecoins may develop to comprise 14% of the $21 trillion US M2 provide, pushed by their velocity and value effectivity in comparison with conventional strategies.

“Certainly, we might very properly be getting nearer to the day when the primary and first use circumstances for stablecoins received’t simply be buying and selling however slightly international capital flows and commerce.” Coinbase predicted.

Tokenization to Thrive Amid Regulatory Challenges

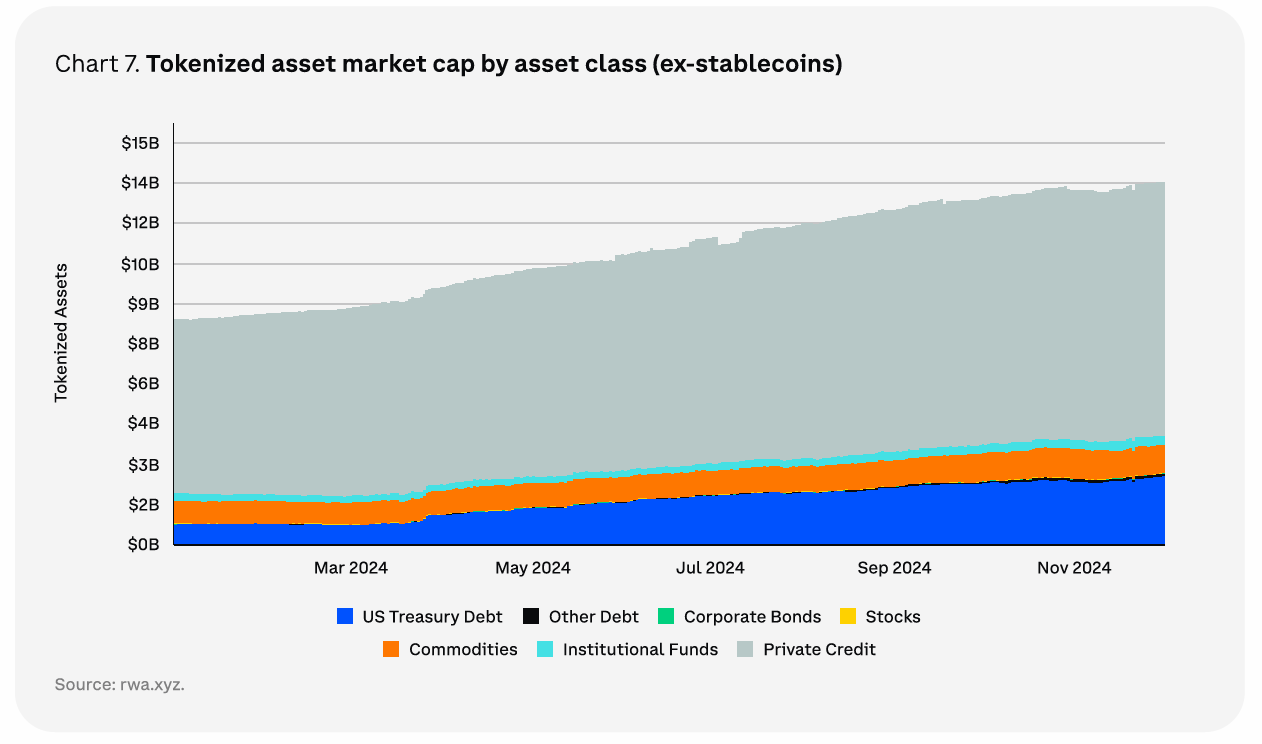

Coinbase expects tokenized belongings to expertise continued progress in 2025. The capitalization of tokenized real-world belongings (RWA) has grown over 60% previously yr, reaching practically $14 billion.

Estimates recommend that RWA capitalization may improve by at the very least $2 trillion over the following 5 years, bolstered by conventional monetary giants like BlackRock and Franklin Templeton.

The tokenization development extends past conventional belongings resembling US Treasury bonds and cash market funds to areas like non-public credit score, commodities, company bonds, actual property, and insurance coverage.

“Finally, we predict tokenization can streamline the whole portfolio building and investing course of by bringing it onchain, though this may increasingly but be a number of years away. In fact, these efforts face their very own set of distinctive challenges, together with liquidity fragmentation throughout a number of chains and chronic regulatory hurdles.” Coinbase predicted.

A Messari report echoes these sentiments, forecasting that Bitcoin and tokenized RWAs will dominate 2025 discussions.

DeFi to Rebound in 2025

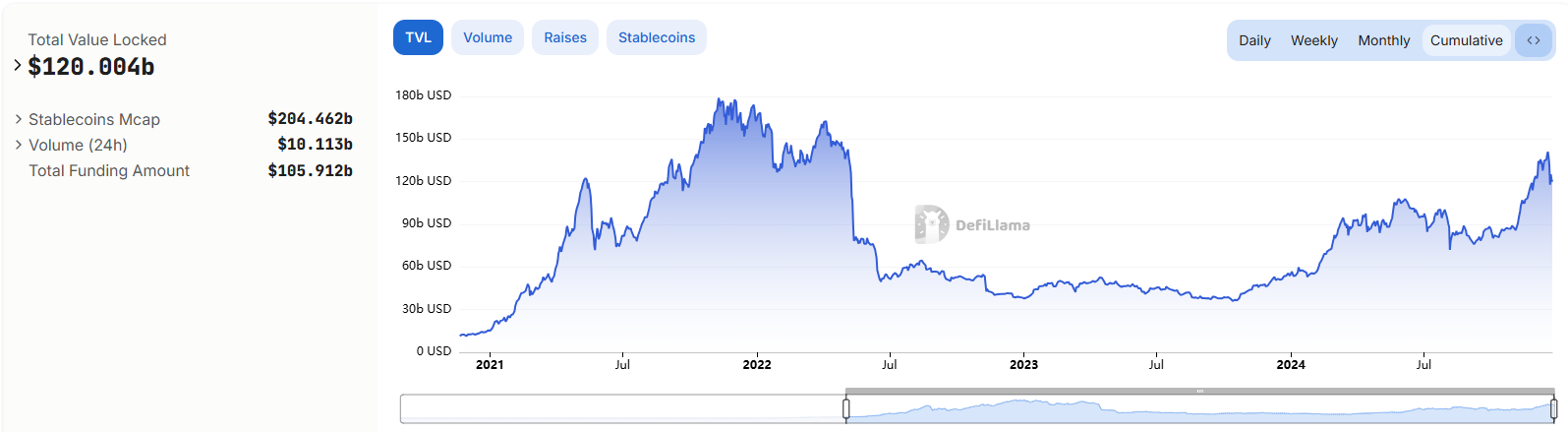

Regardless of the market’s peak capitalization exceeding $3.7 trillion, DeFi’s complete worth locked (TVL) has but to reclaim its earlier excessive of $200 billion; it presently stands at $120 billion.

Coinbase argues that DeFi confronted important challenges within the final cycle, as many protocols supplied unsustainable yields. Nevertheless, regulatory modifications within the US may enable DeFi protocols to share income with token holders, fostering a revival.

The report additionally references feedback by Federal Reserve Governor Christopher Waller, who said that DeFi may complement centralized finance (CeFi) with distributed ledger know-how (DLT), enhancing knowledge storage effectivity.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.