- MSTR is in a high-stakes gamble that might have profound penalties for each the corporate and Bitcoin’s future.

- Common monitoring of MSTR’s steadiness sheet has by no means been extra essential.

“My aim is to purchase extra Bitcoin.”

MicroStrategy’s [MSTR] plan for the long run couldn’t be clearer.

With 444,262 BTC value $41.8 billion beneath its belt, the corporate has solidified its place as a key participant within the crypto market, holding the facility to tip the scales at will.

Now, all eyes are on its newest daring transfer. In a latest SEC submitting, MicroStrategy proposed issuing a whopping 10 billion extra shares – an “pressing” motion that has left market watchers divided.

Will this ‘strategic’ step spark much more Bitcoin purchases, or will it add to the volatility already increase for 2025? The clock is ticking.

MSTR’s steadiness sheet beneath scrutiny

In any main enterprise transfer, buying vital capital is non-negotiable. Now, think about MSTR deciding to purchase an extra $10 billion value of shares whereas already having 330 million shares excellent.

This transfer would undoubtedly thrust its steadiness sheet into the highlight.

Such a big acquisition would elevate questions in regards to the firm’s monetary well being, its capacity to handle the added debt, and the way it impacts current shareholders.

On this case, the stakes are even larger. Given MSTR’s heavy involvement in Bitcoin, traders are prone to speculate on how this acquisition would possibly affect Bitcoin’s value.

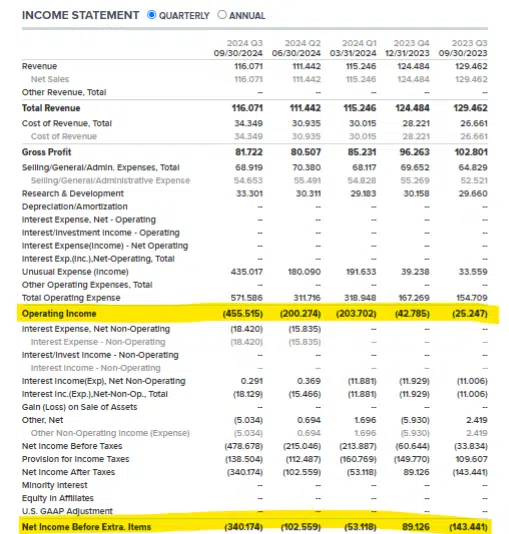

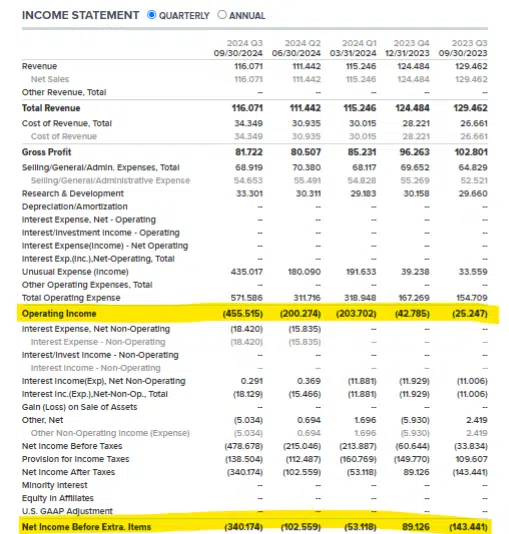

To place issues into perspective, MSTR’s latest financials inform an attention-grabbing story.

Supply : MicroStrategy

For the third quarter, MSTR reported complete revenues of $116.1 million – a ten.3% lower from the earlier yr. Gross revenue stood at $81.7 million, however with a gross margin of 70.4%, down from 79.4% in 2023.

These figures counsel that MSTR is going through some profitability stress. Nonetheless, essentially the most telling quantity lies within the firm’s working bills, which skyrocketed by 301.6% year-over-year, totaling $514.3 million.

This sharp enhance in working bills indicators a daring technique, prone to safe extra capital for BTC-related ventures.

However right here’s the place issues take a dangerous flip: if Bitcoin experiences a big downturn, MSTR’s technique may backfire.

Critics are fast to level out that the corporate could battle to service its rising debt if Bitcoin’s worth drops.

In essence, MSTR’s inventory has turn into a proxy for Bitcoin, that means that Bitcoin’s efficiency straight impacts the corporate’s fortunes. If BTC falls, MSTR’s inventory may observe go well with.

Consequently, MSTR might be pressured to unload its Bitcoin holdings to lift capital, which may negatively impression Bitcoin’s value even additional, creating a possible downward spiral for each.

The underside line: MSTR’s heavy wager on Bitcoin places it in a precarious place.

Whereas the technique may ship enormous positive factors if Bitcoin continues to rise, a pointy drop in BTC may set off a series response of monetary instability.

Thus, right here comes the ‘urgency’

MSTR is caught in a high-stakes gamble, making an attempt to unravel an issue with a fair greater one. The push for $10 billion in capital funding isn’t only a strategic transfer – it’s changing into a matter of urgency.

With 330 million Class A shares already excellent, MSTR is operating out of choices. Clearly, their capacity to lift extra funds by conventional means is nearing its restrict.

Because of this for MSTR to proceed its Bitcoin shopping for spree, this $10 billion capital elevate is completely important.

The excellent news for the corporate? Michael Saylor controls 46.8% of the voting energy, that means solely round 4% of the remaining shareholders have to approve for the proposal to move, which makes it nearly a executed deal.

As soon as this funding is secured, MSTR is prone to ramp up its Bitcoin accumulation even additional, conserving traders engaged and the inventory afloat.

Nonetheless, this technique comes with dangers. As we strategy 2025, the risky crypto market looms massive, presenting vital challenges for each MSTR and Bitcoin.

Learn Bitcoin’s [BTC] Worth Prediction 2025-26

This volatility may set off a cycle of danger, the place every shift in Bitcoin’s value straight impacts MSTR’s capacity to handle its debt.

The stakes have by no means been larger. It is a essential second to observe carefully within the coming months, as these developments may reshape the way forward for each MSTR and Bitcoin.