- The SEC acknowledged Grayscale’s proposal for a Dogecoin ETF, opening a 21-day public remark interval earlier than making a choice.

- Grayscale argues Dogecoin has developed past a meme, calling it a instrument for monetary inclusion and a viable fee technique.

- With current approvals of Bitcoin and Ethereum ETFs, the SEC’s stance on crypto ETFs is shifting, sparking new proposals for Solana, Dogecoin, and XRP ETFs.

The U.S. SEC has formally acknowledged Grayscale’s proposal for a Dogecoin (DOGE) exchange-traded fund (ETF), taking step one within the approval course of.

In a 19b-4 submitting posted Thursday, the SEC known as for public feedback, giving 21 days for responses earlier than making a choice to approve, deny, or lengthen proceedings.

Grayscale’s Push for a DOGE ETF—Extra Than Only a Meme?

Grayscale, which launched its Dogecoin Belief in January, argues that DOGE has developed past its meme roots.

“Dogecoin has transitioned from a Shiba Inu meme to a instrument for monetary inclusion, grassroots activism, and a viable fee technique.”

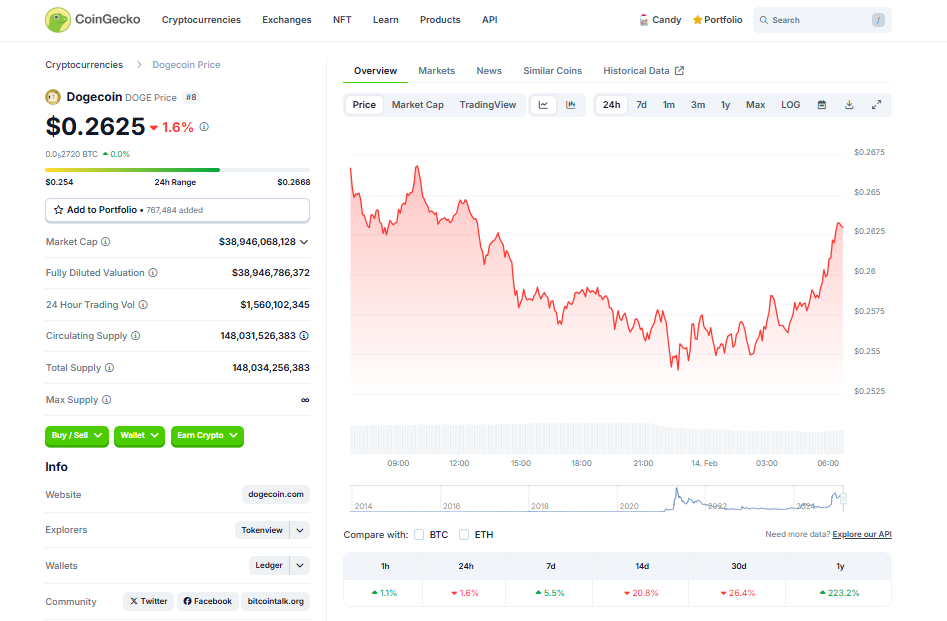

DOGE is at present the eighth-largest cryptocurrency, and its reputation has been fueled by none apart from Elon Musk.

Regulatory Shift—Extra Crypto ETFs on the Horizon?

The SEC has been warming as much as crypto ETFs following the departure of former Chair Gary Gensler, who was notoriously skeptical of digital property.

- Spot Bitcoin ETFs had been authorised in January 2024.

- Spot Ethereum ETFs adopted later that yr.

- Now, companies are testing the waters with proposals for Solana, Dogecoin, and XRP ETFs.

With the SEC now participating in additional open discussions, the crypto ETF panorama may very well be increasing quick.

For now, all eyes are on the Dogecoin ETF choice.