The latest worth surge in GRASS, which is up 187.99% within the final seven days, seems to be fueled by the success of its airdrop and BTC new all-time highs. These components, together with the upcoming itemizing of GRASS on Binance Futures with as much as 75x leverage, have created a wave of bullish momentum.

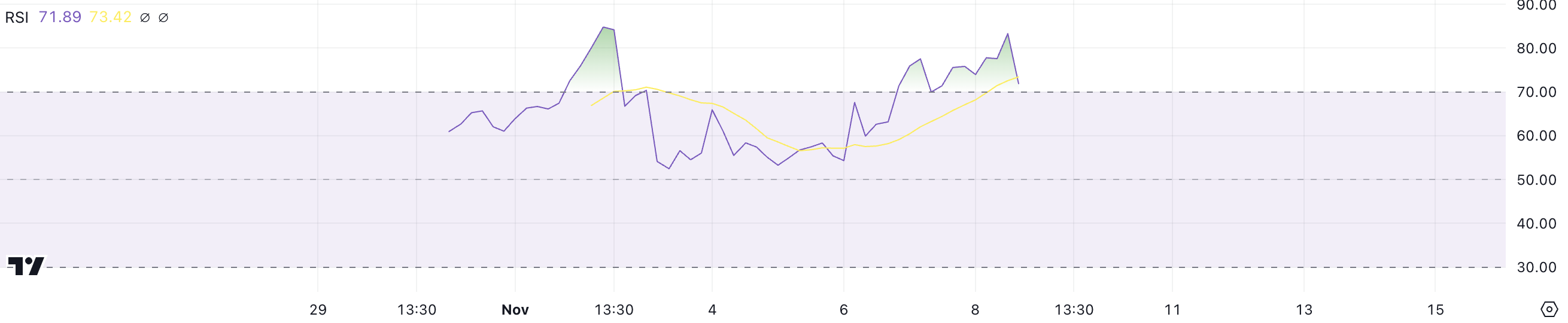

Nevertheless, the present RSI exhibits that GRASS remains to be in overbought territory, suggesting warning could also be wanted as shopping for stress may fade.

GRASS RSI Is Above Overbought Stage

The RSI for GRASS has surged considerably following latest worth will increase, reaching 71.8, up from 55 simply two days in the past. This fast rise signifies sturdy shopping for stress, which has pushed the indicator into an overbought zone.

Such a swift motion highlights that GRASS has been experiencing an intense wave of investor curiosity. It’s necessary to keep in mind that GRASS RSI reached roughly 85, days after its airdrop.

The Relative Energy Index (RSI) is a momentum indicator that measures the velocity and alter of worth actions. RSI values above 70 sometimes sign that an asset is overbought, whereas values beneath 30 point out it’s oversold. With the present RSI at 71.8, GRASS is in overbought territory, suggesting that the latest enthusiasm could have pushed costs too far, too quick.

Nevertheless, since RSI has been dropping closely since yesterday, it may point out a possible cooling-off interval, the place the shopping for momentum is fading, and a worth correction is likely to be imminent.

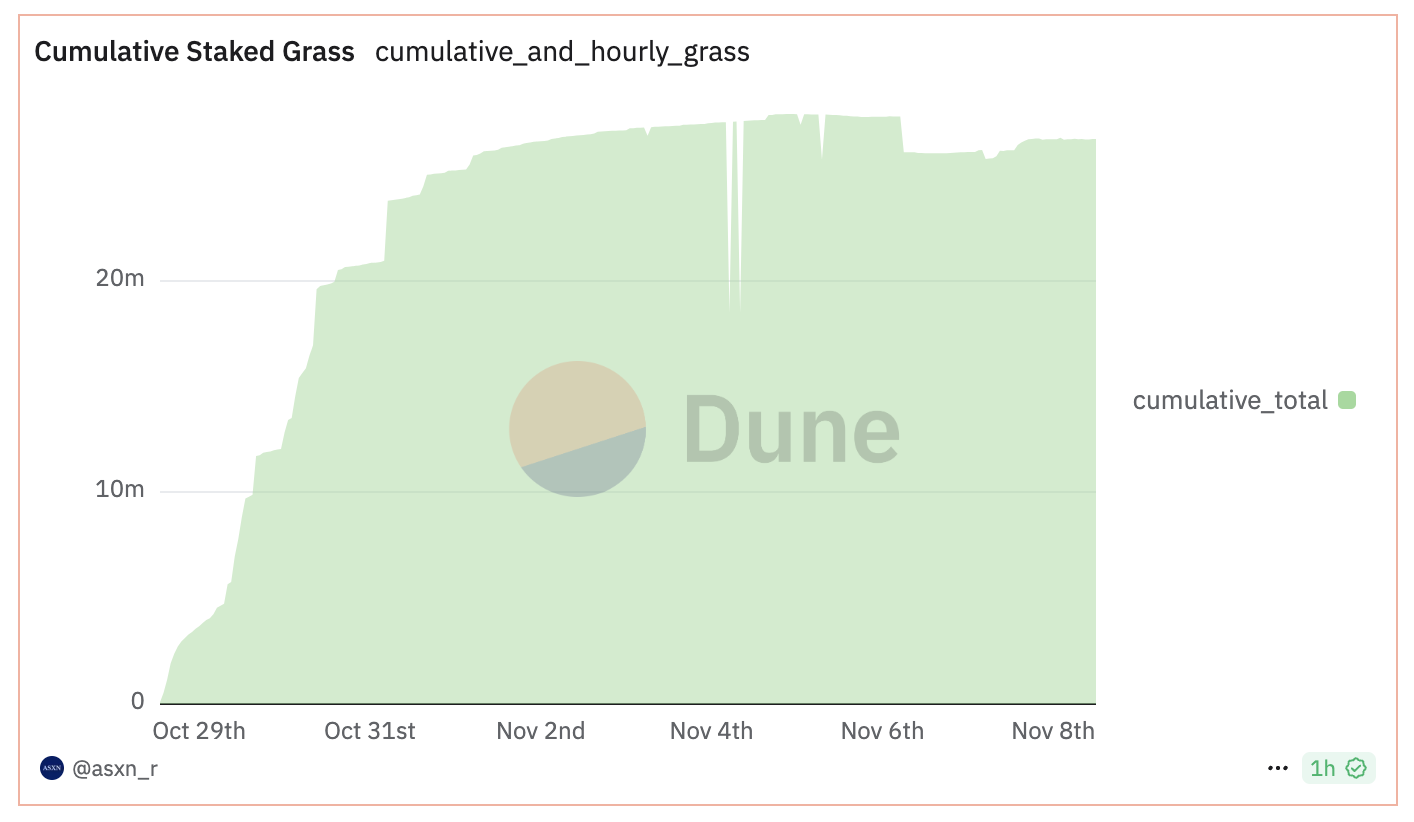

Staked GRASS Is Now Secure

The cumulative staked GRASS has remained steady at 26,600,000 since November 6. This stability follows a slight lower from its peak earlier within the month, suggesting that staking exercise has settled right into a constant sample.

The latest traits point out that the majority of those that have been actively staking have now locked of their positions.

Monitoring the staked coin metric is essential as a result of it offers perception into investor confidence and the dedication to holding the asset long-term. A better quantity of staked GRASS means that buyers are much less prone to promote, lowering out there provide and doubtlessly growing worth stability. On November 4 and 5, the staked quantity approached 28 million however subsequently declined and stabilized at a barely decrease degree.

This motion implies that whereas enthusiasm for staking was sturdy initially, some contributors probably took income or withdrew, resulting in a extra steady base of long-term stakers. This present stability could mirror a interval of consolidation the place dedicated buyers are holding agency.

GRASS Value Prediction: A Potential 28,5% Correction?

Analyzing GRASS Ichimoku Cloud chart exhibits that the value is nicely above the cloud, suggesting sturdy bullish momentum, as the entire Solana ecosystem seems to be pumping.

The primary key assist zone lies across the higher fringe of the cloud, roughly on the $2.9 degree, which aligns with the place the cloud begins to thicken.

If the value declines additional, the decrease fringe of the cloud, across the $2.5 degree, will function the following important assist. That will imply a possible 28.5% worth correction as GRASS turns into one of many cash attracting extra consideration amongst newly launched Solana cash.

If BTC continues its sturdy momentum and the Binance itemizing brings sturdy shopping for stress, GRASS may proceed its uptrend, in all probability breaking the $4 threshold quickly.

Disclaimer

In keeping with the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.