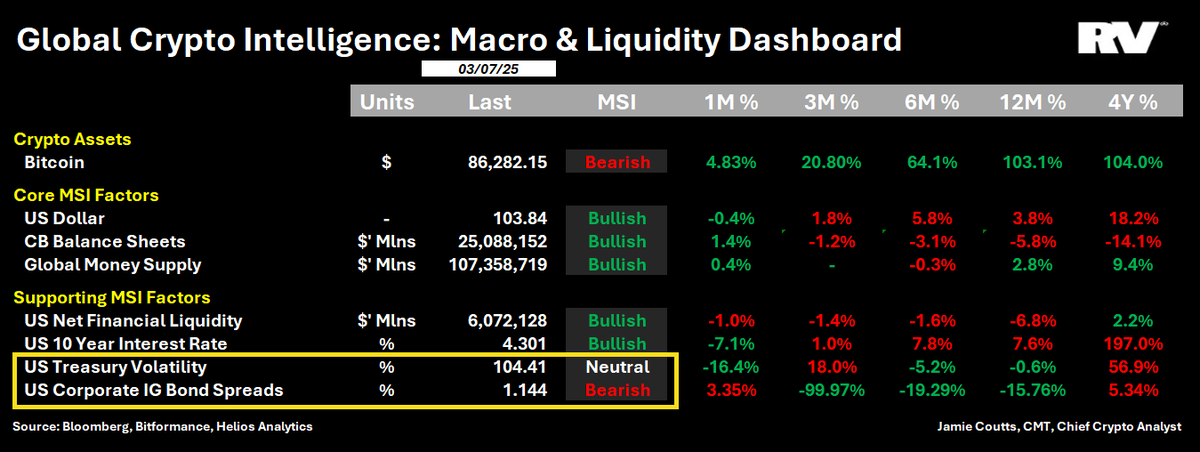

In accordance with market analyst Jamie Coutts from RealVision, Bitcoin’s worth trajectory hinges more and more on the conduct of US Treasury volatility and company bond spreads, regardless of the greenback’s current plunge reinforcing bullish sentiment.

Treasury bond volatility, tracked by the MOVE Index, stays essential since US Treasuries underpin international collateral markets and affect trillions of {dollars} in leveraged positions.

A sustained rise in volatility can set off tighter liquidity situations, prompting lenders to reassess collateral valuations. Coutts highlights that the MOVE Index, secure inside its vary since 2022, might spur central financial institution issues if it surpasses a threshold of round 110.

In the meantime, company bond spreads, a metric reflecting threat urge for food in credit score markets, have widened steadily over current weeks, indicating diminished investor confidence in company debt. Historic evaluation offered by Coutts exhibits an inverse relationship between widening spreads and Bitcoin’s worth, implying potential headwinds for digital property if this pattern persists.

Nonetheless, offsetting these issues is the numerous current decline within the US greenback, its largest month-to-month drop in 12 years, traditionally correlated with Bitcoin’s bull market reversals. Coutts emphasised this dynamic, emphasizing the greenback’s depreciation as a bullish catalyst inside his present market framework.

Coutts believes Bitcoin’s quick path seems depending on central financial institution responses to bond market stability and credit score situations, balanced towards the overarching affect of the depreciating greenback.