Cardano (ADA) is down practically 8% over the previous 30 days however has gained virtually 3% within the final 24 hours as short-term momentum picks up.

The token’s market cap stands at $26 billion, whereas its buying and selling quantity has surged 30% prior to now day, reaching $903 million. Technical indicators are beginning to present early indicators of a possible pattern reversal after a interval of bearish strain. Right here’s a more in-depth take a look at the important thing alerts and worth ranges shaping ADA’s outlook this week.

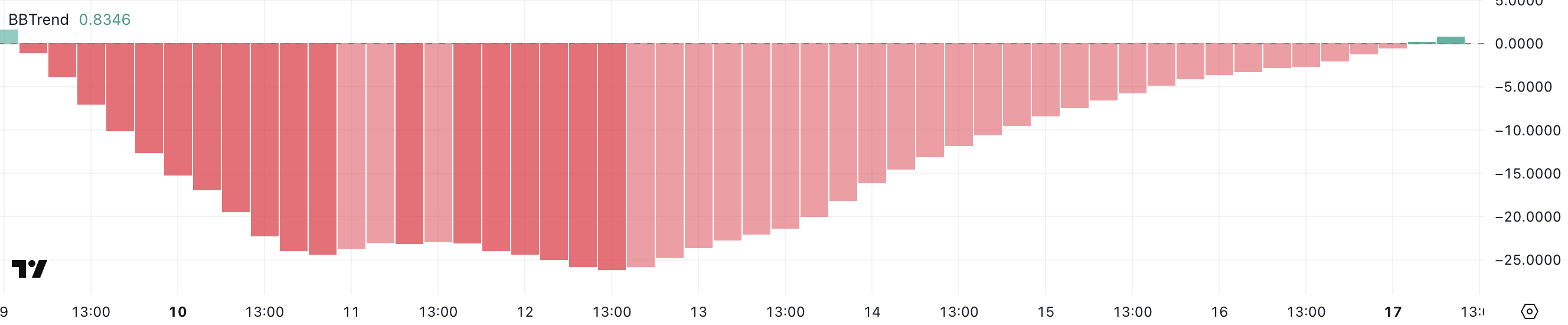

ADA BBTrend Is Now Optimistic After 6 Days

Cardano’s BBTrend has simply turned constructive, ending a six-day streak in unfavourable territory, which included a low of -26.13 on March 12. The indicator is now sitting at 0.83, signaling a shift in momentum after the latest downtrend.

Whereas that is nonetheless a comparatively low studying, the transfer again into constructive territory may very well be an early signal of strengthening shopping for strain.

The BBTrend (Bollinger Band Development) measures the power and route of worth motion relative to the Bollinger Bands. Optimistic values point out an uptrend, whereas unfavourable values level to a downtrend.

Since ADA’s BBTrend hasn’t risen above 10 since March 8, the present studying of 0.83 means that, though the bearish strain has eased, momentum stays weak. For a stronger bullish sign, merchants would sometimes search for the BBTrend to push above 10, confirming a extra decisive upward transfer.

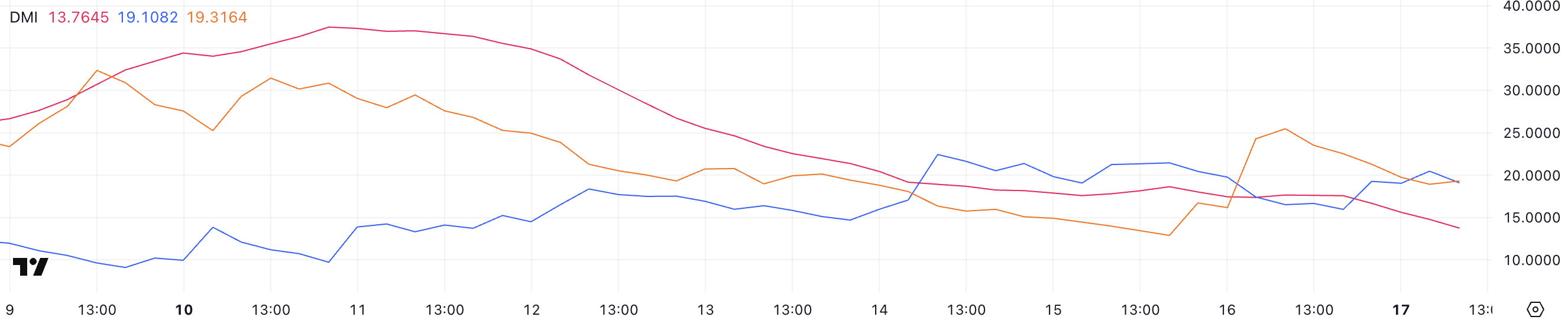

Cardano DMI Exhibits Sellers Are Shedding Management

Cardano’s DMI chart reveals that its ADX has dropped to 13.7 from 17.5 prior to now 24 hours, suggesting a weakening pattern power. Whereas the ADX remains to be signaling a pattern, the decrease studying factors to diminished momentum in comparison with the day past.

The Common Directional Index (ADX) measures the power of a pattern, no matter its route.

Readings above 25 point out a powerful pattern, whereas readings under 20 usually sign a weak or range-bound market. At the moment, ADA’s +DI has risen to 19.1 from 15.96, whereas the -DI has dropped to 19.31 from 25.48, displaying that bearish momentum is fading as bullish strain slowly builds.

With the +DI and -DI traces near crossing, ADA seems to be within the early phases of trying to reverse from a downtrend to a possible uptrend, although a stronger ADX can be wanted to verify a stable pattern shift.

Will Cardano Rise Above $1.10 Quickly?

ADA’s EMA traces have proven indicators of consolidation over the previous few days, although the general construction stays bearish. Quick-term EMAs are nonetheless positioned under the long-term ones.

Nevertheless, latest alerts from each the BBTrend and DMI indicators counsel that this pattern may very well be shifting, with early indicators of bullish momentum constructing.

If Cardano’s worth manages to verify an uptrend, it may first problem the resistance at $0.77. A breakout above this degree could open the trail towards $1.02 and even $1.17, marking the primary time ADA trades above $1 since March 3.

On the draw back, if bearish strain returns, ADA may retest assist at $0.64, and a breakdown under this might push costs as little as $0.58, revisiting ranges not seen since February 28.

Disclaimer

In step with the Belief Challenge tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.