Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Chainlink is presently buying and selling at important demand ranges because the broader crypto market faces ongoing stress. With international monetary circumstances rising more and more fragile, volatility continues to dominate throughout danger property. Geopolitical tensions and sweeping tariffs imposed by world leaders — together with current strikes by US President Donald Trump — have solely added to the uncertainty, shaking investor confidence and stalling bullish momentum in crypto.

Associated Studying

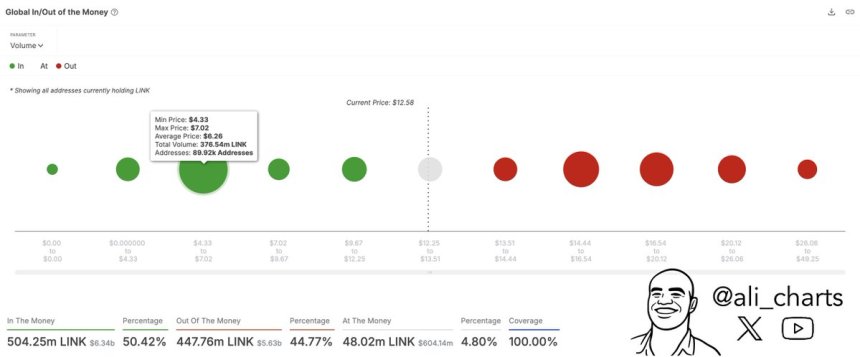

Amid this backdrop, Chainlink has struggled to reclaim increased floor, as an alternative consolidating round a key help zone. Based on on-chain knowledge, LINK’s most crucial demand wall sits at $6.26. This focus of shopping for curiosity marks a doubtlessly robust help space that bulls should defend to keep away from a deeper correction.

As markets react to shifting macroeconomic alerts, Chainlink’s skill to carry this demand zone may decide its subsequent transfer. If this degree fails, further draw back could comply with. But when it holds, it may function the bottom for a possible rebound as soon as sentiment improves. For now, all eyes stay on LINK’s worth motion because it checks some of the necessary accumulation zones on its chart.

Chainlink Consolidates As Subsequent Demand Degree Lies Beneath

Regardless of broader market uncertainty, Chainlink stays some of the distinguished gamers within the real-world asset (RWA) tokenization narrative — a sector anticipated to see substantial progress within the coming years. As conventional finance continues exploring blockchain infrastructure, Chainlink’s oracle expertise and decentralized knowledge feeds stay important to bridging off-chain property with on-chain functions.

Nonetheless, within the brief time period, LINK’s worth motion has mirrored the broader crypto market downturn. Chainlink is down 17% since March 26, with present worth motion exhibiting continued uncertainty. LINK is consolidating simply above a key demand degree, and though bulls have struggled to regain momentum, some analysts imagine the worst could also be behind. Fears of ongoing promoting stress persist, however general market circumstances counsel that the sharpest drawdowns might be over.

Supporting this view, Ali Martinez shared on-chain knowledge revealing that probably the most important demand wall for Chainlink sits at $6.26, the place practically 90,000 traders gathered roughly 376 million LINK tokens. This robust accumulation zone could present the muse wanted for worth stabilization and a possible reversal, particularly if broader market sentiment begins to recuperate.

Whereas analysts nonetheless warn of a doable deeper correction, the fading depth of promoting and the presence of robust help point out rising resilience. Chainlink’s long-term fundamentals, significantly its management within the RWA house, proceed to draw consideration — even throughout instances of market stress. If the $6.26 degree holds, LINK might be well-positioned for a rebound as soon as bullish momentum returns throughout the crypto panorama.

Associated Studying

LINK Holds Strong Floor As Bulls Eye Restoration Affirmation

Chainlink (LINK) is buying and selling at $12.8 after enduring a number of days of heavy promoting stress. Regardless of the current draw back, bulls have managed to defend the essential $12.3 help degree, which has up to now acted as a strong demand zone. This maintain is a key short-term victory, however the broader pattern stays fragile as LINK struggles to regain upward momentum.

To verify a possible restoration rally, bulls should push LINK above the $14.6 degree — a important resistance zone that aligns with each the 4-hour 200-day shifting common (MA) and the exponential shifting common (EMA). A decisive breakout above this space would sign renewed energy and doubtlessly appeal to extra patrons again into the market.

Associated Studying

Nonetheless, the chance of additional draw back nonetheless looms. If LINK loses its grip on the $12.3 demand zone, the subsequent logical help may lie close to the $10 mark, a psychological degree that hasn’t been examined since early This autumn 2023. With the broader crypto market nonetheless underneath stress and sentiment cautious, LINK stays at a crossroads. The approaching days might be pivotal as bulls try and reclaim momentum and keep away from slipping deeper into correction territory.

Featured picture from Dall-E, chart from TradingView