- ai16z has made a robust upswing on its value charts, rising by 16.5% as demand for lengthy positions soars.

- The altcoin is experiencing sturdy demand for lengthy positions, risking a protracted squeeze.

ai16z [AI16Z] skilled a large uptick on its value charts within the final 24 hours, surging from a low of $00.129 to a excessive of $0.157. This marked a 16.5% improve on its each day charts.

Over the identical interval, the memecoin noticed a 16.31% improve in its quantity, reaching $118.4 million.

Equally, ai16z’s Open Curiosity has surged by 17.8% hitting $61.19 million. When each quantity and OI rise, it means that buyers are strategically positioning earlier than the market makes a transfer — they’re opening positions.

Supply: Coinalyze

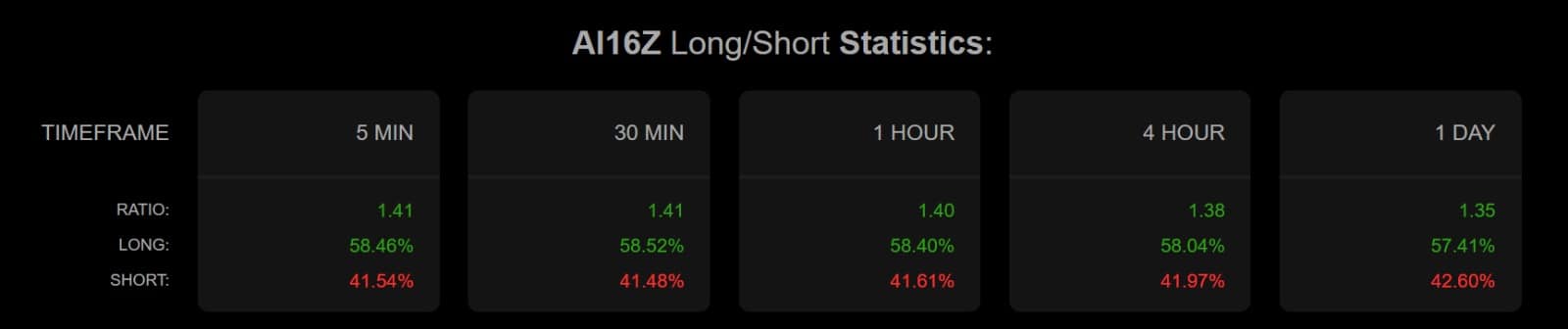

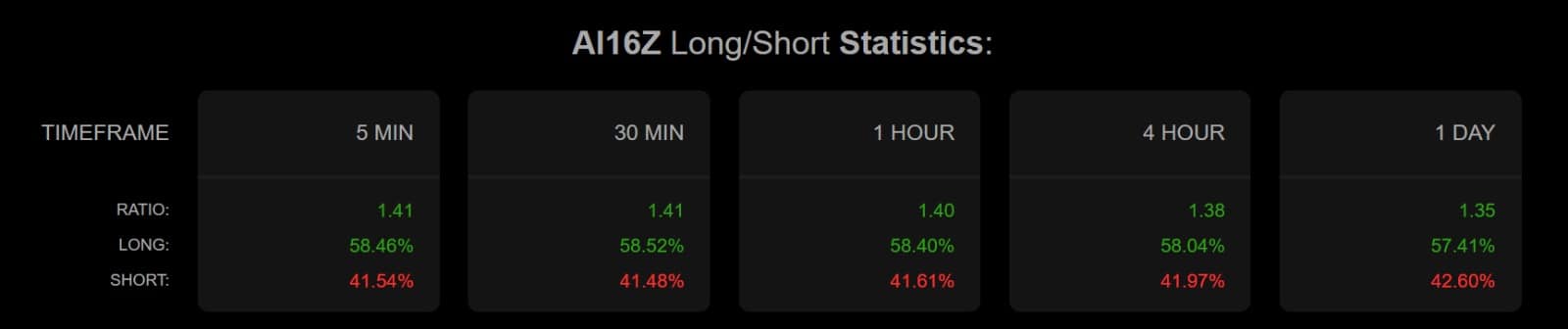

Trying on the Lengthy/Brief Ratio, it exhibits that these buyers are getting into the market and opening lengthy positions.

In truth, longs account for 57.41% of Future contracts, whereas shorts are 42.6%. When longs dominate, it means that buyers are optimistic and anticipate costs to maneuver upwards.

Furthermore, the Funding Price remained optimistic for 2 straight days—one other telltale signal of bullish market sentiment.

Nonetheless, whether or not this rally has legs or not stays in query.

Is a rally forward for ai16z or is it only a bull lure?

In accordance with AMBCrypto’s evaluation, ai16z patrons are getting again into the market to strategically place themselves.

Supply: TradingView

For starters, ai16z’s RSI had risen from 41 to 47 at press time. An uptick in RSI means that patrons are beginning to come again into the market and there are extra features than losses.

Since RSI stayed under the 50 mark, bearish undertones nonetheless lingered. A break above 50 would solidify bullish energy.

At the moment, though patrons are again available in the market, they haven’t but had complete management of the market and sellers are nonetheless energetic.

Supply: CoinGlass

A lure—or a launchpad?

Having mentioned that, sellers didn’t disappear. Spot netflow remained optimistic, suggesting alternate deposits outpaced withdrawals.

After all, this sample often alerts profit-taking, particularly by holders who had been underwater and used the bounce to exit. Regardless of the rise in longs, such promoting strain diluted the uptrend’s energy.

As such, the uptrend appears weak.

combined alerts, it might be protected to say that ai16z is seeing a bull lure, and a protracted squeeze would possibly happen.

Subsequently, ai16z might retrace from the latest uptick and decline to $0.146. Nevertheless, if the try by bulls holds, we might see the altcoin surge to $0.160.